How Can Loan Investors Prepare For Economic Shock?

As the end of the year approaches, many investors trying to find how to invest $500 show concern about the potential slowdown in the economy. This caution is with good reason, as the slowdown in China and lull in US job growth point to a high likelihood of the US economy being affected. A recent Washington Post Article, “Economists are starting to […]

Five Common Mistakes P2P Loan Investors Make: Investing In A Single Platform (Part 3 of 5)

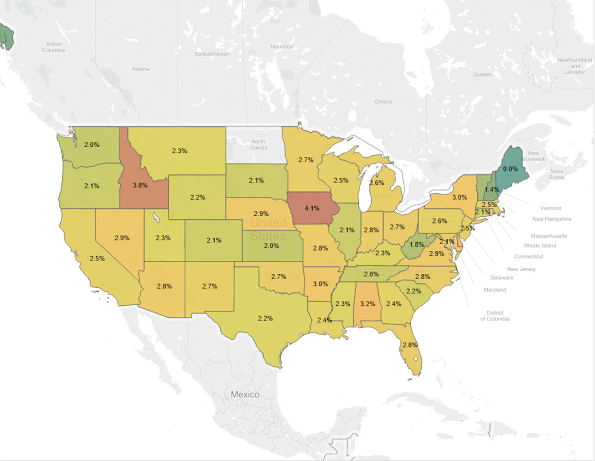

Mistake #3: Investing in A Single Platform (Part 3 of 5) A few weeks ago, we briefly examined the issue of diversification in the first post of our series (Mistake#1: Insufficient Diversification) and unsurprisingly, it creeps up again. We discovered that many investors believe that it is sufficient to diversify their portfolios by purchasing multiple […]

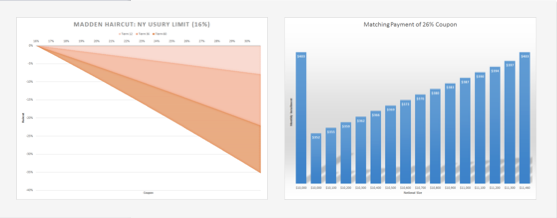

What's The Madden With You?

The Madden v. Midland Funding, LLC ruling proves the importance of understanding the regulatory risk faced when pricing any asset class- especially in marketplace lending. Below is the MonJa analysis on how this ruling effects p2p institutional investors. First though, some of the facts: For a Madden v. Midland case overview, check out Lend Academy’s post […]