Earlier this month, Moody’s put the C notes of the Prosper/ Citi securitizations CHAI 2015-PM1 / 2015-PM2 / 2015-PM3 on a review for downgrade. The most material change in the forecast was an increase of expected cumulative lifetime net loss to 12%, from 8% to 8.5% of the 3 transactions. On the reason for this downgrade watch, a Moody’s spokesperson was quoted in saying:

“Charge-offs have been coming in at a higher rate than expected, very simply.”

Unfortunately, this recent release is quite misleading, because it mischaracterized what is going on with the Prosper loan performance. The timing for this review for downgrade is particularly curious, as the CHAI 2015-PM3 deal was rated on December 18, 2015, less than 2 months prior. The composition of the CHAI portfolios is fairly representative of Prosper’s origination, with a weighted FICO 705, a weighted borrower rate of 13.6%, and a roughly 60%/40% mix of 36 month vs 60 month term loans.

To get a baseline estimate of what the cumulative numbers should be, we start with Prosper’s own performance historical loss curves:

36 Month Loans

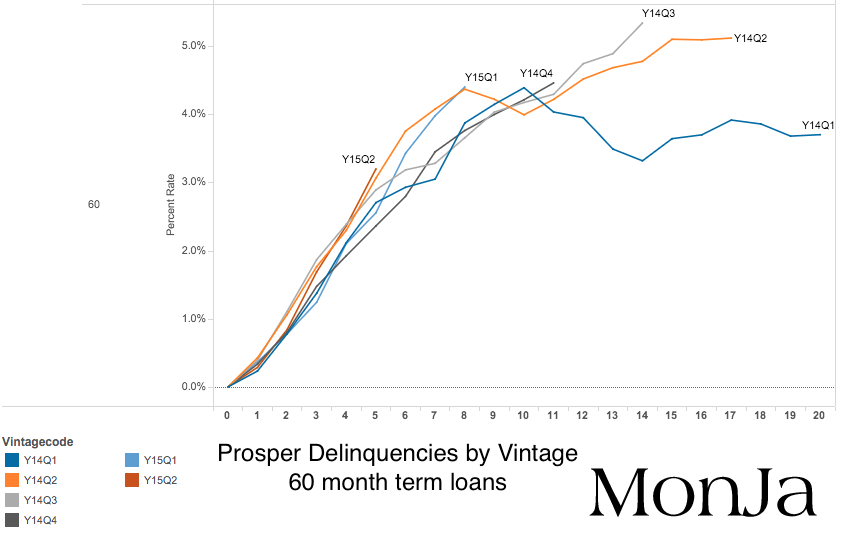

60 Month Loans

Source: Prosper, LendAcademy

- 2009-2012 losses were much higher. But recent vintages appear to be tracking 2013H1 – 2013H2 fairly well.

- 36m segments are on track for ~8%, 9% cumulative charge off.

- 60m segments are a little noisier, but generally trending to 14%-16% charge off.

- There has been no major deviations from trends, which you would have expected to see if losses are much higher than expected.

Next we take a closer look at the 60m delinquency chart:

The 2015Q2 vintage is indeed tracking higher, but still within the range of recent vintages – nothing that would seem to indicate a 50% higher loss rate.

Blending the 36m and 60m loss numbers, this will put the portfolio at 11-12% cumulative net loss rate – based on the information already available at 2015 Q3 – Q4. This is inline with the historical performance of Prosper’s most recent vintage loans and significantly better than Prosper’s more seasoned vintages. Moody’s isn’t far off in the current loss assessment – it’s just incorrect to call it a downgrade. We believe that Moody’s incorrectly estimated their loss assessment for these loans the first time around, and are now readjusting their estimate, perhaps with extra conservatism given market sentiments. MonJa believes that these loans will perform inline with recent vintage Prosper loans.

To see the performance of each Prosper vintage in detail, sign up to receive our Prosper delinquency and loss vintage curve report in your inbox.