Mistake #3: Investing in A Single Platform (Part 3 of 5)

A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple notes on one lending platform. What they don’t know is that this type of thinking is an unconsidered risk. When investors decide that they are set on a single platform, they are essentially committing their funds to one particular underwriting standard. Perhaps, these investors believe that only one lending platform can match their investment criteria.

But why not explore other alternatives? After all, investors peeked into the peer to peer lending space because it is an alternative investment class.

(The above map shows major P2P platform providers in the US)

As marketplace lending industry continues to grow, the number of lending platforms will also continue to multiply and provide for different asset types, such as consumer, small businesses, and real estate. Larger lending platforms, such as Lending Club, offer consumer and business loans, and smaller lending platforms tend to specialize in one type. Lending platforms that focus on specific asset types attract distinct types of borrowers, which characterizes the quality of borrowers on that platform. Upstart is one example because it caters to millennials who don’t have much credit experience; yet they have the potential of being a prime borrower based on their education, area of study, and job experience.

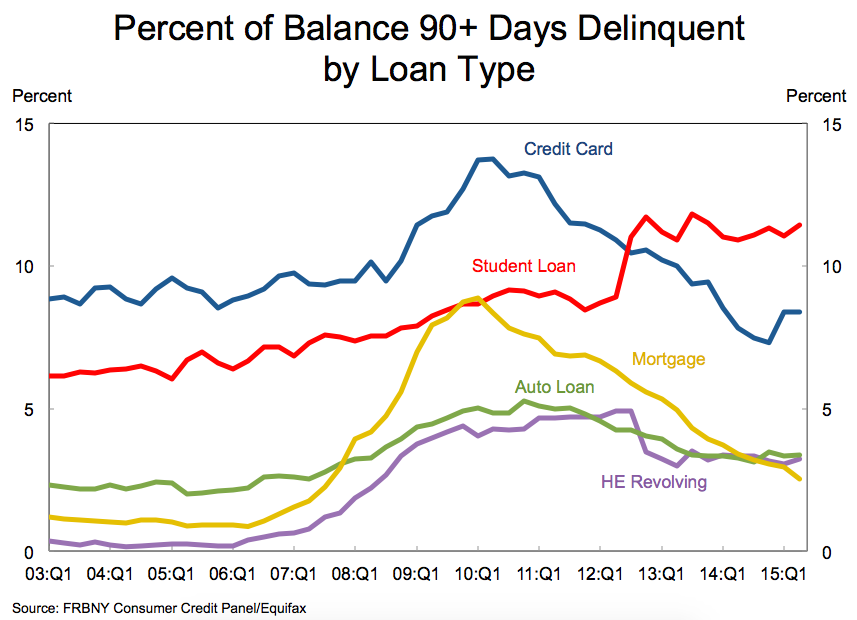

As an investor, you do not want to put all your eggs in one basket or lend to any type of borrower. You want to work with lending platforms that have suitable terms on the loans and have good data about their borrowers. More importantly, you want to understand different default rates for specific loans because it can affect the returns on your loan portfolio. Below is a graph of the delinquency rates for different loan types based on FRBNY’s 2015 Q2 Report on Household Debt and Credit.

While all other loans are improving, default rates for student loans are steadily increasing. How might this affect your loan portfolio? If you are funding only student borrowers, you’ll definitely experience higher default rates. If you’re funding across different types of borrowers (consumer credit, small business, and real estate), you will minimize the risk of those default rates. However, diversification of lending platforms can be tricky since you need to be aware of the risk factors for all asset classes. At MonJa, we aim to help investors and the P2P lending community better understand and respond to these macro trends. By using platform data and public data, MonJa’s loan selection models weigh macro variables to help filter the loans and reduce delinquency rates.