[vc_row][vc_column][vc_column_text]8 Minutes Read.

Small businesses play a critical role in the American economy. They employ half of the private sector workforce and have created approximately 60% of the new jobs in the US since 1995. Access to credit is essential to the health of small businesses. It helps small firms maintain cash flow, bring on new employees, buy additional inventory or equipment, and pursue growth strategies.

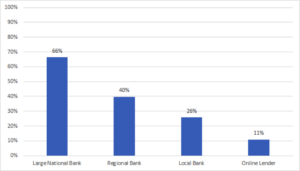

While online lenders have recently stepped into the small business loan arena, the overwhelming majority of external credit still comes from traditional commercial banks. As shown below, a recent survey reported that 66% of small business borrowers applied for loans at a large national bank, 40% at a regional bank, and 26% at a local bank. Only 11% sought small business funding from an online lender.

Small Businesses Rely on Traditional Banks for Financing: Where Businesses Apply for Loans

It’s true that some cyclical lending factors have improved in recent years. Traditional banks, however, continue to face several structural roadblocks that make it difficult to ramp up small business lending. The most important issue facing the banks are:

- Many banks are still stuck with an archaic borrowing process which involves mounds of paperwork and weeks of processing. In the digital banking era, SME clients will be lost to online lenders who are nimble and provide a hassle-free borrowing experience.

- The credit models do not have the sophistication to handle new age businesses like e-commerce and SaaS companies. Multiple restrictive covenants (minimum 3 years of history, no loss in operations, straight-line growth) means that many promising SMEs are funneled out of the lending process.

- The cost of handling a borrower’s application from a traditional brick and mortar branch versus an online application is too expensive to make small business lending a long-term profitable proposition for banks looking to grow in this segment.

The Profit Puzzle of Commercial Banks

Loans to small businesses are often less profitable than loans to larger businesses. This is because underwriting a smaller loan costs the banks just as much as underwriting a larger loan. The unit economics push the banks to prioritize larger firms. Also, lending to small businesses is typically riskier and costlier than lending to larger firms. Another factor contributing to the plight is that small businesses are less immune to financial downturns in the economy. Small businesses fail at a higher rate than larger firms. Nearly 11% of companies with fewer than 10 employees fail, while only 2% of firms with between 100 and 499 employees fail.

Evaluating detailed financial information of small businesses can prove onerous if the business has a limited operating history. Lending decisions in traditional banking often rely heavily on information gathered through relationships—and relationships can be quite expensive. As such, evaluating applications and thoroughly assessing creditworthiness of small businesses can be prohibitively costly for commercial banks. And it doesn’t stop with the decision to lend; once credit is extended, small business loans must be monitored for firm performance, further eating into the lender’s potential profit.

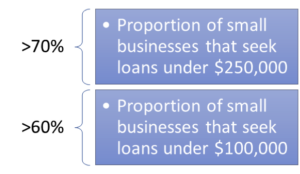

Loan sizes also add to the problem: Small businesses typically seek small-dollar loans, which are less appealing to banks. More than 70% of small businesses seek loans under $250,000, and more than 60% want loans under $100,000. When the potential costs of evaluating an application and monitoring a loan are compared to the small dollar amount, many commercial banks simply can’t justify the math.

A Preference for Small-Dollar Loans

Another critical reason for banks shying away from small business lending is the massive regulatory burden associated with extending credit to small businesses. Banks had to cough up billions of dollars in fines after the 2008-09 economic recession for reckless funding to consumers and small businesses. The banks’ risk departments consequently killed any appetite for small business loans by demanding an exorbitant level of scrutiny on such loans. This made small business loans not only non-profitable but also undesirable due to the regulatory stigma attached to them.

The Future of Small Business Lending

Vacating the trillion-dollar small business lending market is not the solution for banks. But opening the credit taps or lowering the criteria for a small business loan is neither prudent nor enough to draw-in borrowers. Fintech lenders have stolen a march with their digital lending platforms. VCs have invested billions of dollars in such lenders and financial institutions now account for over half of lending volume on many alt-lending platforms. Thus, capital is no longer a reliable moat for banks.

How can banks solve the profit puzzle and ramp up small business lending? The answer is in digital onboarding of borrowers and tech-driven process automation. There is an urgent need for banks to adopt tools and technologies for enhanced data collection, process automation, automated scoring, and rule-based decisioning. This is imperative to improve the risk evaluation process, reduce reliance on relationship banking, and bolster profitability in the small business loan space. Key areas to be covered:

- Loan Underwriting Technology: Banks need to automate the loan underwriting procedure. Manual credit processing is too time consuming, expensive and error prone to be scalable. Credit algorithms can now incorporate thousands of data points, which is simply not possible for a human.

- Artificial Intelligence: AI can help banks improve accuracy of the lending process. It has the power to analyze a colossal amount of data. Machine Learning can help the systems learn from the data being processed and improve simultaneously. According to a research report, AI can power a 22% reduction in the operating expenses in banking operations.

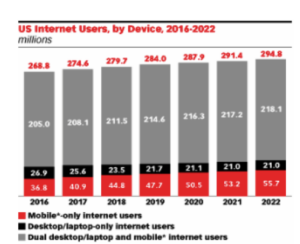

- Mobile Powered Lending: The United States has close to 80% smartphone penetration. For millennials, this number jumps to a whopping 94%. Mobile only Internet browsers are also increasing on a year-on-year basis. Having a mobile strategy for on-boarding customers is a must have.

Source: https://www.emarketer.com/Report/US-Digital-Users-eMarketers-Estimates-2018/2002215

- Portfolio and Risk Analytics: The portfolio and risk monitoring tools help in analyzing the loan portfolio and the level of risk involved on a real-time basis. This also includes tracking the loan pools and forecasting the cash flow projections.

Conclusion: Choosing the Right Underwriting Service Provider

The writing is on the wall. If you want to survive in small business lending, investing in automation is necessary for survival. But it is important to evaluate whether the bank should opt for a specialist technology partner or depend on its legacy IT systems providers for a radical overhaul. ROI on technology is the first parameter to consider.

MonJa offers AI-based end-to-end loan underwriting automation solution for banks and credit unions. Our company has achieved the following impact for it’s existing clients:

– 70% reduction of time spent on manual document collection and setting.

– 42% decrease in loan processing duration.

– 20% increase in loan origination volume.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_custom_heading text=”Want to start lending profitably to small businesses? Request a Free MonJa’s Loan Underwriting Demo Today!” font_container=”tag:h4|font_size:25|text_align:left” google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_custom_heading text=”Looking For Ways To Optimize Lending Workflow? MonJa Offers Underwriting Automation Platform That May Be The Right Fit For Your Financial Institution.” font_container=”tag:p|font_size:20|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal” css_animation=”bounceInUp”][/vc_column][vc_column width=”1/2″][vc_column_text][yikes-mailchimp form=”10″ submit=”Request Demo”][/vc_column_text][/vc_column][/vc_row]