Life After Lending Club: How The Market Is Responding To The Problems Of 2016

2016 has been quite the year for marketplace lending — beginning with Lending Club’s troubles in May, whose effects have rippled throughout the rest of the year, and continuing with external political factors affecting the global market (read: Brexit in June, the U.S. election in November). It has certainly been a difficult year for all […]

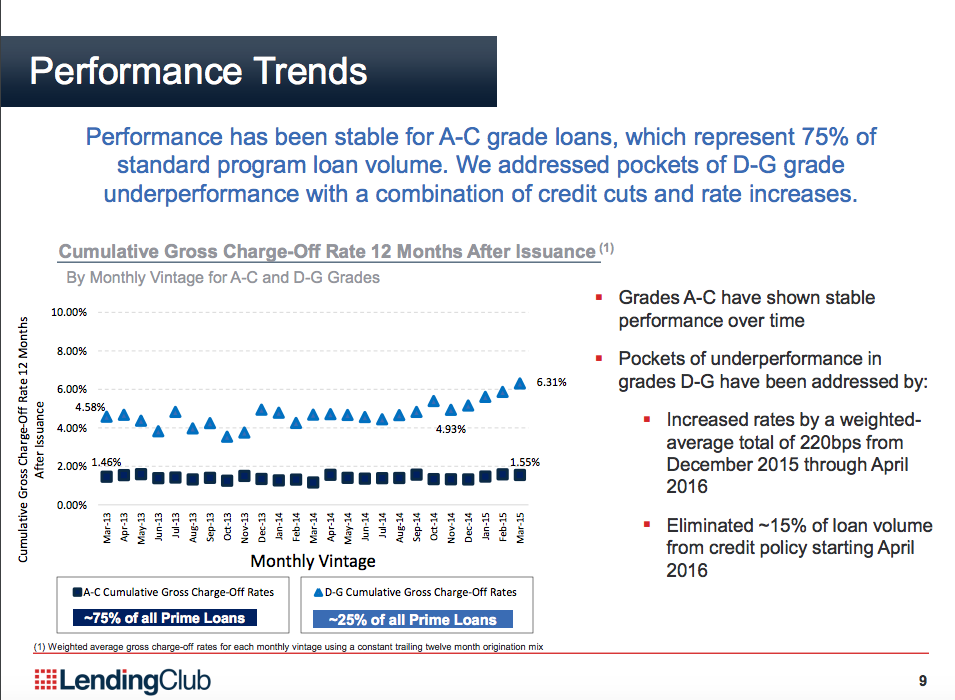

Changes in Lending Club Underwriting – Looking Beneath the Headlines

The news at Lending Club was a shock to everyone in the direct lending world. The process failings and potential business / legal ramifications have been discussed ad nauseam – and they are extremely serious. Several institutional investors have pulled back on their purchasing programs, for good reasons. Lending Club needs to show investors that […]

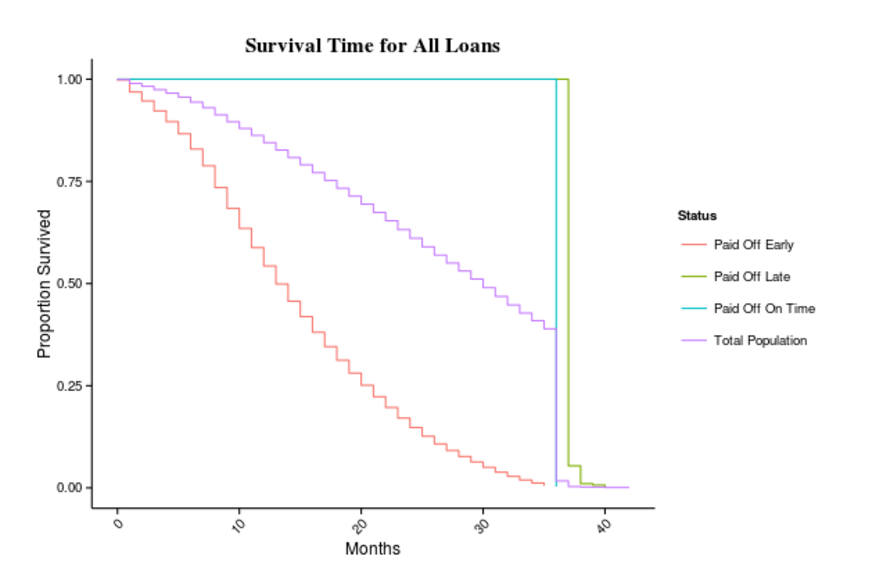

Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

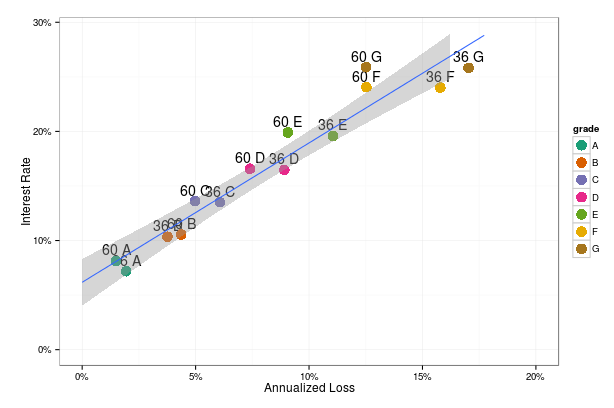

Are you buying the wrong loans? A pricing analysis of Lending Club loans

Many of our clients spend a lot of time thinking about selecting the right “buckets” to invest. Within a platform like Lending Club, that means selecting the right term and grades. We help managers think through the right expectation of returns within each bucket, and usually, this conforms to their intuition. But occasionally a loan […]