The Roles of Automated Software in Small Business Lending

[vc_row][vc_column][vc_column_text]4 Minutes Read. The small business lending sector was revolutionized with the introduction of Fannie Mae’s Desktop Underwriter in 1995. The many roles the automated system filled in the lending process convinced financial institutions of the value of investing in a business lending software solution. Such software essentially operates as a fast, accurate employee who […]

E-book: How Automation Can Help With Small Business Loan Underwriting

[vc_row][vc_column][vc_column_text] Looking for ways to grow and expand the loan origination volumes? Wondering how do this cost-effectively? Trying to simplify your loan underwriting workflow? It may be the right time to start exploring automation. Check out our e-book to learn how loan underwriting automation can simplify and boost the productivity of your lending process.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text] Download […]

Signs You Need a Lending Solution Software

[vc_row][vc_column][vc_column_text]4 Minutes Read. Loan approvals are growing at near-record rates among all types of financial institutions, particularly in small business loans, which is why many lenders are turning to lending solution software. Automated lending solutions can help financial institutions streamline processes and improve customer service by reducing the time and potential for errors in manual […]

Speed To Market Is Critical In Small Business Loan Underwriting

[vc_row][vc_column][vc_empty_space height=”50px”][vc_column_text]8 Minutes Read. The demand for small business loans is growing at an astonishing pace worldwide, which presents new opportunities as well as formidable challenges to traditional lenders and small lenders alike. Both large and small lenders are facing stiff competition for small business loan underwriting business. Small lenders – with their agility and […]

5 Questions To Ask Your Lending Automation Vendor

[vc_row][vc_column][vc_column_text] In today’s ultra competitive lending market, fintechs have taken a march over traditional banks with their digital first service and speed of closing loan applications. Brick and mortar banks now realize that their work is as much about technology as it is about finance. Legacy IT solutions are convenient for in-house operations but can’t be expected […]

Monthly News Update- August 2018

Here are some of the top online lending news, stories and trends of July 2018 for online lending investors and industry watchers. Industry News: 7/3/2018 “Equifax research reveals that a significant proportion of UK consumers would be up for sharing their data…” (AltFi News) 7/4/2018 Amazon has already made some moves to fintech. What are […]

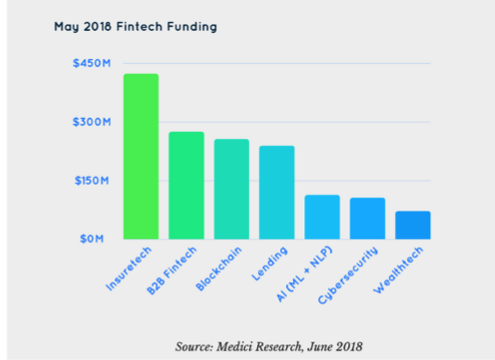

MonJa's Digital Banking and Lending Monthly Roundup | June

[vc_row][vc_column][vc_column_text]MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a world full […]

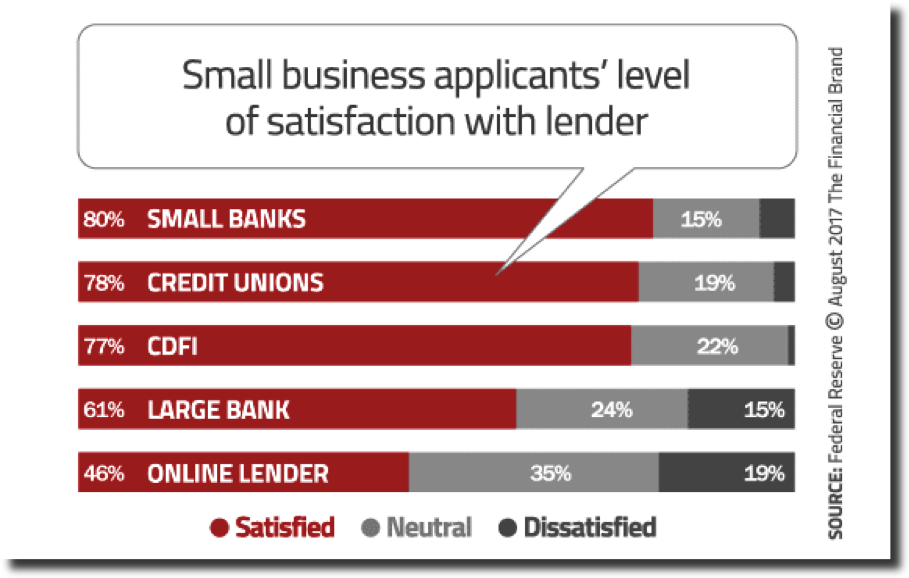

Small Banks and Why They Need To Adapt To The Latest In Artificial Intelligence and Machine Learning

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]Small banks and credit unions play an important role in the US financial system particularly in serving rural and small metropolitan areas. Why should they care about artificial intelligence and machine learning when their business with borrowers is based on personal relationships? Their essence is in relationships built with the community at the local level, […]

Overview of US Consumer Lending

Financial system across the US took a beating in the aftermath of the 2008 financial crisis and American views changed overnight with regards to their financial system. In a 2014 Gallup poll, only 26 percent expressed having “‘a great deal’ or ‘quite a lot’ of confidence in banks,” down from 41 percent in 2007 and […]