The major P2P lending platforms, such as Lending Club and Prosper, have been terrific at underwriting and setting a level playing field for marketplace lending – and several of them have recently launched or improved their passive vehicles; this is great news for investors seeking passive income with a minimal amount of hassle. A common question that I often get is, does active investing actually work for p2p lending?

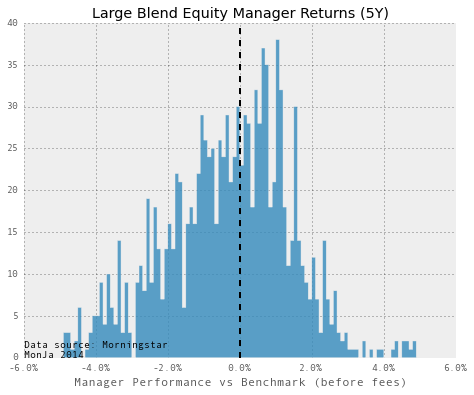

Having worked in investment analytics in the past decade, I can tell you right now: the active vs passive debate is pretty much settled in public equity markets. Indeed, in the past 10 years, we’ve seen passive investing emerge as a dominant factor in investment management, particularly in equity and traditional fixed income. It’s now conventional wisdom that most active equity managers don’t really add much value, with passive index funds and ETFs taking huge inflows away from traditional active managers. Below is a distribution of returns from large blend managers, for the past 5 years:

Passive managers, active managers, skilled or unskilled, all forming a neat distribution. An average equity investor, holding a middle of the road, diversified passive portfolio, can expect to do as well as most active manager before fees – the hallmark of an efficient market. Therefore, an investor can buy a broadly diversified portfolio cheaply without losing returns – a terrific bargain.

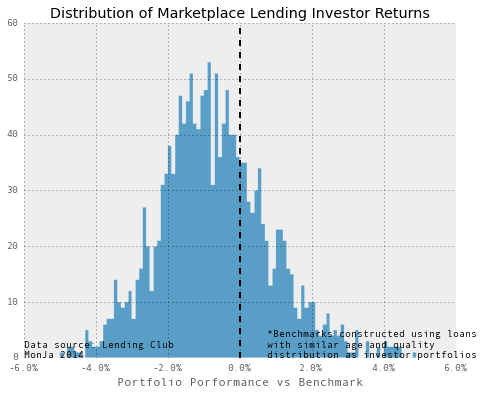

Below is a similar comparison done on marketplace lending investor portfolios*:

The distribution is a familiar bell curve, except the average investor, is underperforming the broader loan universe. Having the average portfolio underperform the overall loan universe sounds like a paradox, except when you consider the fact that portfolios aren’t all the same size. A natural question to ask is, are some large investors systematically outperforming the market?

The answer is yes. Since we’ve been active in marketplace lending, we have worked with some truly impressive investors – and their outperformance is real and persisting. Broadly speaking, the investor return distribution also has a right skew, with a couple of outliers on the high return side.

In the equity market, if a professional investor starts buying an underpriced asset, he will drive up its price – and a passive investor with a Total Market ETF will benefit from the appreciation. For marketplace lending, a similar price equilibrium mechanism does not exist – once an underpriced loan is purchased it’s simply gone from the supply. In other words, the evidence is clear: the hard work of credit research can and does pay off for many top investors.

*The specific example uses 19m-21m average loan age portfolios on Lending Club, although we see average investor shortfall on other platforms and loan segments too.