MonJa Launches Advanced Fraud Detection Feature for Safer Document Analysis. LEARN MORE

Get exclusive MonJa Co. insights on document automation before you leave

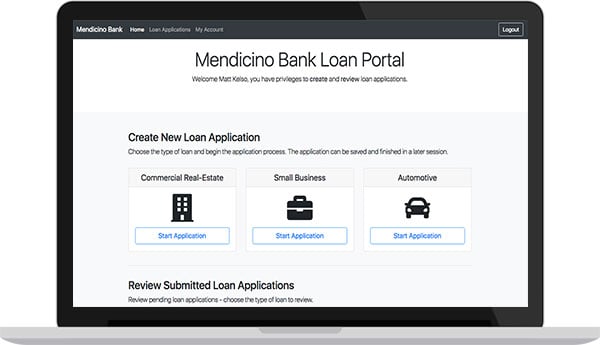

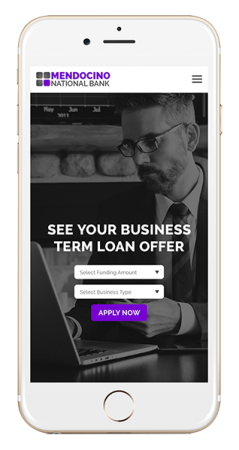

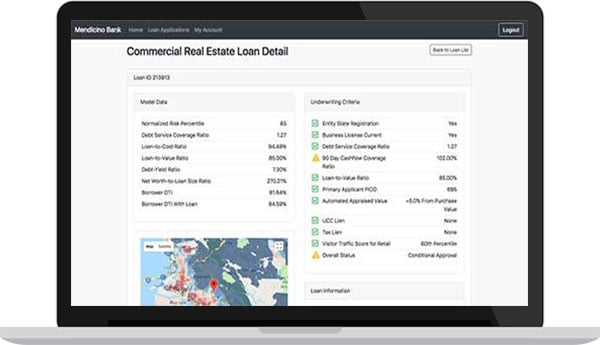

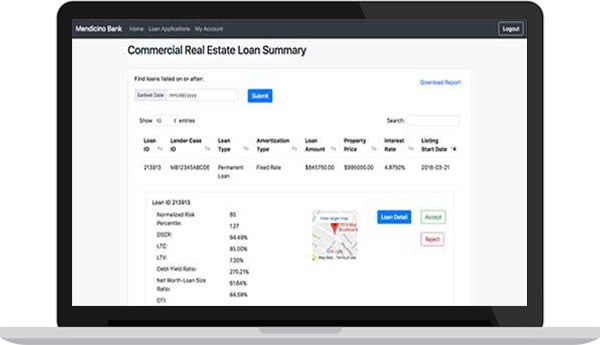

Looking for ways to automate commercial or consumer lending at your institution? MonJa’s loan underwriting automation platform may be the right fit for your organization.

We help banks and credit unions automate commercial (C&I, CRE, vehicle, and other SMB loans) & consumer (consumer term & auto) lending . Learn more by requesting our free demo today!