MonJa's Digital Banking and Lending Monthly Roundup | June

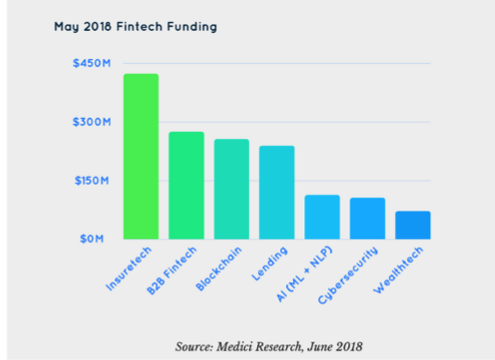

[vc_row][vc_column][vc_column_text]MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a world full […]

Small Banks and Why They Need To Adapt To The Latest In Artificial Intelligence and Machine Learning

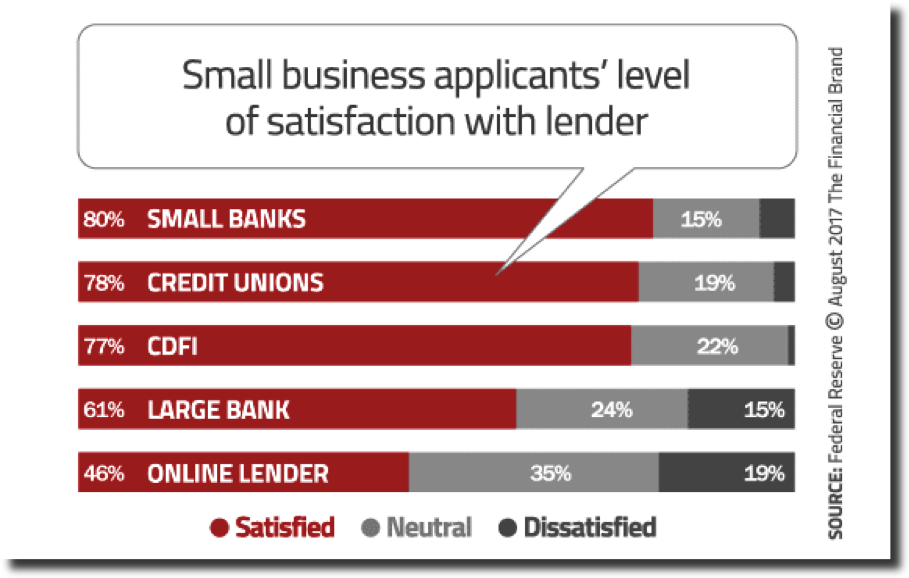

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]Small banks and credit unions play an important role in the US financial system particularly in serving rural and small metropolitan areas. Why should they care about artificial intelligence and machine learning when their business with borrowers is based on personal relationships? Their essence is in relationships built with the community at the local level, […]

Overview of US Consumer Lending

Financial system across the US took a beating in the aftermath of the 2008 financial crisis and American views changed overnight with regards to their financial system. In a 2014 Gallup poll, only 26 percent expressed having “‘a great deal’ or ‘quite a lot’ of confidence in banks,” down from 41 percent in 2007 and […]

From Wall Street to Main Street: How will Goldman's new consumer product, Marcus, fare?

Goldman Sachs enters the consumer lending market with its new product, Marcus, rousing mixed responses from the industry. Last week, Goldman Sachs debuted Marcus, an online-loan service geared toward prime consumers paying down credit-card debt. Essentially, as representatives at Goldman put it, Marcus aims “to help Americans manage debt better.” In sum, consumers (typically those with a credit […]

MonJa Monthly News Update- October 2016

Here are some of the top stories and trends of September 2016 for marketplace lending investors and industry watchers: Industry News: 09-01-2016- Plentiful opportunities in alternative credit and niche lending, says PIMCO (altfi) 09-01-2016- New Fintech Partnership: Currencycloud Links with Arkéa Banking Services (Crowdfund Insider) 09-05-2016- KKR: Alternative credit set to be “star performing” asset […]

Part 2 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the second post in a two part blog series that examines the “40 Act Funds”. In part 1 we examine the structure and performance of the funds in the UK and US. In part 2 below, we will delve into the implications of funds on marketplace lending. Go here to read part 1 Impact on investors, […]

MonJa Monthly News Update- September 2016

Here are some of the top stories and trends of August 2016 for marketplace lending investors and industry watchers: Industry News: 08-03-2016- The Online Lending Obstacle Course (Bloomberg) 08-03-2016- How Millennials Will Change Online Lending (Orchard Platform) 08-03-2016- Do We Need Bank Branches? (Lend Academy) 08-08-2016- What does a drop in interest rates mean for […]

Why Marketplace Lending Fund Returns Look Terrible

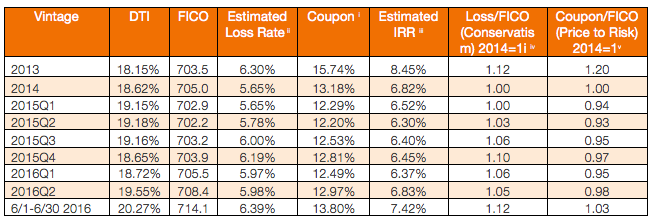

Since the end of 2015, the marketplace lending industry has been seen in a negative light. The news portrayal is a result of several events- the Lending Club upheaval, platform job cuts, consumer loan defaults, and more. Funds appeared to be performing poorly. As a result, investors have pulled back from investing, opting to wait […]

Five Common Mistakes P2P Loan Investors Make: Investing In A Single Platform (Part 3 of 5)

Mistake #3: Investing in A Single Platform (Part 3 of 5) A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple […]

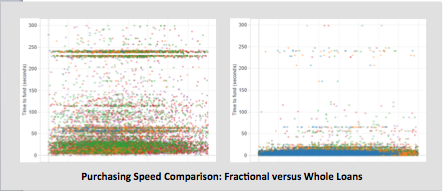

Gone in 60(/12) seconds – 3 types of loans algorithmic investors buy

A few weeks ago Simon Cunningham at Lending Memo wrote a great post on algorithmic investing in marketplace lending. There is a perception that institutional investors are buying the best loans using credit models. This is a good assumption. But it’s also worth asking: do institutional investors really behave differently from retail investors on the […]