This is the first post in a two part blog series that examines the “40 Act Funds”. In part 1 of this series, we examine the structure and performance of the funds in the UK and US. In part 2, we will delve into the implications of funds on marketplace lending.

Introduction

The first and second mutual funds (“40 Act Funds”) for marketplace loans have been approved in the US, and the mutual fund industry is now abuzz trying to gauge the demand for marketplace lending financial products. In addition, experts are curious to see how many more funds will be launched, what the retail investor demand is, and what the ultimate performance of these vehicles will be over longer time horizons. The US fund launches have followed the launch of five closed-end mutual funds in the UK, where the regulatory approval process has been less restrictive.

In this two part blog series, we will examine the structure of these funds, discuss the benefits and drawbacks of these fund structures for retail investors and financial advisors, and seek to understand the implications for the marketplace lending industry as a whole.

Fund Structures

UK Marketplace Lending Fund Structure — Closed-End Funds

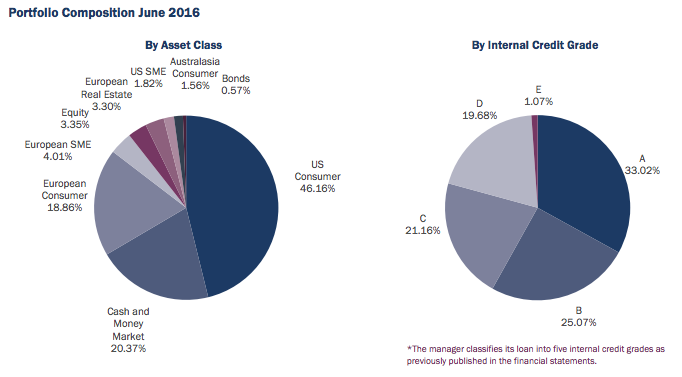

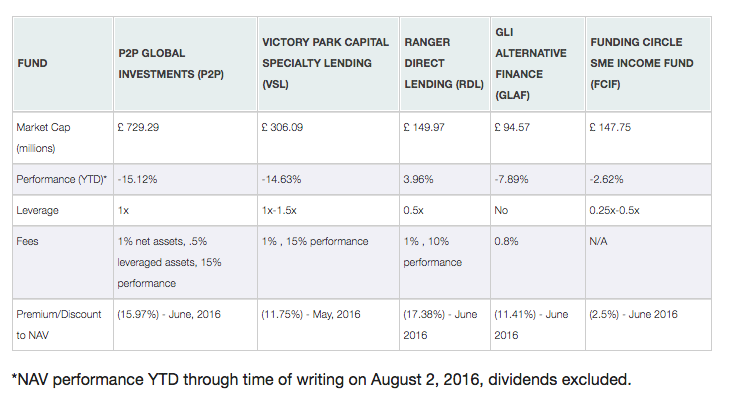

The mutual fund industry in the UK blazed the trail in creating investable marketplace lending products. In June 2014 P2P Global Investments PLC launched their marketplace lending closed-end fund.¹ Since then, the fund has grown to over £800M in net asset value (NAV).² Subsequently, four more closed-end funds were launched in the UK and have gathered smaller amounts of assets.

The closed-end fund structure was seen as an ideal vehicle in the UK for launching a marketplace lending fund. Because marketplace loans are illiquid assets, fund managers wanted to use a structure that simultaneously allows investors to have liquidity in the shares of the fund, and protects fund managers from having to liquidate underlying fund assets to satisfy investor redemption request. This structure simultaneously protects fund managers from having to liquidate underlying fund assets to satisfy investor redemption requests. The advantage of the closed-end fund structure is that it satisfies both needs. Investors obtain liquidity through the ability to trade shares of the fund through a broker, and fund providers are protected from redemptions.

Unfortunately, there are also some drawbacks to closed-end funds, which the funds in the UK are currently suffering from. Because shares of closed-end funds are only traded amongst investors and cannot be redeemed at the fund’s NAV, the market price of the fund shares can trade at a premium or a discount to the NAV of the fund shares. In some cases, those values can drastically diverge. As of August 2016, all five of the funds launched in the UK were trading at a discount to NAV. Four of the five funds were trading at a discount of more than 11% to NAV.³ The investors in the UK funds have not fared well, despite the underlying loans having adequate performance.

US Marketplace Lending Fund Structure — Interval Funds

In the US, the first two marketplace lending mutual funds were granted SEC approval with a slightly different fund structure. Stone Ridge Asset Management and RiverNorth Capital Management both announced that their marketplace lending mutual funds would use the interval fund structure.4

An interval fund aims to solve the drawbacks of the closed-end funds used in the UK, by trying to anchor the share price to the NAV. In order to do so, the fund manager creates and redeems fund shares at the NAV, as in open ended mutual funds. Investors can invest money into the fund at any time. However, interval funds restrict investor redemptions to certain time periods and certain amounts — both US funds only allow redemptions on a quarterly basis and restrict withdrawals to an amount of 5%-25% of the fund NAV.

The advantage of an interval fund is that the investor will realize the performance of the fund NAV, while not suffering from wild swings in market price away from NAV. The obvious disadvantage is that the investor can only redeem shares quarterly. For now, the impact of this restriction should be minimal, as both funds are really focused on very high net worth investors (Stone Ridge has indicated that the minimum investment for its fund is $15M and RiverNorth’s minimum is $1M).5 Important to note, both funds are available to investors for lower amounts if they invest through an investment adviser. Higher net worth investors are usually able to tolerate investments with lower liquidity, as they usually have more diversified investment portfolios and are able to wait for fund redemption windows to open if there is a need to liquidate their investments. While Stone Ridge and RiverNorth have determined that interval funds are the best vehicle for launching their marketplace lending funds, it remains to be seen if other fund providers will follow in their footsteps or if the interval fund structure will be seen as unacceptable structures for more down market retail investors.

Part 2: Impact on investors, financial advisors, and lending platforms

These new investment funds solve several problems for individual investors in the marketplace lending space. The funds bring a promise to move marketplace lending away from a niche asset class towards a true alternative asset class with a broad investor base. Most significantly, marketplace lending mutual funds will provide desperately needed liquidity to investors in the space. Whether a fund can be sold at any time (as in the UK) or only in quarterly windows (as in the US), investors will no longer be forced to hold marketplace loans to maturity.

We will explore delve further into the implications in the next post in our series. We’ll post part two early next week, so stay tuned…

______

References:

¹http://www.p2pgi.com/investorrelations/view/FactsheetJuly2016

²http://www.lendacademy.com/navigating-publicly-listed-funds-uk/

³ http://www.lendacademy.com/navigating-publicly-listed-funds-uk/

4 http://www.lendacademy.com/rivernorth-gets-approval-sec-marketplace-lending-40-act-fund/

5 http://stoneridgefunds.com/documents/LENDX_prospectus.pdf?v=009

* The opinions expressed in this post only represent the views of the author. The author has no positions in the securities mentioned and no intention to buy or sell any of the securities mentioned within the next 72 hours.