Moody's "downgrades" Prosper-backed deal despite consistent performance

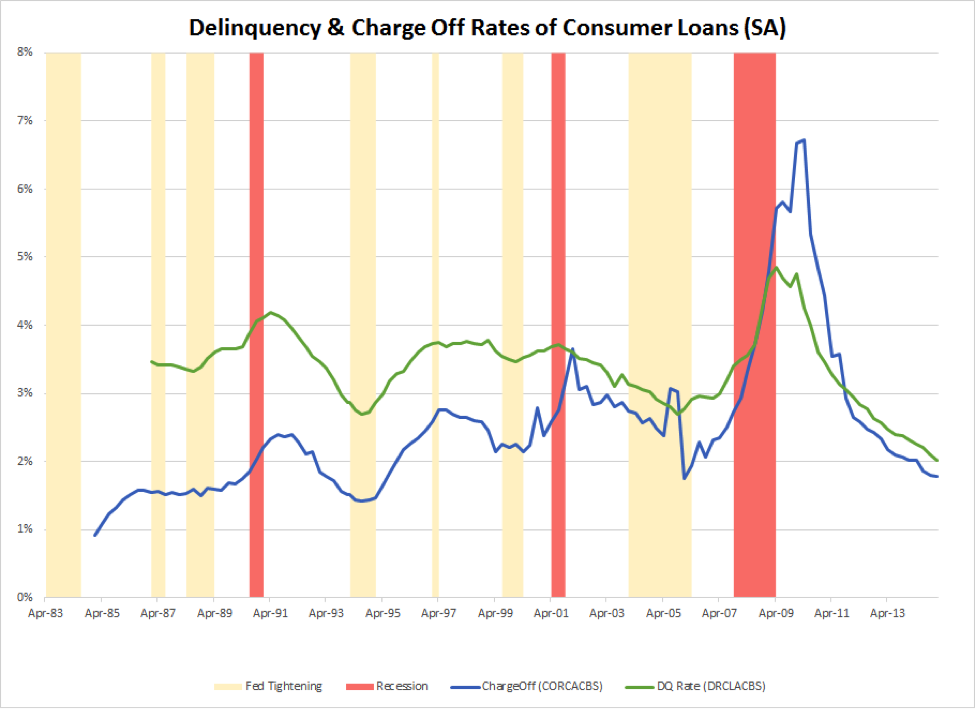

Earlier this month, Moody’s put the C notes of the Prosper/ Citi securitizations CHAI 2015-PM1 / 2015-PM2 / 2015-PM3 on a review for downgrade. The most material change in the forecast was an increase of expected cumulative lifetime net loss to 12%, from 8% to 8.5% of the 3 transactions. On the reason for this […]

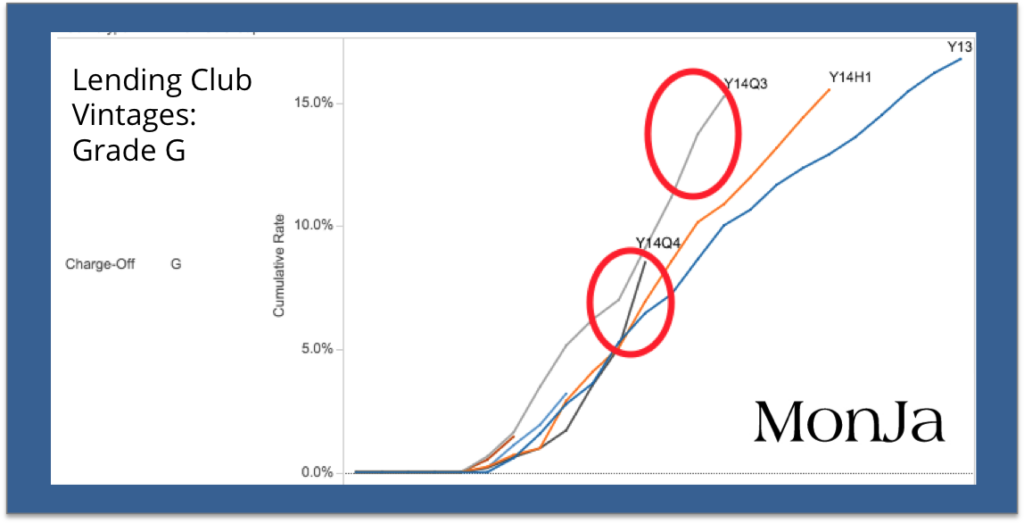

Lending Club Performance – The Good And The Bad (Feb 2016)

As I previously wrote, some of the recent coverage on Lending Club’s credit performance is somewhat one-sided, and we believe Lending Club’s loan performance is broadly in line with expectation. That said, the actual performance depends on the specific segment in question, which we will explore in greater detail in this post. Similar to what […]

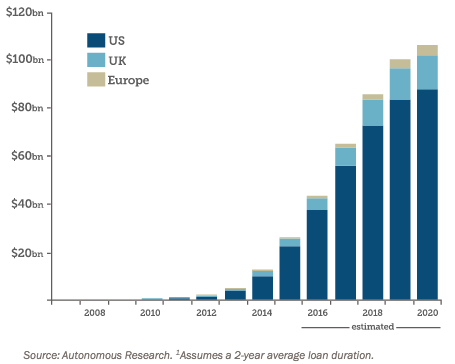

Marketplace Lending Outlooks

At MonJa, we strive to support industry watchers and investors further their understanding of the marketplace lending sector. Several financial enterprises release their investment outlooks on marketplace lending. Here are some general trends to be cognizant of: – FinTech Partners’ February 2018 Overview– The PDF reports provide a broad coverage of transactions specifically in the alternative lending space. –K&L […]

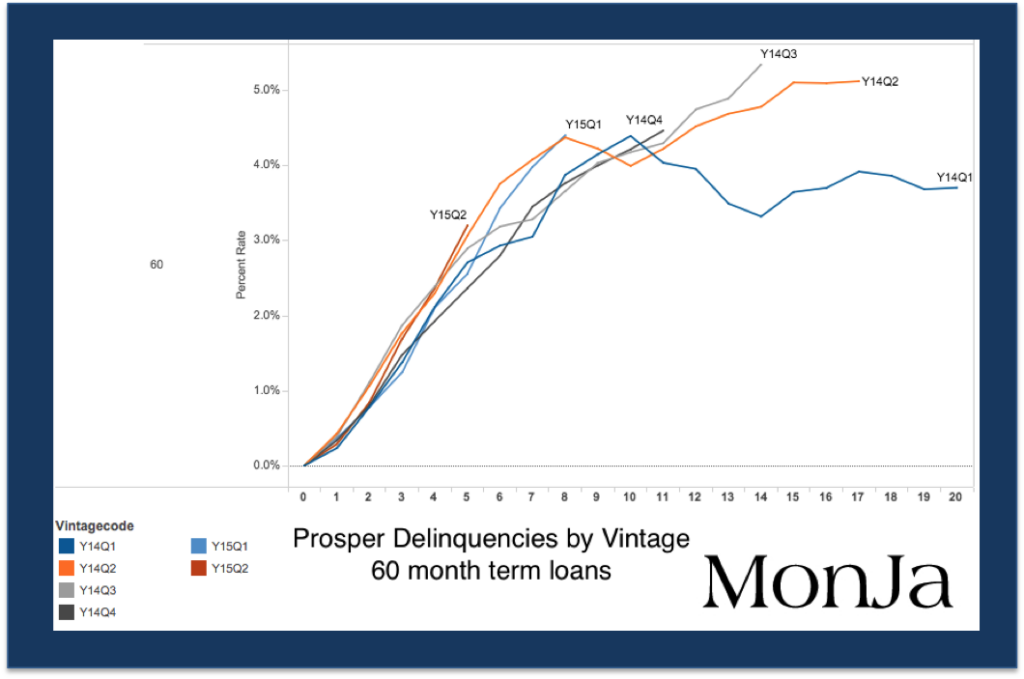

LendingClub did not "misfire" in their underwriting

Late last week, there was a Bloomberg Business article on LendingClub’s recent “misfiring” of loan origination models. While I personally enjoy most of Bloomberg’s coverage of marketplace lending (positive or negative), this article appears to have taken a recent LC-Advisor report out of context. Below are a couple actual data points on LendingClub’s underwriting performance: […]

MonJa Monthly News Update- January 2016

Here are some of the top stories and trends of January 2016 for marketplace lending investors and industry watchers: Industry News: 01-31-2016 How Alternative Lenders Are Challenging the Traditional Value of Consumer Credit Ratings (Finance Magnates)-FinTech companies continue to find new ways to measure credit worthiness of borrowers, such as abandoning FICO scores, assessing how […]

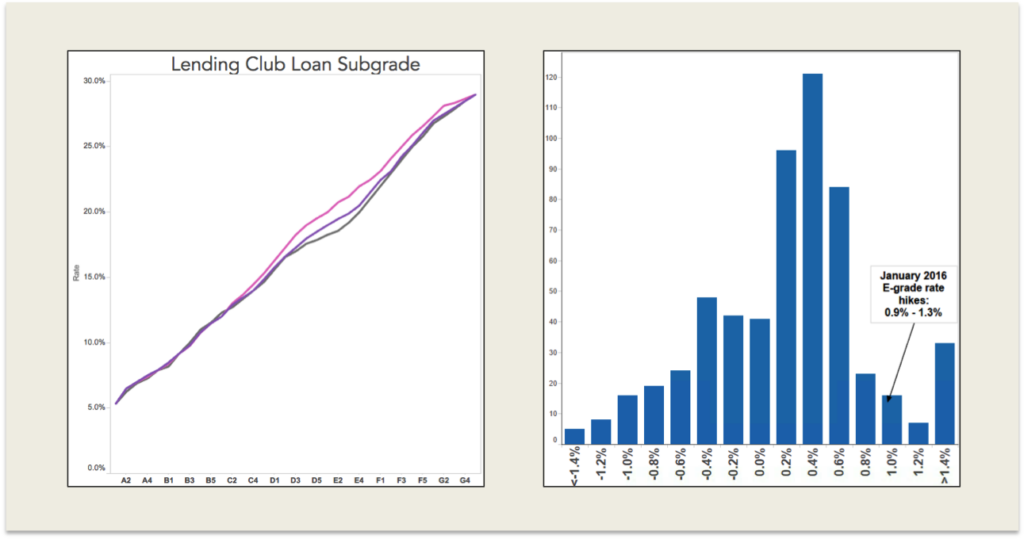

How significant is Lending Club's recent rate hike?

A few days ago, Lending Club increased it’s borrower rate – second time in two months, after the December hike that coincided with the Fed rate hike. Investors should read Lending Club Advisor’s Commentary of 2016 for more background on the rate changes. In addition to the Fed rate hike, LC’s interest rate change may be caused by the […]

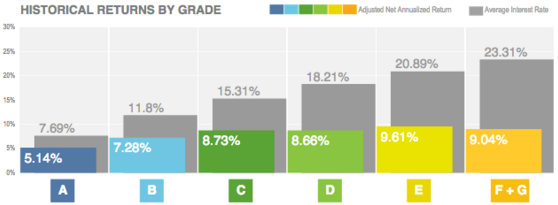

Five Common Mistakes P2P Loan Investors Make: Investing in only Low Interest Rate Loans (Part 5 of 5)

In the fall of 2015, MonJa launched our blog series “5 Common Mistakes P2P Loan Investors Make.” We’ve delved into the following 4 potential shortcomings that can happen to investors- insufficient diversification, using simple filters, investing in a single platform, and investing in only high-interest loans. In our fifth and final piece, we explore what happens when […]

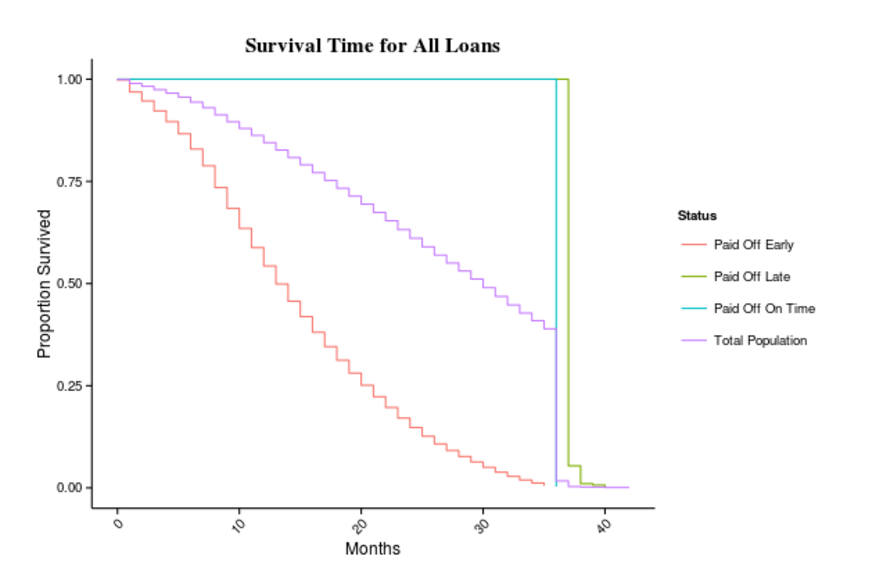

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

Five Common Mistakes P2P Loan Investors Make: Investing in Only High Interest Loans (Part 4 of 5)

Mistake #4: Investing in Only High Interest Loans (Part 4 of 5) In the beginning of fall, MonJa launched our “5 Common Mistakes P2P Loan Investors Make” blog series. This week, we will talk about the fourth mistake investors make in peer-to-peer lending. These observations aim to help investors understand essential investment strategies. There is a […]