MonJa is pleased to announce the release of an innovative fraud detection feature, engineered to significantly enhance OCR document automation for lenders, brokers and financial institutions. Leveraging artificial intelligence and machine learning, this sophisticated feature addresses critical aspects of fraud detection.

A Quantum Leap in Financial Security

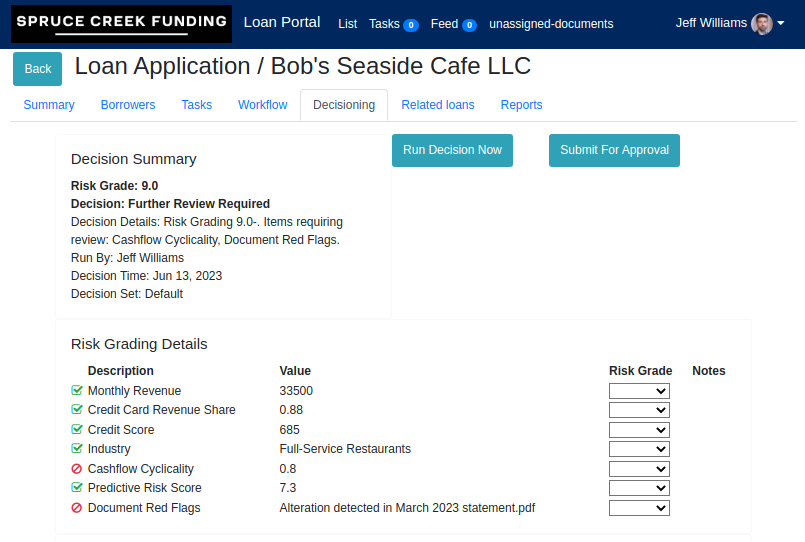

MonJa’s new fraud detection feature, automatically zeroes in on potential fraud signals in bank statements, tax returns, and other financial documents.

1. File Tampering Detection

MonJa’s advanced fraud detection system exhibits an acute attention to detail in identifying document tampering. It meticulously discerns which fields have been altered, as well as the nature of the modifications. This precision is indispensable for lending institutions to make well-informed decisions.

2. Insightful Visualization of Fraudulent Activity

The MonJa system provides astute visualizations of fraudulent activity, enabling analysts to discern anomalies that may otherwise evade human detection. Furthermore, it possesses the capability to recover original documents, facilitating an effective comparison between original and altered fields.

3. Streamlining Fraud Detection Through Automation

The MonJa fraud detection feature replaces traditional, labor-intensive manual review processes with automated workflows. This automation contributes to a notable increase in both efficiency and accuracy, which are essential in the expedient detection of fraud.

4. Robust Machine Learning Models

By processing an extensive volume of lending documents, MonJa’s feature develops machine learning models that possess a profound understanding of file structures and key data. During its customer beta program, MonJa’s feature demonstrated an exemplary ability to uncover potential fraud, testifying to the strength of its machine learning algorithms.

For a closer glimpse of our automation platform, check out our demo video:

Adaptation to the Digital Evolution in Lending

The lending industry is undergoing a rapid transformation, with an increasing shift towards digital loan application processes. While this shift offers convenience, it is also accompanied by a proliferation of more sophisticated fraud. MonJa’s fraud detection feature is engineered to provide unequivocal and reliable fraud signals, enabling lenders to process loans with increased assurance.

If you wish to learn more about MonJa’s advanced fraud detection feature, you can read the full press release here.