On October 30, 2015, many key players in the marketplace lending industry submitted their comments to the U.S. Department of Treasury’s RFI for the online marketplace lending industry. While sifting through many of the comments, I’ve selected a few excerpts that might be relevant to investors looking into the space. In this blog post, we’ll explore the benefits and risk factors that investors consider when directly investing on platforms.

What makes this asset class so attractive?

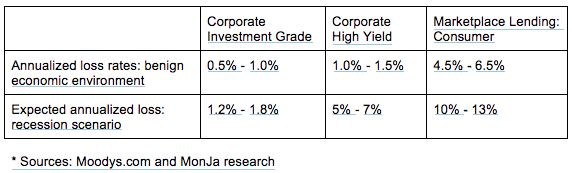

Investors are attracted to this asset class because of the lower duration and higher yields characteristics that marketplace lending notes hold. In MonJa’s comment to the RFI, we compared the corporate investment grade portfolios with marketplace lending portfolios. “A marketplace lending portfolio can typically deliver 1.5% – 3.5% higher returns than corporate high yields and >4% higher returns than corporate investment grade portfolios. Marketplace notes are also less sensitive to rising interest rates due to the shorter maturity and amortized payment schedule. This chart summarizes the difference amongst corporate and marketplace lending yields.

A marketplace lending note has a typical duration of < 2 years, compared to 4 years for high yield and nearly 8 years for corporate investment grade notes. With the expectations of interest rates rising, this asset class can provide additional returns without increased the duration risk of a fixed income portfolio” (p. 2).

Now you know the rewards, so what are the risk factors to consider?

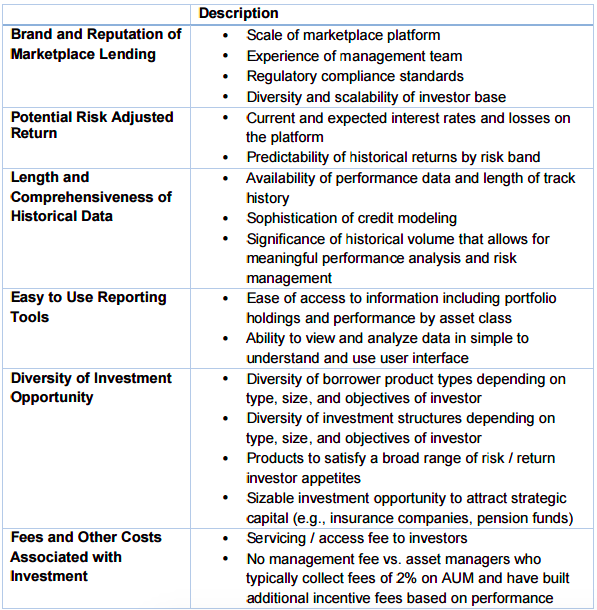

There are a number of factors investors consider when entering into marketplace lending. Lending Club’s comment to the RFI provides an excellent summary of what to observe when choosing a platform.

*Source: Lending Club’s Comment to U.S. Department of Treasury RFI

To dig deeper into the factors, investors should examine which structures to consider when buying from lending platforms. Some investors finance whole loans and hold them onto their balance sheets. Other investors purchase fractional loans, which may or may not be affiliated with a bankruptcy remote vehicle from the loan originator.

How do you manage the loan-level hazards from marketplace lending?

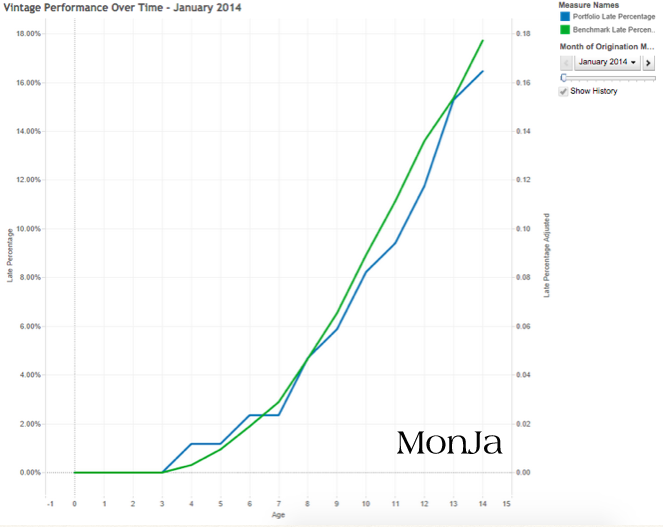

There’s always higher risk involved when there is a greater reward. To manage risk factors, marketplace lending investors can utilize risk modeling of prepayments and delinquency rates to model expected cash flow. Minimizing risk is important for every investor, so it is often required for portfolio managers to have macro variable stress tests to assess risk factors and employ performance attribution for a drilled-down analysis on the loans. By paying attention to the potential loss of different economics scenarios, investors can approach portfolio construction accordingly.