Part 2 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the second post in a two part blog series that examines the “40 Act Funds”. In part 1 we examine the structure and performance of the funds in the UK and US. In part 2 below, we will delve into the implications of funds on marketplace lending. Go here to read part 1 Impact on investors, […]

Part 1 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the first post in a two part blog series that examines the “40 Act Funds”. In part 1 of this series, we examine the structure and performance of the funds in the UK and US. In part 2, we will delve into the implications of funds on marketplace lending. Introduction The first and […]

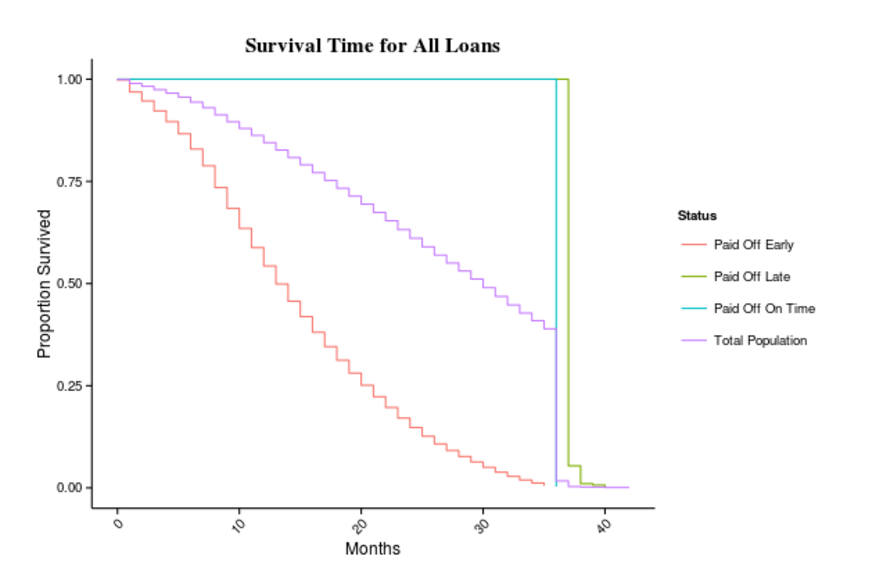

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

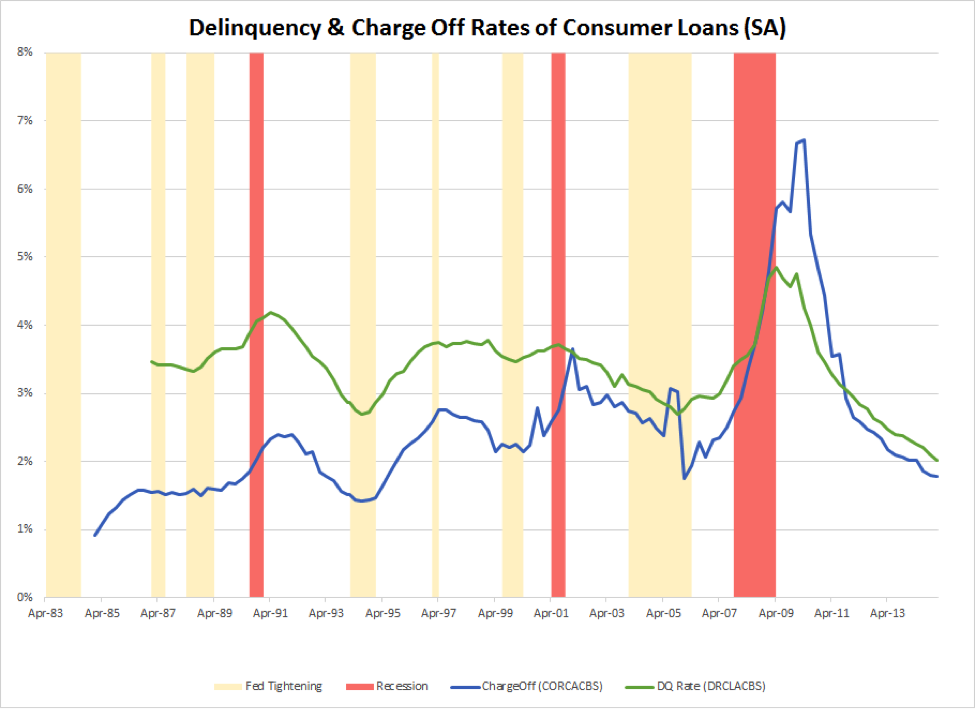

Growth in Marketplace Lending Spawns Specialized Risk Services and Tools

With the growth of marketplace lending, institutional investors need to manage their risk exposure. It’s important to understand what makes this market different from other asset classes and how to employ tools and models tailored for its risks. Originally written by Katherine Heires and posted by GARP Risk Intelligence on November 19, 2015, this article highlights different […]

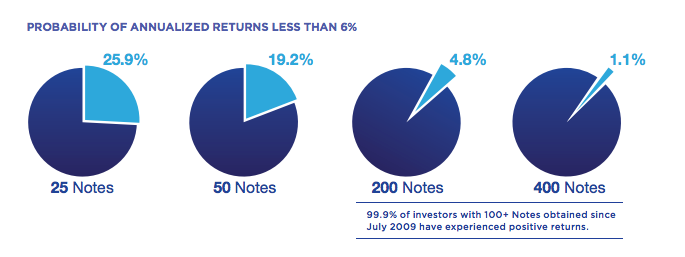

Five Common Mistakes P2P Loan Investors Make: Investing In A Single Platform (Part 3 of 5)

Mistake #3: Investing in A Single Platform (Part 3 of 5) A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple […]

NSR Invest and MonJa Announce Strategic Partnership

MonJa will partner with NSR Invest to bring institutional analytics and performance reporting to financial advisors in peer-to-peer lending. This strategic partnership was announced in Crowdfundinsider on September 28, 2015. Below is the original PRNewsWire release. DENVER and SAN FRANCISCO, Sept. 26, 2015 /PRNewswire/ — NSR Invest, a leading peer-to-peer investment management platform, and MonJa, a leading […]

5 Common Mistakes P2P Loan Investors Make: Insufficient Diversification (Part 1 of 5)

MonJa is excited to announce their five part blog series “5 Common Mistakes P2P Loan Investors Make”. With the growth of peer-to-peer lending, more institutional investors are investing in marketplace platforms. There are several introductory guides out there on p2p lending, yet investors are applying sophisticated credit strategies in buying loans- something basic guides don’t […]