Life After Lending Club: How The Market Is Responding To The Problems Of 2016

2016 has been quite the year for marketplace lending — beginning with Lending Club’s troubles in May, whose effects have rippled throughout the rest of the year, and continuing with external political factors affecting the global market (read: Brexit in June, the U.S. election in November). It has certainly been a difficult year for all […]

MonJa Monthly News Update- November 2016

Here are some of the top stories and trends of October 2016 for marketplace lending investors and industry watchers: Industry News: 10-02-2016- Cambridge Centre for Alternative Finance Holds Standout Inaugural Conference (Crowdfund Insider) 10-03-2016- International P2P Lending Services – Loan Volumes September 2016 (p2p-banking) 10-04-2016- Oleg Seydak on Blackmoon & Marketplace Lending as a Service […]

From Wall Street to Main Street: How will Goldman's new consumer product, Marcus, fare?

Goldman Sachs enters the consumer lending market with its new product, Marcus, rousing mixed responses from the industry. Last week, Goldman Sachs debuted Marcus, an online-loan service geared toward prime consumers paying down credit-card debt. Essentially, as representatives at Goldman put it, Marcus aims “to help Americans manage debt better.” In sum, consumers (typically those with a credit […]

Part 2 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the second post in a two part blog series that examines the “40 Act Funds”. In part 1 we examine the structure and performance of the funds in the UK and US. In part 2 below, we will delve into the implications of funds on marketplace lending. Go here to read part 1 Impact on investors, […]

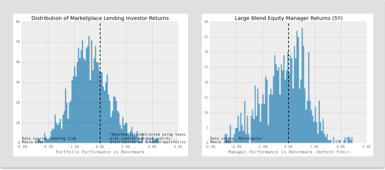

Why Marketplace Lending Fund Returns Look Terrible

Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait […]

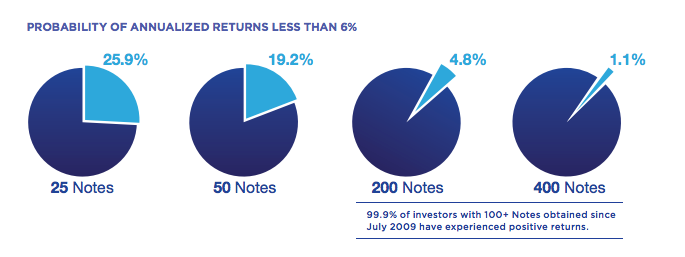

5 Common Mistakes P2P Loan Investors Make: Insufficient Diversification (Part 1 of 5)

MonJa is excited to announce their five part blog series “5 Common Mistakes P2P Loan Investors Make”. With the growth of peer-to-peer lending, more institutional investors are investing in marketplace platforms. There are several introductory guides out there on p2p lending, yet investors are applying sophisticated credit strategies in buying loans- something basic guides don’t […]

A Day In The Life Of A MonJa Intern

Two rockstar interns joined the MonJa team this summer. When they’re not amazing us with their lightning speed coding abilities, they keep us laughing with their amusing comments and millennial insights. We asked them to share their summer experiences. Zi Wei, an anime loving sophomore at the University of Illinois Urbana Champaign, illustrates that MonJa life in […]

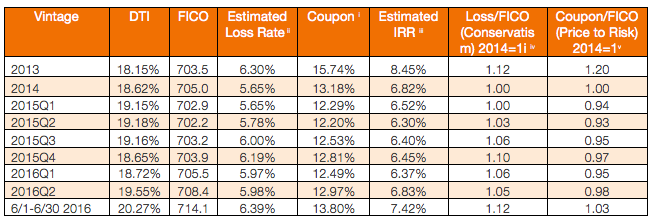

Loan Selection In P2P Lending: Does It Actually Work?

The major P2P lending platforms, such as Lending Club and Prosper, have been terrific at underwriting and setting a level playing field for marketplace lending – and several of them have recently launched or improved their passive vehicles; this is great news for investors seeking passive income with a minimal amount of hassle. A common […]

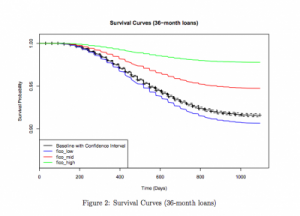

Survival Analysis Applied to Marketplace Loans

MonJa would like to introduce Professor Matthew Dixon, whose current research interests include credit modeling for peer-to-peer loans. Over the last several months, Prof Dixon and Litong Dong, a recent graduate of USF, have engaged in a collaborative research project with us here at MonJa. Their research focuses on survival analysis and how it might apply […]

Which Marketplace Lenders Are Making Moves?

Here at MonJa we have a strong pulse on what’s happening in the marketplace lending space. During our weekly team meetings, we always spend time discussing recent peer to peer lending activity. This week we discussed the increase in venture capital funding amongst financial tech companies. These past months, VCs have invested heavily in this […]