Measuring Who Prepays in Marketplace Lending: An Observation Based on Lending Club Loans

As an investor, it pays off to understand who prepays on personal loans. Prepayment is the early repayment of a loan by a borrower, often as the result of optional refinancing to take advantage of lower interest rates. Borrower prepayment means forgone interest income, and many peer-to-peer lending platforms don’t charge a prepayment penalty. Thus, […]

Top 3 Marketplace Lending Insights in 2015

Over this past year, the MonJa team has provided our credit risk insights (and our intern’s cartoon drawings) on our company blog. Investors and partners often refer to these entries (common comment: “Your team really knows what it’s talking about…” Well geez, thanks. Only been in credit risk analytics for 20 years…). These comments have led to […]

Growth in Marketplace Lending Spawns Specialized Risk Services and Tools

With the growth of marketplace lending, institutional investors need to manage their risk exposure. It’s important to understand what makes this market different from other asset classes and how to employ tools and models tailored for its risks. Originally written by Katherine Heires and posted by GARP Risk Intelligence on November 19, 2015, this article highlights different […]

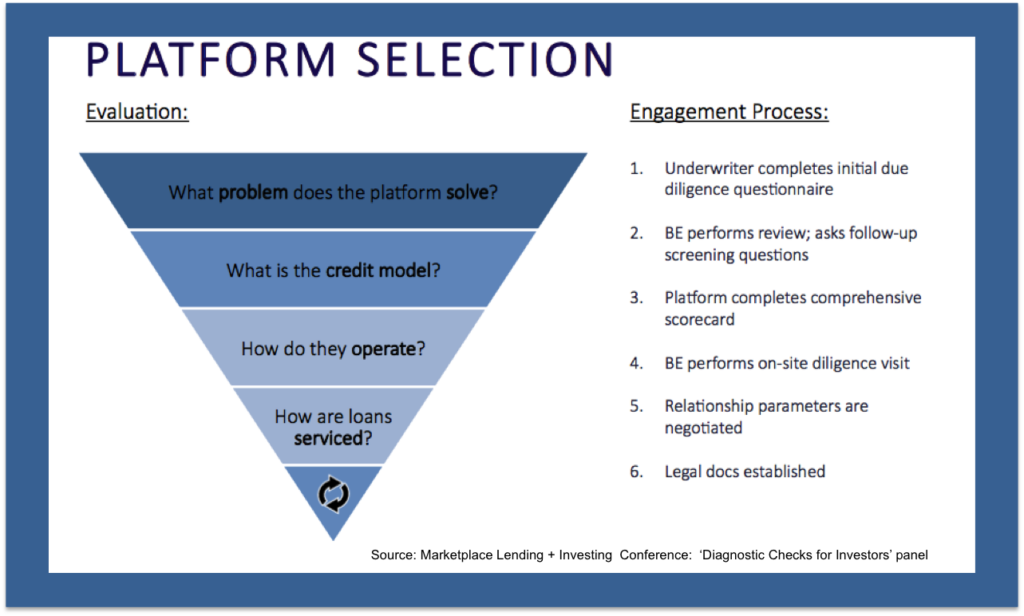

What We Learned At Industry Conferences: Marketplace Lending Trends

Earlier this month, MonJa attended the IMN Investor’s Conference on Marketplace Lending, AltFi Global Summit, and American Banker’s Marketplace Lending and Investing in New York. For those who were not able to attend, we present an overview of common themes and challenges that were discussed among issuers, service providers, banks, and investors. We also give a […]

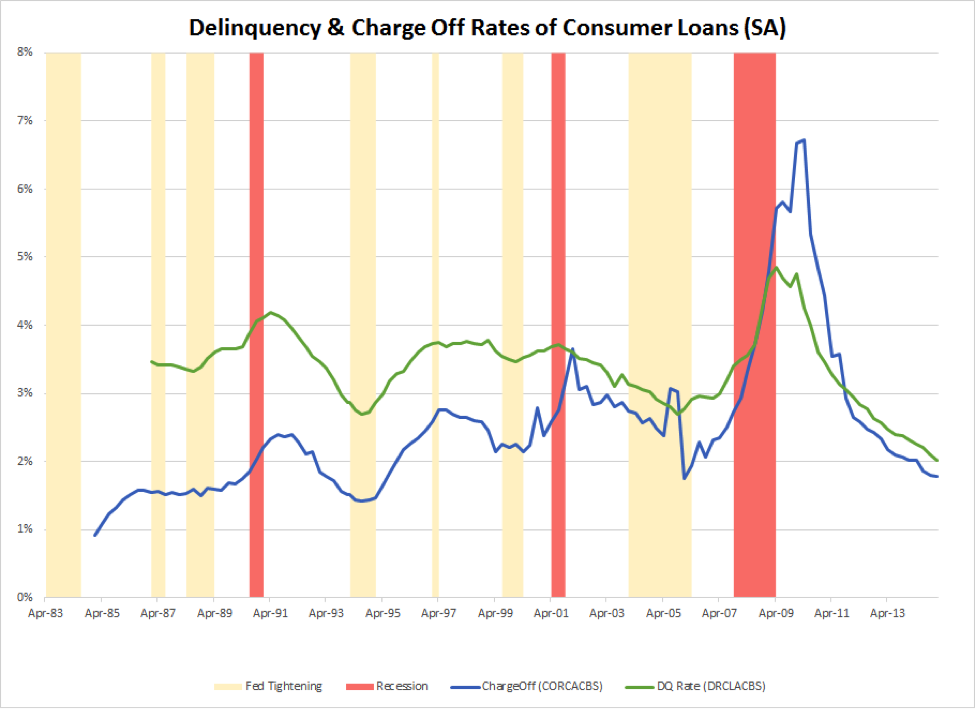

How Can Loan Investors Prepare For Economic Shock?

As the end of the year approaches, many investors trying to find how to invest $500 show concern about the potential slowdown in the economy. This caution is with good reason, as the slowdown in China and lull in US job growth point to a high likelihood of the US economy being affected. A recent Washington Post Article, “Economists are starting to […]

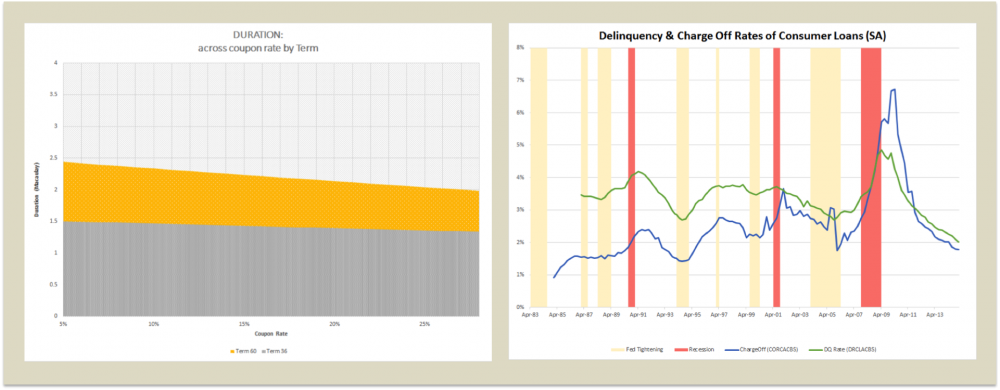

4 Ways An Interest Rate Hike Will Impact Investors

This post was originally featured on October 5, 2015, in Orchard Platform’s Thought Leadership Series, where blog series where marketplace lending leaders share their industry insights. Below I share insights gained from my 10+ years of experience overseeing the loss forecasting of $9+ billion diverse small business lending products and managing $100+ billion in retirement assets. On […]

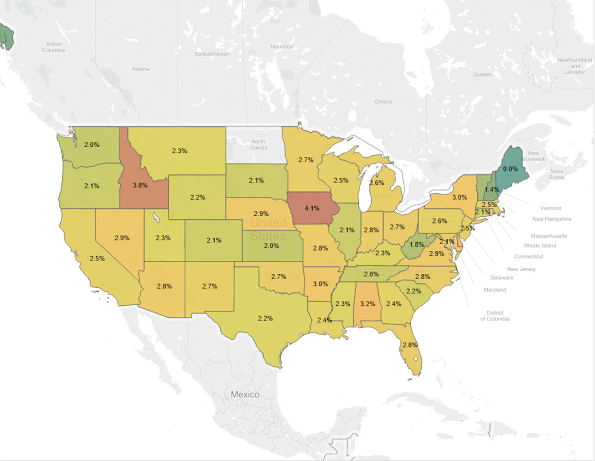

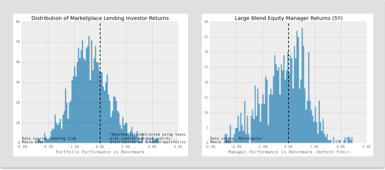

Loan Selection In P2P Lending: Does It Actually Work?

The major P2P lending platforms, such as Lending Club and Prosper, have been terrific at underwriting and setting a level playing field for marketplace lending – and several of them have recently launched or improved their passive vehicles; this is great news for investors seeking passive income with a minimal amount of hassle. A common […]

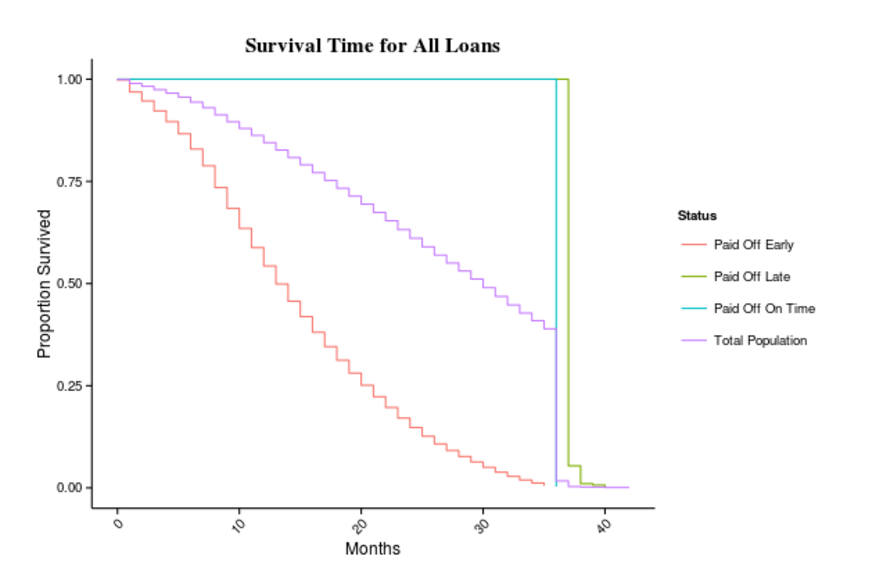

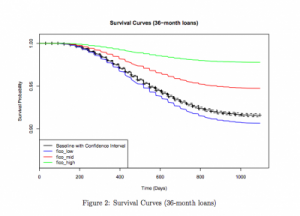

Survival Analysis Applied to Marketplace Loans

MonJa would like to introduce Professor Matthew Dixon, whose current research interests include credit modeling for peer-to-peer loans. Over the last several months, Prof Dixon and Litong Dong, a recent graduate of USF, have engaged in a collaborative research project with us here at MonJa. Their research focuses on survival analysis and how it might apply […]

Which Marketplace Lenders Are Making Moves?

Here at MonJa we have a strong pulse on what’s happening in the marketplace lending space. During our weekly team meetings, we always spend time discussing recent peer to peer lending activity. This week we discussed the increase in venture capital funding amongst financial tech companies. These past months, VCs have invested heavily in this […]