Monthly News Update- August 2018

Here are some of the top online lending news, stories and trends of July 2018 for online lending investors and industry watchers. Industry News: 7/3/2018 “Equifax research reveals that a significant proportion of UK consumers would be up for sharing their data…” (AltFi News) 7/4/2018 Amazon has already made some moves to fintech. What are […]

MonJa's Digital Banking and Lending Monthly Roundup | June

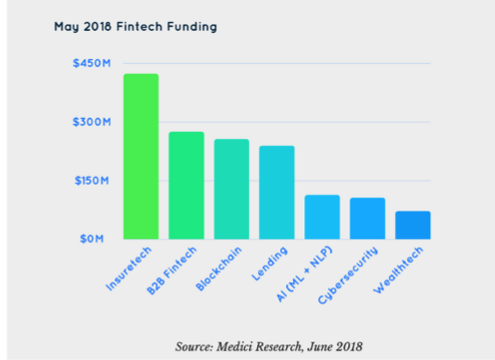

[vc_row][vc_column][vc_column_text]MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a world full […]

Overview of US Consumer Lending

Financial system across the US took a beating in the aftermath of the 2008 financial crisis and American views changed overnight with regards to their financial system. In a 2014 Gallup poll, only 26 percent expressed having “‘a great deal’ or ‘quite a lot’ of confidence in banks,” down from 41 percent in 2007 and […]

Overview of US-Based Small Business Lending Platforms (Alternative Lenders).

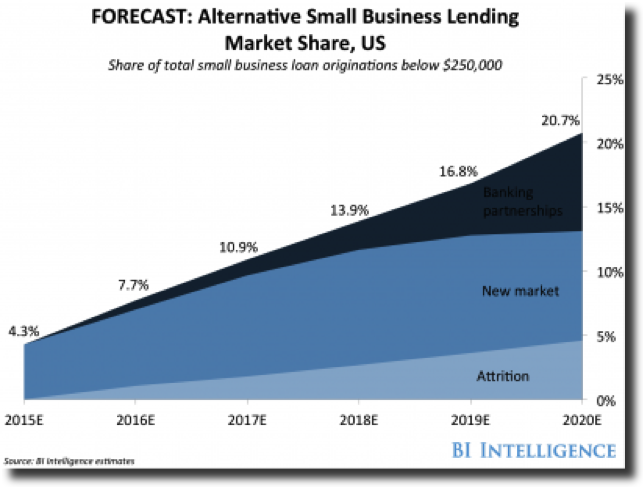

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]“Of the 28 million small businesses in the United States, over half faced financial challenges in the last year [2016] Janet Zablock; Former Head of Global Small Business at Visa and currently, an Independent Board member at Nav Inc. As we have all heard multiple times, Small and Medium Businesses (SMB) are the backbone of the […]

MonJa Monthly News Update- November 2016

Here are some of the top stories and trends of October 2016 for marketplace lending investors and industry watchers: Industry News: 10-02-2016- Cambridge Centre for Alternative Finance Holds Standout Inaugural Conference (Crowdfund Insider) 10-03-2016- International P2P Lending Services – Loan Volumes September 2016 (p2p-banking) 10-04-2016- Oleg Seydak on Blackmoon & Marketplace Lending as a Service […]

From Wall Street to Main Street: How will Goldman's new consumer product, Marcus, fare?

Goldman Sachs enters the consumer lending market with its new product, Marcus, rousing mixed responses from the industry. Last week, Goldman Sachs debuted Marcus, an online-loan service geared toward prime consumers paying down credit-card debt. Essentially, as representatives at Goldman put it, Marcus aims “to help Americans manage debt better.” In sum, consumers (typically those with a credit […]

MonJa Monthly News Update- October 2016

Here are some of the top stories and trends of September 2016 for marketplace lending investors and industry watchers: Industry News: 09-01-2016- Plentiful opportunities in alternative credit and niche lending, says PIMCO (altfi) 09-01-2016- New Fintech Partnership: Currencycloud Links with Arkéa Banking Services (Crowdfund Insider) 09-05-2016- KKR: Alternative credit set to be “star performing” asset […]

Part 2 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the second post in a two part blog series that examines the “40 Act Funds”. In part 1 we examine the structure and performance of the funds in the UK and US. In part 2 below, we will delve into the implications of funds on marketplace lending. Go here to read part 1 Impact on investors, […]

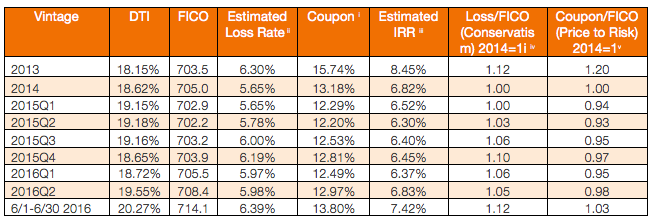

Why Marketplace Lending Fund Returns Look Terrible

Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait […]

Five Common Mistakes P2P Loan Investors Make: Investing In A Single Platform (Part 3 of 5)

Mistake #3: Investing in A Single Platform (Part 3 of 5) A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple […]