Part 1 of 2: The Emergence of 40 Act Funds & What It Means For Marketplace Lending

This is the first post in a two part blog series that examines the “40 Act Funds”. In part 1 of this series, we examine the structure and performance of the funds in the UK and US. In part 2, we will delve into the implications of funds on marketplace lending. Introduction The first and […]

MonJa Monthly News Update- September 2016

Here are some of the top stories and trends of August 2016 for marketplace lending investors and industry watchers: Industry News: 08-03-2016- The Online Lending Obstacle Course (Bloomberg) 08-03-2016- How Millennials Will Change Online Lending (Orchard Platform) 08-03-2016- Do We Need Bank Branches? (Lend Academy) 08-08-2016- What does a drop in interest rates mean for […]

Mark Your Calendars, P2P Investors!

Investing in marketplace lending and want to be aware of the latest marketplace lending industry trends? This blog is for you! It aims to inform investors about upcoming events and conferences in the P2P industry. Current Events: AltFi Global Summit 2016 When? September 14, 2016 Where? The Pierre, NYC Description: “Marketplace lending, direct lending, trade finance, BDCs, asset-backed finance, […]

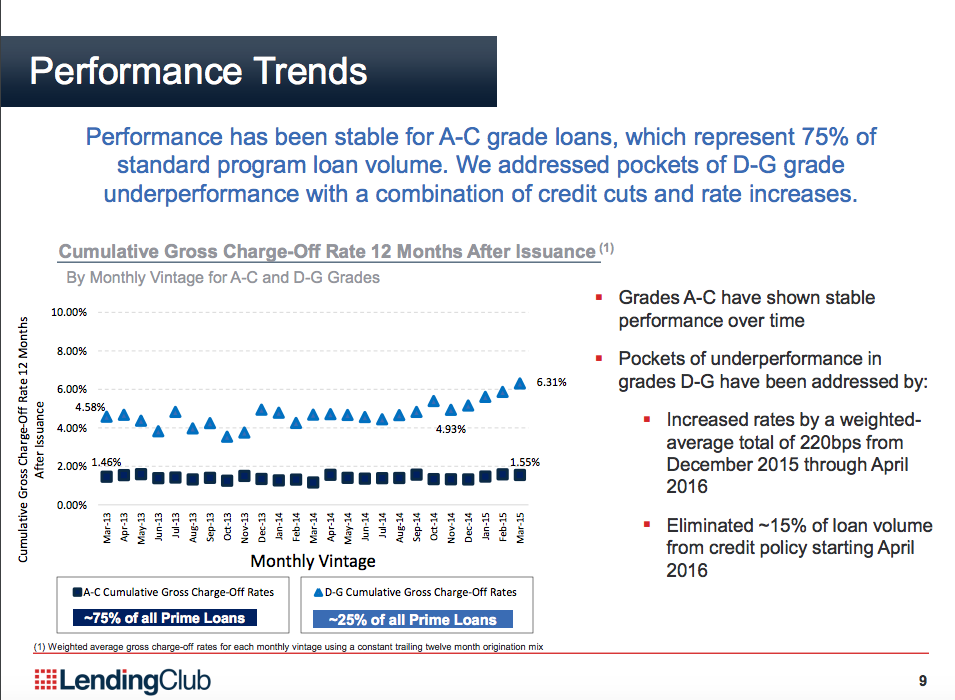

Changes in Lending Club Underwriting – Looking Beneath the Headlines

The news at Lending Club was a shock to everyone in the direct lending world. The process failings and potential business / legal ramifications have been discussed ad nauseam – and they are extremely serious. Several institutional investors have pulled back on their purchasing programs, for good reasons. Lending Club needs to show investors that […]

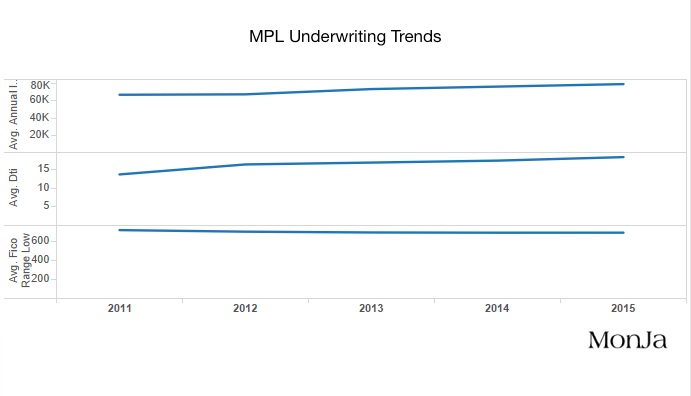

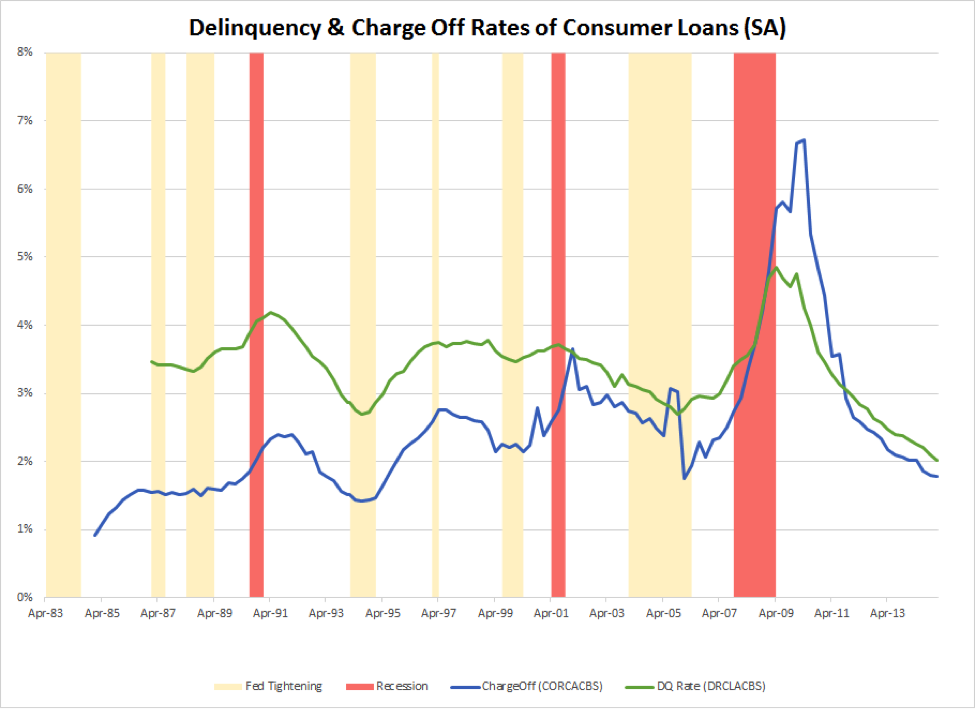

Marketplace Lending Analysis: Understanding The Recent Uptick In Delinquencies

We’ve all read the recent headlines. Since late 2015, sentiments have changed in the marketplace lending sector and investors have expressed concern. As an independent risk analytics platform, MonJa is often asked its if credit quality is deteriorating in the marketplace lending space and if investors need to readjust their expectations about the quality of […]

Five Common Mistakes P2P Loan Investors Make: Investing in only Low Interest Rate Loans (Part 5 of 5)

In the fall of 2015, MonJa launched our blog series “5 Common Mistakes P2P Loan Investors Make.” We’ve delved into the following 4 potential shortcomings that can happen to investors- insufficient diversification, using simple filters, investing in a single platform, and investing in only high-interest loans. In our fifth and final piece, we explore what happens when […]

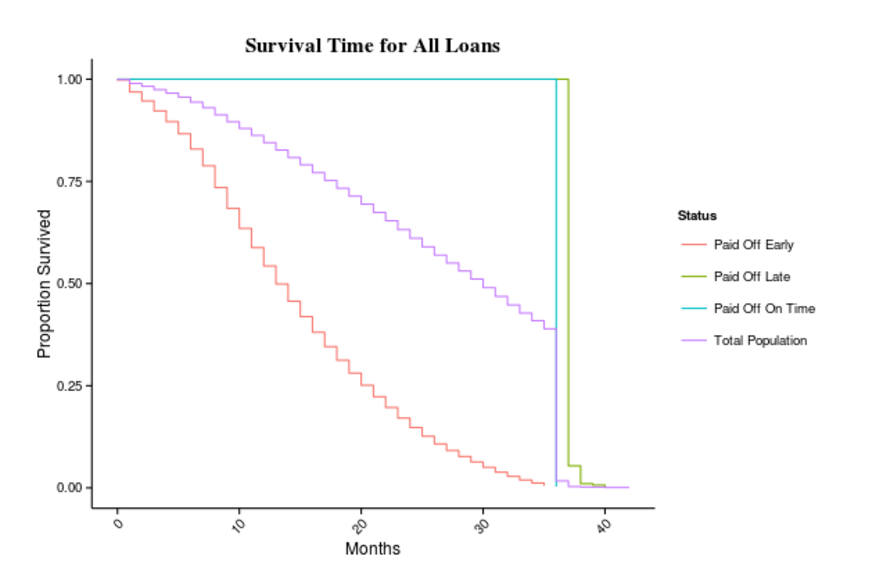

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

Growth in Marketplace Lending Spawns Specialized Risk Services and Tools

With the growth of marketplace lending, institutional investors need to manage their risk exposure. It’s important to understand what makes this market different from other asset classes and how to employ tools and models tailored for its risks. Originally written by Katherine Heires and posted by GARP Risk Intelligence on November 19, 2015, this article highlights different […]

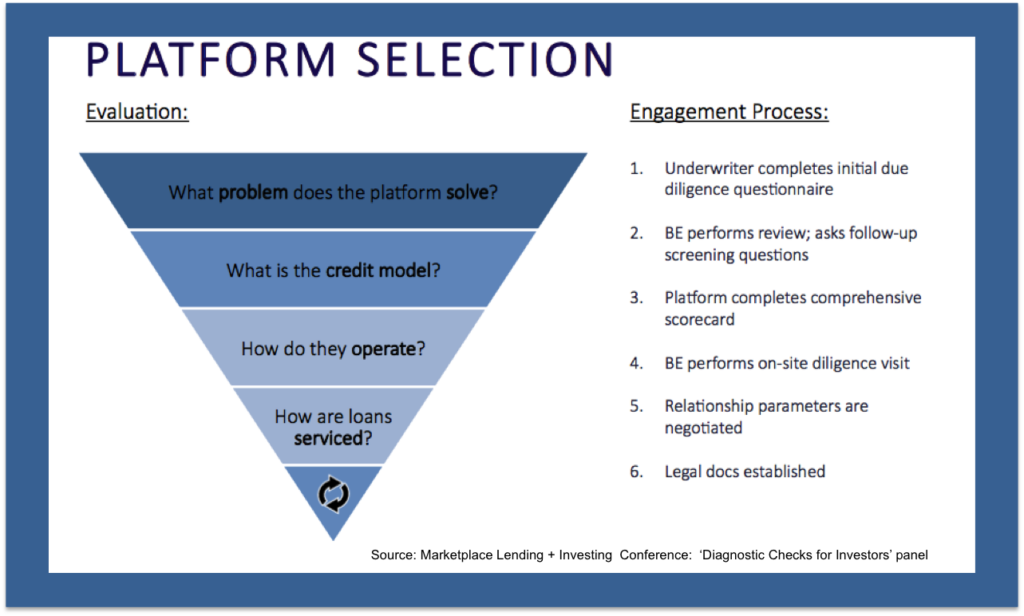

What We Learned At Industry Conferences: Marketplace Lending Trends

Earlier this month, MonJa attended the IMN Investor’s Conference on Marketplace Lending, AltFi Global Summit, and American Banker’s Marketplace Lending and Investing in New York. For those who were not able to attend, we present an overview of common themes and challenges that were discussed among issuers, service providers, banks, and investors. We also give a […]