Organized by Golden Gate Risk Management Association (RMA) and Enterprise for Youth, the event took place on Thursday, 30th November 2017 at Wells Fargo Bank, San Francisco.

Panelist – Matt Kelso (Co-Founder & CTO, MonJa), Jan Beranek (Founder, Beranek Consulting Group), Dave Sherman (Chief Analytics Officer, Waybeyond Rewards), Ben Chan (Director of Engineering, BitGo), Joe Serrato (SVP, Union Bank (MUFG) and Ryan Miller (SVP, Wells Fargo). Joe Benfatti (Partner at BSM) moderated the panel.

Last month MonJa’s Co-Founder and CTO, Matt Kelso attended a panel event in San Francisco. Many leading players of the banking as well as FinTech industry were present to discuss the latest developments.

The focus was on how FinTech startups and legacy financial institutions can PARTNER with each other and how demographic shifts have necessitated such an approach.

This blog post presents an overview of the common themes and covers the important insights that were brought up by the panel during their discussion.

Key Issues Discussed:

- How technology has evolved in the last few years and how it is expected to evolve in the coming 3-5 years?

- Demographic changes and their effect on technology adoption.

- Partnering with FinTech startups.

- How to attract new talent?

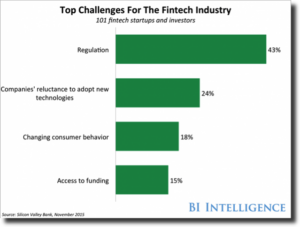

- How regulations affect the startup ecosystem?

Matt Kelso (Co-Founder and CTO of MonJa) feels there is a lot more sensitive information exposed online since the advent of the cloud. Though cloud has been a revelation, it does leave companies and clients vulnerable to data theft. There is renewed emphasis on verification and cyber protection because it will be mission-critical for companies to safeguard against such frauds.

With regards to generational demographics: Matt feels Generation X and younger borrowers are extremely technology savvy and are very active on social media; they do not fit into traditional credit profiles which makes them a perfect fit for alternative lending products.

He thinks the real challenge is in underwriting loans for such profiles and data verification will play a crucial role in ensuring authenticity.

He also feels there has been a seismic shift in the industry in terms of competition, earlier it was focused on brand and service and now the focus is (and it should be) on TECHNOLOGY.

Why does this matter?

Now the million-dollar question is how FTs can best partner with FIs, which will enable both to grow in a supportive environment.

Jan Beranek (Founder, Beranek Consulting Group) feels that there is a common misconception that FinTech companies are lightly regulated as compared to their traditional banking peers. He uses the example of Lending Club (LC) to bring home the point; loans originated by LC are regulated in exactly the same manner as loans originated by other banks. Lending Club’s and Prosper’s loans are actually underwritten by WebBank, based in Salt Lake City, Utah.

He advised youngsters, who are trying to break into the FinTech industry, to consider San Francisco to start their professional journeys. There are hundreds of FinTech startups based here and they are all at different stages of evolution.

He also emphasized the value of reading industry news daily as it augments your knowledge and keeps you abreast with the latest developments in the industry.

Dave Sherman (Chief Analytics Officer, Waybeyond Rewards) was asked about how startups and traditional banks can work constructively. Dave feels because FinTech startups are nimble and agile, they have an upper hand over traditional FIs. He also shared that banks have a strict set of requirements with startups they want to work with and not many startups are able to fulfill those parameters. Also, a FI is present in multiple verticals whereas one startup would be focused on only one of those business lines. This adds an additional layer of administration for the FI as it needs to first strike partnerships across multiple verticals and then make sure that they are all working under one cohesive strategy.

http://www.tearsheet.co/funding/why-banks-dont-acquire-fintech-companies

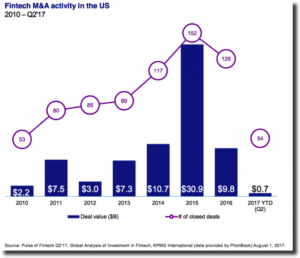

Dave’s point is reflected in this graph, which shows M&A activity has declined since 2015, as banks look for more sophisticated technology.

Ben Chan (Director of Engineering, BitGo) is a blockchain veteran and heads the engineering team at Bitgo. He explained why there is a dearth of talent especially in the blockchain industry and how companies can overcome this challenge. He thinks the budding millennial workforce is more interested in what the company stands for and believes in rather than just perks and other benefits offered by the companies. So moving forward, companies need to be “real” and clear in their vision to attract talent.

Other side of the coin

To gain better perspective about the trends in the industry, it is always beneficial to hear from different players from different verticals. The panel also had two SVPs of banks, who were able to shed light on the issues from a FI’s perspective.

Joe Serrato (SVP, Union Bank (MUFG) shared the importance of NETWORKING. Joe feels that there are no boundaries for building relationships; it can be both inside and outside of the company’s boundary. With regards to attracting talent, he feels it is an ongoing and continuously evolving process. FIs need to sell the future potential and growth possibilities to prospective employees in order to attract talent.

Ryan Miller (SVP, Wells Fargo) believes being faster than FIs works in favor of FinTech companies and that is the reason why FinTech companies are able to capture market opportunities. That is why he thinks that partnerships are a WIN-WIN for both the parties involved.

The best part?

Wells Fargo has set up a Startup Accelerator Program that will enable the bank to learn from startups and will also help startups in getting advice from the bank with regards to controls, audits, compliance etc.

http://ff-bd.org/2017/03/the-financial-world-is-not-enough/

The graph above illustrates what Ryan discussed and why learning compliance from a leading bank can be a major differentiator for a young FinTech startup.

Q&A session & Conclusion

Panel discussion was followed by a Q&A session. The panel answered various questions on how will FT help in creating new financial services? How can the entire financial ecosystem be made more secure and safer? What is the scope for FinTech companies since online lenders currently account for only 5% of the overall market?

One thought on which almost the entire panel agreed was with 8,000 banks in the US and not enough FinTech companies, the space will see a lot of activity via either partnerships or M&As.

That’s not all…

Interested to learn how a BANK can benefit from partnering with MonJa? Please submit your comment ↓ or email us at info.monjaco.com.