James Wu, MonJa’s Co-Founder and CEO, recently attended the 3-day American Banker’s Small Business Banking Conference. It’s a seminal event in its 23rd year with major BANKING and FinTech leaders attending to present their thoughts on the vector of small business lending. The event took place in Austin, Texas from 29th November 2017 to 1st December.

It was organized by Source Media, the parent company of American Banker, to bring actionable insights to the banks regarding the burgeoning market of small businesses, how to ramp up LOANS for small businesses, strategies for reaching the right customer through ANALYTICS and AI and to bring innovation by integrating new technologies with traditional banking. At the same time, the event also focused on facilitating Bank-FinTech partnerships in the field of credit and payments.

Speakers

Throughout the event, leading personalities from banking industry shared their opinions on the trends shaping the small business segment. A lot of focus was on how banks can have higher customer satisfaction and make money by integrating digital payment ecosystems. Notable personalities from the banking world shared how banks can augment their revenues by lending to small businesses by partnering with FinTech companies.

Nick Miller, President of Clarity Advantage Corporation– a leader in helping banks sell to small businesses, chaired the conference. With his 30 years of experience in banking industry, his opening remarks regarding small business financing were extremely insightful. He spoke about how the entry of new players is disrupting the industry through innovation and new technologies. Nick focused on the needs of the small businesses and how financial service providers need to tailor their services accordingly in order to survive.

The other keynote speakers in the conference include George Bevis, founder and chief executive of Tide and Alejandro E. Carriles, director of BBVA Compass. He spoke on how small businesses have been forgotten by banks as far as loans are concerned. Ryan S. Goldberg and Sharon Miller were other keynote speakers at the conference. Mark Sievewright, Nicol Matthews, Mark Cox, Will Barr, Victoria Dougherty, Patrick Freeman, David Catalano, Rob Pascal, Kevin Condon were some of the featured speakers who shared their views on strategies for financial institutions with their small business portfolio or how FinTech collaboration can help banks in making small business lending more efficient and profitable.

So, what’s the story?

Credit unions and banks seem to be losing the plot in the small business lending segment. The financial crisis of 2008-09 led to enactment of stringent laws and regulations for lending. The enhanced due-diligence and compliance made servicing the segment unprofitable for a lot of banks and they vacated the space en-masse. Small businesses pivoted towards alternative financing. FinTech companies saw a gap and leveraged technology and low overhead costs to create a convenient and cost-effective experience for small business consumers.

Individual Insights

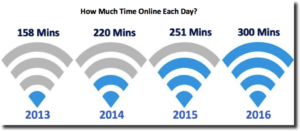

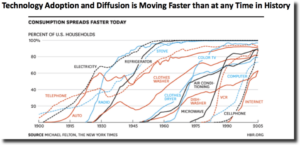

Mark Sievewright explained how the world has gone digital and the extent to which technology has invaded our lives.

The above images illustrate how banks need to see their customers in this new digital-age. They need to go where their customers are and thy need to get their fast.

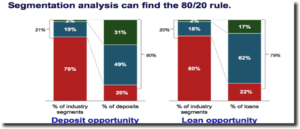

Lori Chillingworth helped the audience analyze that the 80/20 Pareto rules hold good for the small business industry as well and how the management needs to concentrate on the 20% of the client base that accounts for 80% of the opportunity.

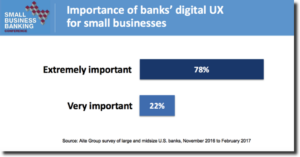

Sanjeev Kriplani also brought forward an important point for the bankers to digest.

Why does this matter so much?

We are living in a digital age where presentation is as important as the actual product. Attracting millenials and today’s Instagram generation is impossible if you have not invested in Digital UX. The above survey proves that accessibility and usability perception is enhanced if the user considers the Digital UX favorably. It can also be argued that these are in-fact the raison d’etre FOR investing in Digital UX in the first place.

There were various other important conversations going on a range of topics:

- Speakers at the conference discussed on how to ramp up the volume in small business loans;

- How using AI and analytics can help banks find the right customers.

- The main focus of the event was to create a conducive environment where banks and FinTech companies could collaborate on bringing efficiency to small business lending.

- The sessions also revolved around how to innovate while providing banking services to small business corporations.

- There were also discussions on the best practices banks need to follow for partnering with FinTech companies in credit or payments.

- The discussion regarding the future of digital currencies in small business space also found place in the conference.

- Tailored marketing strategies were another hot topic.

The best part?

James had the opportunity to meet decision makers at multiple banks. He could see how Banks find it difficult to partner with other FinTech companies or even initiate the process of finding online lenders for acquiring pools of loans. The conference created a platform that helped break the ice. Bankers acquainted themselves with MonJa and its set of proprietary solutions.

The key points James pressed upon was:

- MonJa offers underwriting assessment of online lenders and fast due diligence for FinTech loan purchases. It also provides other services like credit underwriting report, data and model validation, historical consistency assessment etc. James also apprised them of the company’s offerings in performance attribution, loan scoring, portfolio monitoring and risk management. With MonJa’s loan selection strategy and portfolio analytics, investors can significantly improve their portfolio performance.

- Underwriting parameters and sophistication of algorithms has changed significantly for small business lending over the past few years. The company helps banks either with in-house origination or through an outside FinTech partner. Its non-traditional scorecards use hundreds of qualitative and quantitative metrics that are powered with machine learning and AI. Email us at info@monjaco.com if you are a bank interested to explore our capabilities.

Conclusion

The event was a good opportunity for banks and fintechs to network and size up each other. The conference was designed to help bankers “access thought leadership, best practices and leading solution providers”. It was successful in allowing a meaningful dialogue among participants from different spheres of banking, fintech and allied services.