Marketplace Lending Outlooks

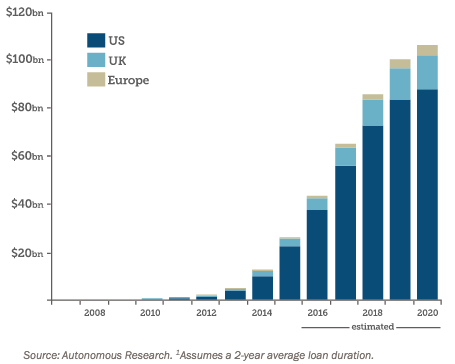

At MonJa, we strive to support industry watchers and investors further their understanding of the marketplace lending sector. Several financial enterprises release their investment outlooks on marketplace lending. Here are some general trends to be cognizant of: – FinTech Partners’ February 2018 Overview– The PDF reports provide a broad coverage of transactions specifically in the alternative lending space. –K&L […]

LendingClub did not "misfire" in their underwriting

Late last week, there was a Bloomberg Business article on LendingClub’s recent “misfiring” of loan origination models. While I personally enjoy most of Bloomberg’s coverage of marketplace lending (positive or negative), this article appears to have taken a recent LC-Advisor report out of context. Below are a couple actual data points on LendingClub’s underwriting performance: […]

MonJa Monthly News Update- January 2016

Here are some of the top stories and trends of January 2016 for marketplace lending investors and industry watchers: Industry News: 01-31-2016 How Alternative Lenders Are Challenging the Traditional Value of Consumer Credit Ratings (Finance Magnates)-FinTech companies continue to find new ways to measure credit worthiness of borrowers, such as abandoning FICO scores, assessing how […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

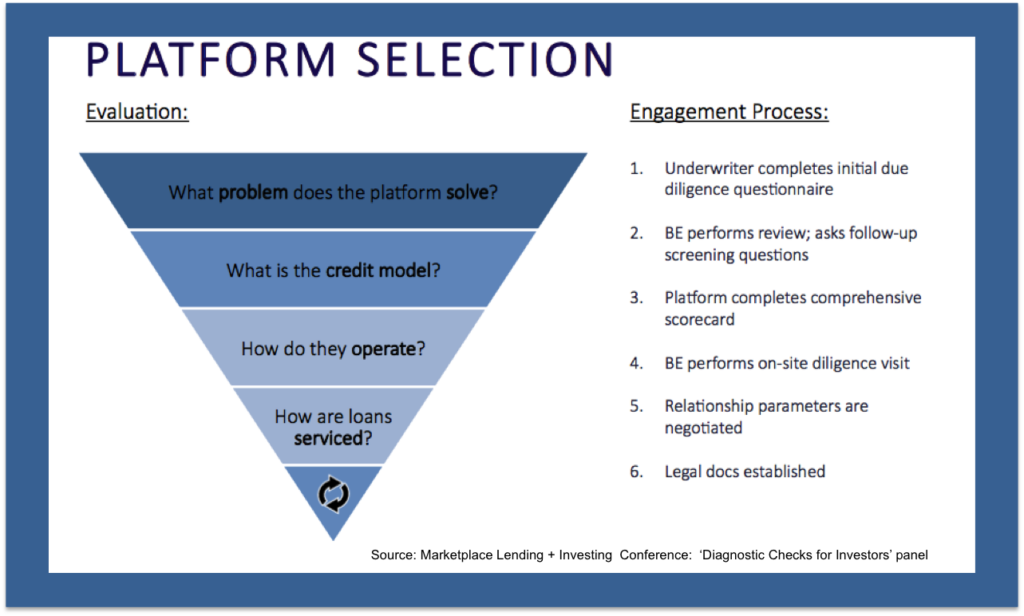

What We Learned At Industry Conferences: Marketplace Lending Trends

Earlier this month, MonJa attended the IMN Investor’s Conference on Marketplace Lending, AltFi Global Summit, and American Banker’s Marketplace Lending and Investing in New York. For those who were not able to attend, we present an overview of common themes and challenges that were discussed among issuers, service providers, banks, and investors. We also give a […]

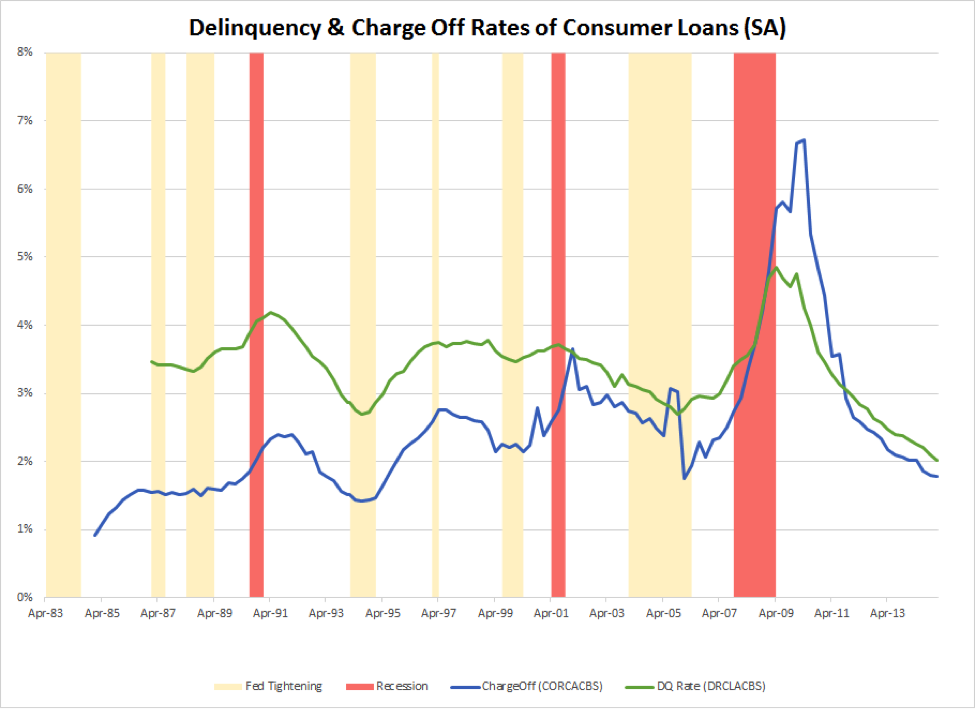

How Can Loan Investors Prepare For Economic Shock?

As the end of the year approaches, many investors trying to find how to invest $500 show concern about the potential slowdown in the economy. This caution is with good reason, as the slowdown in China and lull in US job growth point to a high likelihood of the US economy being affected. A recent Washington Post Article, “Economists are starting to […]

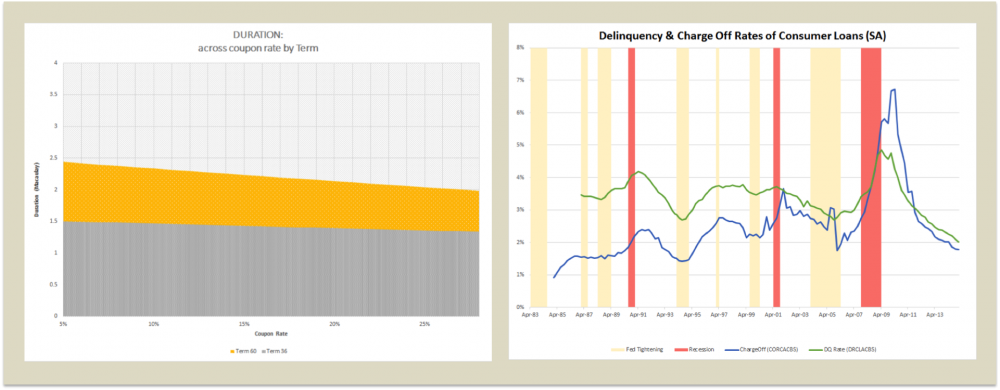

4 Ways An Interest Rate Hike Will Impact Investors

This post was originally featured on October 5, 2015, in Orchard Platform’s Thought Leadership Series, where blog series where marketplace lending leaders share their industry insights. Below I share insights gained from my 10+ years of experience overseeing the loss forecasting of $9+ billion diverse small business lending products and managing $100+ billion in retirement assets. On […]

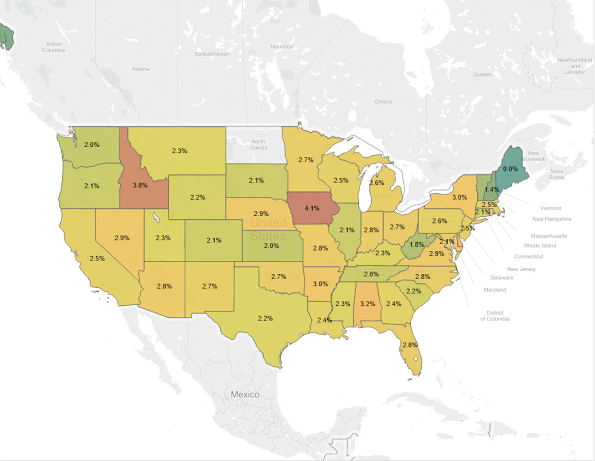

6 Factors to Consider When Investing on Lending Platforms

On October 30, 2015, many key players in the marketplace lending industry submitted their comments to the U.S. Department of Treasury’s RFI for the online marketplace lending industry. While sifting through many of the comments, I’ve selected a few excerpts that might be relevant to investors looking into the space. In this blog post, we’ll […]

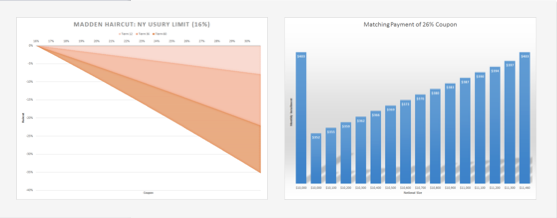

What's The Madden With You?

The Madden v. Midland Funding, LLC ruling proves the importance of understanding the regulatory risk faced when pricing any asset class- especially in marketplace lending. Below is the MonJa analysis on how this ruling effects p2p institutional investors. First though, some of the facts: For a Madden v. Midland case overview, check out Lend Academy’s post […]

Which Marketplace Lenders Are Making Moves?

Here at MonJa we have a strong pulse on what’s happening in the marketplace lending space. During our weekly team meetings, we always spend time discussing recent peer to peer lending activity. This week we discussed the increase in venture capital funding amongst financial tech companies. These past months, VCs have invested heavily in this […]