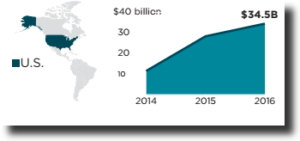

Financial system across the US took a beating in the aftermath of the 2008 financial crisis and American views changed overnight with regards to their financial system. In a 2014 Gallup poll, only 26 percent expressed having “‘a great deal’ or ‘quite a lot’ of confidence in banks,” down from 41 percent in 2007 and a high of 60 percent in 1979. Alternative lenders have made most of this opportunity by serving the US population with technology-driven funding. Since 2008, it has been growing at a neck-breaking pace and in 2016, US P2P market was worth a staggering $34.5 billion and it is widely expected that market will grow with the same momentum in the coming years.

Consumer Lending Model

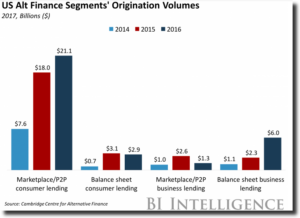

The marketplace consumer lending model is by far the most prevalent online alternative finance model in the US and accounts for 61% of the US market. In 2016, this model grew by 17% and generated $21.1billion in originations. But interestingly balance sheet consumer lending is also an important part of the mix with $2.9 billion in originations. The 2016 average loan size for the Marketplace/P2P Consumer Lending in the US was approximately $28,000 compared to $19,000 for Balance Sheet Consumer Lending.

Trends in the industry

Considering the size of the market and the opportunity it represents, it is imperative to understand the tailwinds for the industry. The major trends seen across the industry segment are:

- Keep in mind the diversified population- By 2044, America is expected to become a major minority population, which means Asians, African-Americans, Hispanics will outnumber the whites, that means lenders have to design products that are structured for the diversified demographics. For example, Latinos are expected to become the majority of new homebuyers by 2020 as per Center for American Progress, yet one in five African-Americans or Latinos doesn’t have a bank account. Gaps like these pose challenges as well as create opportunity for the alternative lenders to develop products that are tailored for people from different ethnicities.

- Rise of millennial and their reliance on technology- Millennials are now the largest living generation in the United States and by 2020 it is expected that one in three adults will be millennial. They rely heavily on their phones and tablets; adults in nine states and District of Columbia have now greater access to cell phones than bank accounts. This represents a huge opportunity for the alternative lenders to develop mobile-friendly apps and solutions to lure this millennial generation.

- Stringent regulations- There is no denying P2P market is booming but lately it has been plagued by lot of problems mainly significant increase in delinquencies, corporate mis-governance etc. This is because the industry was loosely regulated in its early days and players in the industry made most of the opportunity. But to avoid a repeat of the financial crisis, the regulatory authorities are finally tightening the screws to improve transparency and make it streamlined for the consumers. This will help in taking out non-serious players as well as borrowers and will also provide much needed integrity to the industry.

Though the entire online consumer lending industry has been witnessing a steady growth in the last few years, there are few platforms that are a cut above the rest:

- Lending Club (https://www.lendingclub.com/) Lending Club is an online financial community that brings together creditworthy borrowers and savvy investors. It is considered to be the pioneer of the industry. Renaud Laplanche and John Donovan founded it in 2007. It was listed on NYSE in 2014 and raised approximately $865 million. It has lent over $34 billion to over 1.5 million customers. It offers loans ranging from $1,000 to $40,000 with APR ranging from $5.99%- 35.89% and loan duration ranges from 3-5 years. It is currently valued at $1.77 billion.

- Prosper (https://www.prosper.com/) The Company’s online lending platform connects people who want to borrow money with individuals and institutions that want to invest in consumer credit. It was founded in 2005 by Chris Larsen, John Witchel and is headquartered in San Francisco, California. It has raised over $400 million in various rounds of funding. It offers loans ranging from $2,000 to $35,000 with APR ranging from 5.99%-35.99% and loan durations from 3-5 years. The platform facilitated more than $10 billion in consumer loans.

- Avant (https://www.avant.com/) – is an online marketplace that provides users with access to personal loans to consolidate debt, pay unexpected medical expenses, and for family vacations. It was founded in 2012 by Albert Goldstein, John Sun and Paul Zhang. It has raised over $1.7 billion in various rounds of funding. It offers loans ranging from $2,000 to $35,000 with APR ranging from 9.95%- 35.99%. It offers loan terms from 2-5 years. It has lent over $4 billion to over 600,000 people.

- Affirm (https://www.affirm.com/) Based in San Francisco, California, Affirm is a financial services company that offers installment loans to consumers at the point of sale. It was founded in 2012 by Jeffrey Kaditz, Nathan Gettings, and Max Levchin. It has managed to raise over $520 million in four rounds of funding. It offers loan amount ranging from $100 to $10,000 with APR ranging from 10% to 30% and loan duration varies from 3 to 36 months.

- Marlette funding (https://www.marlettefunding.com/) – Marlette Funding is the parent company of Bestegg, a platform which helps consumers pay debt in a structure which suits their lifestyle. Brian Conneen and Jeffrey Meiler founded it in 2013. It has raised over $150 million in two rounds of funding and has been involved in loan originations over $3.6 billion. It offers loans ranging from $2,000 to $35,000 with APR ranging from 5.99%- 29.99% and loan duration from 3-5 years.

- Marcus (https://www.marcus.com/)- Marcus by Goldman Sachs offers a fixed-rate, no fee personal loan. Marcus offers loans that range from $3,500 to $30,000. Its personal loans carry a fixed annual percentage rate of 6.99 percent to 23.99 percent. Marcus has crossed the $1 billion mark in loan originations and is looking to aggressively ramp up the originations.

- BorrowersFirst (https://www.borrowersfirst.com/) – is a tech-enabled consumer-lending platform organized around providing superior value and experience for borrowers. It was incepted in 2013 by Jonathan Ende. It has raised over $100 million from various rounds of funding. It offers loans ranging from $2,500 to $35,000 with APR ranging from 5.99% to 26.99% and loan duration ranging from 36 to 60 months.

- Earnest (https://www.earnest.com/) – is a technology-enabled lending company that uses data science, design, and software automation to offer a better and merit-based lending experience. Louis Beryl and Benjamin Hutchinson founded it in 2013. It has raised over $115 million in various round of funding. It offers loans ranging from $5,000 to $500,000 with APR ranging from 3.35% to 6.39% (fixed) and 2.57%-6.19% (variable) and duration of loan ranging from 5-20 years. Navient, the student-loan servicing giant, recently bought it for $155 million in cash.

- LendingPoint (https://www.lendingpoint.com/) – is a leading online direct loan provider, and is committed to redefining who is able to access money at fair rates and empowering consumers to build financial momentum. It was founded in 2014 and has headquarters in Georgia, United States. It has raised $600 million in two rounds of funding. It offers loans ranging from $3500- $25,000 with APR ranging from 15.49%-34.99% and duration of loan ranging from 24 -48 months. It is on track to hit almost $500 million in direct lending.

- Upgrade (https://www.upgrade.com/)- is an online lending platform that combines personal loans with free credit monitoring, helping customers secure more affordable credit in the long run. It was founded in 2016 by Renaud Laplanche(founder and former CEO of Lending Club) and Jeff Bogan. It has raised $60 million as seed funding. It offers loans ranging from $1,000-$50,000 with APR ranging from 5.66%-35.97% with loan duration ranging from 3-5 years.

- Upstart (https://www.upstart.com) Upstart is the first lending platform to leverage artificial intelligence and machine learning to price credit and automate the borrowing process. It was founded by Dave Girouard, Anna M. Counselman and Paul Gu in 2012. It has raised over $85 million in various rounds of funding. It offers loan ranging from $1,000- $50,000 with APR ranging from 9.49%- 29.99% and loan duration ranging from 3-5 years.

- LoanNow (https://www.loannow.com/) LoanNow has been helping people by bringing access, transparency, and fairness to the subprime lending industry. Harry Langenberg and Miron Lulic launched it in 2013. It has raised $56 million in various rounds of funding. It offers loans ranging from $1,000- $5,000 with APR ranging from 29%-299% depending on the creditworthiness of the borrower, and loan duration varies between 12-24 months.

Conclusion

The alternative consumer-lending industry is on track to becoming a 100 billion dollar business in the near future. The players have become increasingly sophisticated and are partnering with banks for a win-win association. The startups bring their tech onboard and understanding of millennials to leverage the traditional bank’s low cost funding an entrenched customer base. The next few years will decide the players that dominate the industry.