This is the second post in a two part blog series that examines the “40 Act Funds”. In part 1 we examine the structure and performance of the funds in the UK and US. In part 2 below, we will delve into the implications of funds on marketplace lending.

Impact on investors, financial advisors, and lending platforms

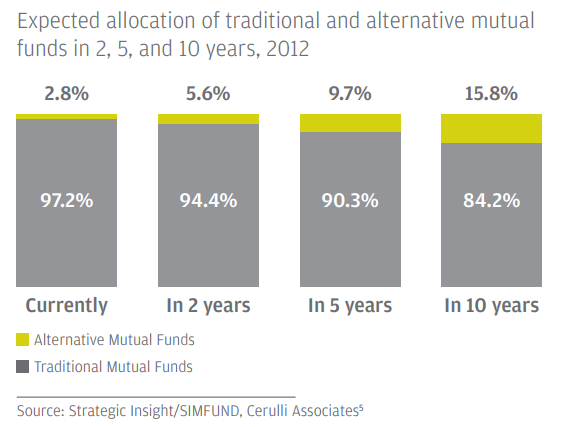

These new investment funds solve several problems for individual investors in the marketplace lending space. With these funds comes a hopeful promise to move marketplace lending away from a niche asset class towards a true alternative asset class with a broad investor base. Most significantly, marketplace lending mutual funds will provide desperately needed liquidity to investors in the space. Investors will no longer be forced to hold marketplace loans to maturity based on if a fund can be sold at any time (as in the UK) or only in quarterly windows (as in the US). Additionally, these fund vehicles will allow investors to conveniently and easily invest across several marketplace lending platforms without the hassle of opening separate accounts at each platform. These funds also allow investors to access the leverage that the funds employ.

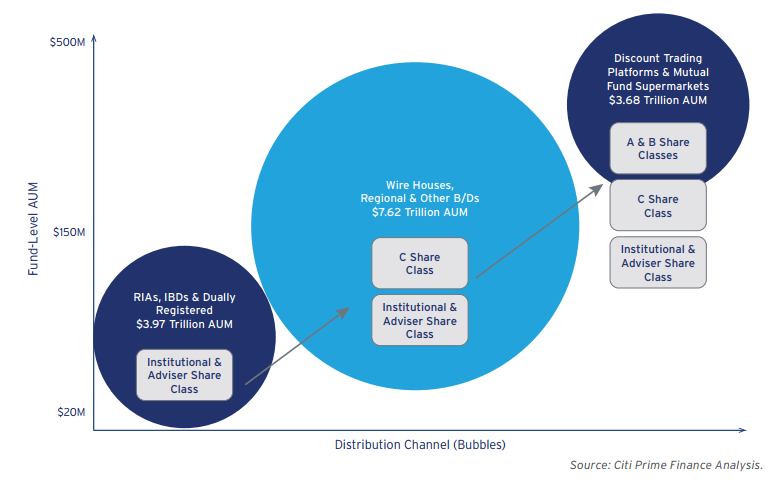

Because marketplace lending mutual funds are more liquid, financial advisors and other investor fiduciaries should be able to incorporate marketplace lending funds into a client’s holistic financial planning process. Investors will be able to create more customized client portfolios that directly address specific client needs. It has been difficult for advisors to purchase individual loans for clients up to this point in time because individual loan sizes are small, illiquid, and not priced on a regular basis. Additionally, marketplace loans have not yet been integrated into the portfolio management and trading software that financial advisors use to manage client accounts, making managing and rebalancing those assets in the context of a client’s total portfolio an unwieldy process. Overcoming these hurdles makes marketplace loans investable for a broad base of investors, especially investors who invest via an advisor.

By expanding marketplace loans to a broader investor base, these new funds will transform the industry and could eventually move today’s platforms towards principal broker-dealer markets, similar to other fixed income instruments. At this point, most of the marketplace loans that these funds have purchased have been issued by the top platforms: Lending Club, Prosper and SoFi in the US, and Funding Circle in the UK. This trend is expected to continue since fund managers that cater to a broader investor base require higher quality research, analytics, disclosure, and transparency in order to assist in their loan selection and meet enhanced compliance and regulatory guidelines. While institutional level analytical tools are still in their infancy in the marketplace, current marketplace loan analytics providers, such as DV01, MonJa, and Orchard, are well positioned to benefit from further adoption from fund managers.

Conclusion

Though we have just seen the launch of the first few marketplace lending mutual funds in the UK and US, several others are likely to follow- especially if interest rates continue to remain near zero for an extended period of time. Fund providers are likely to experiment with other fund structures to enhance the appeal of their products to as wide of an investor base as possible. A broader investor base should lead to continued development of advanced analytical tools, portfolio management and trading software, corporate structures, and regulations that will move marketplace loans from a niche “fintech” product to a core investment asset class.

Market forces are going to change the current marketplace lending landscape in the following ways:

- More investors will have access to higher yielding investment products

- Borrowers are likely to have greater access to funds

- Platforms are likely to issue more loans

- Fund managers should be able to generate revenue by offering new and exciting products to a wider investor base.

As marketplace loans become part of the everyday financial landscape, these forces are likely to be a win-win for the industry and its borrowing and investing clients.