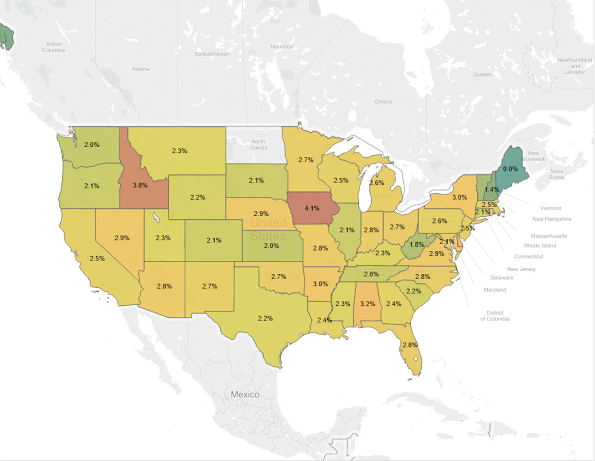

How Can Loan Investors Prepare For Economic Shock?

As the end of the year approaches, many investors trying to find how to invest $500 show concern about the potential slowdown in the economy. This caution is with good reason, as the slowdown in China and lull in US job growth point to a high likelihood of the US economy being affected. A recent Washington Post Article, “Economists are starting to […]

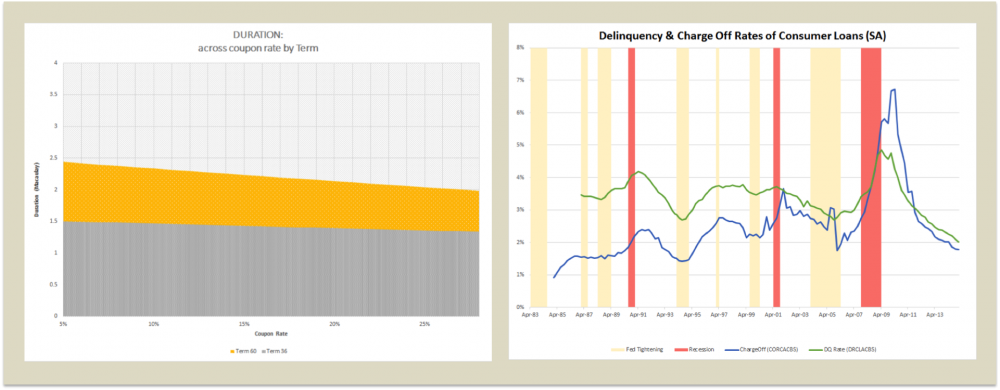

4 Ways An Interest Rate Hike Will Impact Investors

This post was originally featured on October 5, 2015, in Orchard Platform’s Thought Leadership Series, where blog series where marketplace lending leaders share their industry insights. Below I share insights gained from my 10+ years of experience overseeing the loss forecasting of $9+ billion diverse small business lending products and managing $100+ billion in retirement assets. On […]

Five Common Mistakes P2P Loan Investors Make: Investing In A Single Platform (Part 3 of 5)

Mistake #3: Investing in A Single Platform (Part 3 of 5) A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple […]

NSR Invest and MonJa Announce Strategic Partnership

MonJa will partner with NSR Invest to bring institutional analytics and performance reporting to financial advisors in peer-to-peer lending. This strategic partnership was announced in Crowdfundinsider on September 28, 2015. Below is the original PRNewsWire release. DENVER and SAN FRANCISCO, Sept. 26, 2015 /PRNewswire/ — NSR Invest, a leading peer-to-peer investment management platform, and MonJa, a leading […]

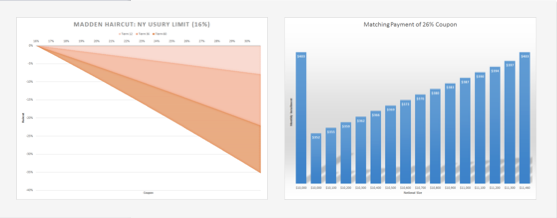

What's The Madden With You?

The Madden v. Midland Funding, LLC ruling proves the importance of understanding the regulatory risk faced when pricing any asset class- especially in marketplace lending. Below is the MonJa analysis on how this ruling effects p2p institutional investors. First though, some of the facts: For a Madden v. Midland case overview, check out Lend Academy’s post […]

A Day In The Life Of A MonJa Intern

Two rockstar interns joined the MonJa team this summer. When they’re not amazing us with their lightning speed coding abilities, they keep us laughing with their amusing comments and millennial insights. We asked them to share their summer experiences. Zi Wei, an anime loving sophomore at the University of Illinois Urbana Champaign, illustrates that MonJa life in […]

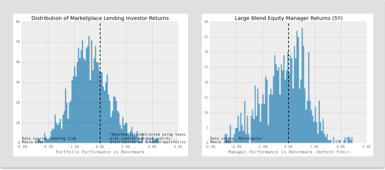

Loan Selection In P2P Lending: Does It Actually Work?

The major P2P lending platforms, such as Lending Club and Prosper, have been terrific at underwriting and setting a level playing field for marketplace lending – and several of them have recently launched or improved their passive vehicles; this is great news for investors seeking passive income with a minimal amount of hassle. A common […]

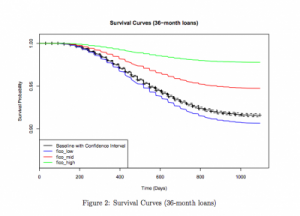

Survival Analysis Applied to Marketplace Loans

MonJa would like to introduce Professor Matthew Dixon, whose current research interests include credit modeling for peer-to-peer loans. Over the last several months, Prof Dixon and Litong Dong, a recent graduate of USF, have engaged in a collaborative research project with us here at MonJa. Their research focuses on survival analysis and how it might apply […]

Which Marketplace Lenders Are Making Moves?

Here at MonJa we have a strong pulse on what’s happening in the marketplace lending space. During our weekly team meetings, we always spend time discussing recent peer to peer lending activity. This week we discussed the increase in venture capital funding amongst financial tech companies. These past months, VCs have invested heavily in this […]

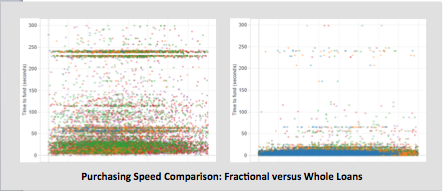

Gone in 60(/12) seconds – 3 types of loans algorithmic investors buy

A few weeks ago Simon Cunningham at Lending Memo wrote a great post on algorithmic investing in marketplace lending. There is a perception that institutional investors are buying the best loans using credit models. This is a good assumption. But it’s also worth asking: do institutional investors really behave differently from retail investors on the […]