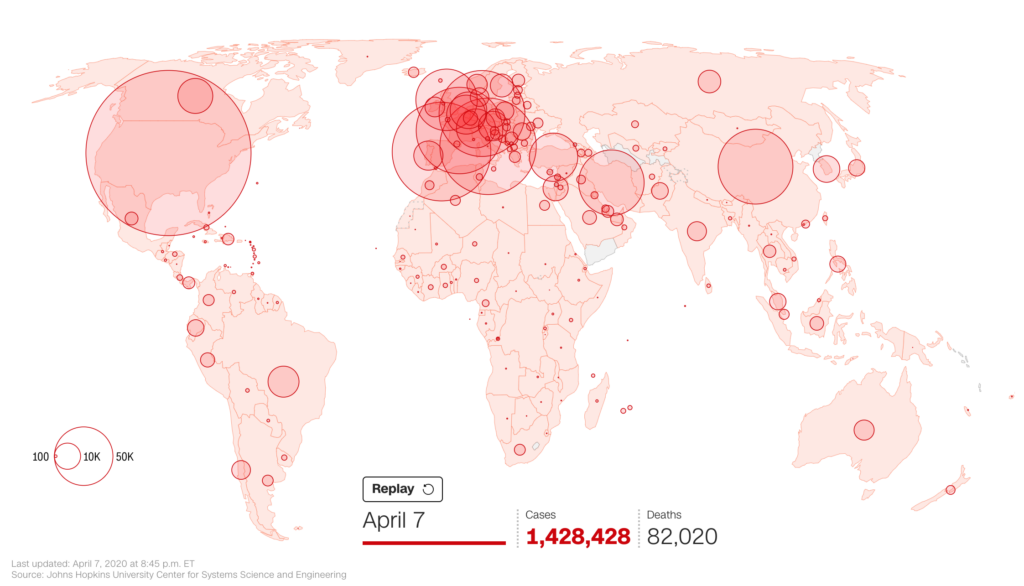

Top 7 Predictions on Coronavirus and its Impact on the Lending Industry

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text]The outbreak of the deadly respiratory virus, COVID-19 has been catastrophic for humanity. The pandemic carries with it a potentially equally disruptive economic fallout. The COVID-19 virus, which till now has spread across six continents and 100+ countries, had been officially declared as a Public Health Global Emergency by the World […]

Online Lending Monthly News – April 2020

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_single_image image=”10635″ img_size=”large”][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text] Online Lending Monthly News. Here are some of the top stories and trends of March 2020 for online lending investors and industry watchers. [/vc_column_text][vc_column_text] Industry News [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_column_text]3/3/2020 Lenders debate whether Open Finance will boost or curtail lending (AltFi News) 3/3/2020 Tips to Pay off Debt in 2020 for Financial Freedom (Prosper Loans) 3/4/2020 […]

Banks: To Stay Relevant – Build Partnerships With Fintech

[vc_row][vc_column][vc_column_text]Read time: 5 minutes Fintech allows community banks and credit unions to compete with the larger financial conglomerates. Most banks are likely already utilizing some fintech, but the addition of artificial intelligence and machine learning produces better outcomes. For example, automated loan underwriting software can help a bank to increase the number of applications that […]

Online Lending Monthly News Update- March 2020

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_single_image image=”10520″ img_size=”large” alignment=”center”][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text] Online Lending Monthly News. Here are some of the top stories and trends of February 2020 for online lending investors and industry watchers. [/vc_column_text][vc_column_text] Industry News [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_column_text]2/3/2020 Mintos sees 300% lending growth in 2019 (AltFi) 2/3/2020 3 Reasons for a Bank To Tap Into Outside Loan Underwriting Services (AltFi) 2/4/2020 What Brexit […]

How Can a Bank Increase Revenue By Accessing Fintech Automated Underwriting?

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_single_image image=”10314″ img_size=”large” alignment=”center”][vc_column_text] Introduction Any lending business faces a challenge with modern banking processes. How can your institution balance the loan amount with the time spent underwriting to ensure that loan processing is profitable and functions as a revenue stream generator? Luckily, your institution can use Fintech automated underwriting software […]

Online Lending Monthly News Update- February 2020

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_single_image image=”10382″ img_size=”large” alignment=”center”][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text] Online Lending Monthly News. Here are some of the top stories and trends of January 2020 for online lending investors and industry watchers. [/vc_column_text][vc_column_text] Industry News [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_column_text]1/2/2020 The Ten Biggest News Stories of the Decade in Marketplace Lending (LendAcademy) 1/3/2020 Bitcoin, despite its ups and downs, had a monster decade of growth […]

Can a Bank Quickly Streamline Loan Underwriting With the Help of Fintech?

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text] Introduction Manual underwriting processes make typical commercial loans (especially complex ones) extremely time-consuming for community banks and credit unions to analyze and underwrite. Financial institutions and lenders that use digital technology and tools, supported by risk assessments and artificial intelligence (AI), can process loans much faster and more efficiently. Companies […]

3 Reasons for a Bank To Tap Into Outside Loan Underwriting Services

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text] Introduction The financial lending landscape evolves constantly and often community banks and credit unions falter when adopting new technology. You need to make sure customer data is safe for your reputation and make sure you have fast data access when undergoing audits, all while maintaining a competitive edge. An obvious […]

Want to Speed Up Your Commercial Loan Underwriting? Smart Scan Technology Automates the Process

[vc_row][vc_column][vc_column_text]Read time: 5 minutes [/vc_column_text][vc_column_text] Introduction MonJa’s automated underwriting system is the biggest value we provide to banks and credit unions. We help your financial institution to speed up commercial loan (C&I, CRE, commercial vehicle, SBA and other small business loans) underwriting by 70%. We do it with the help of MonJa smart scan technology. […]

Online Lending Monthly News Update- January 2020

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_single_image image=”10307″ img_size=”large” alignment=”center”][/vc_column_inner][/vc_row_inner][vc_row_inner][vc_column_inner][vc_column_text] Online Lending Monthly News. Here are some of the top stories and trends of December 2019 for online lending investors and industry watchers. [/vc_column_text][vc_column_text] Industry News [/vc_column_text][/vc_column_inner][/vc_row_inner][vc_column_text]12/3/2019 Fintechs now offering financial services to small businesses. (AmericanBanker) 12/4/2019 Monzo, Bud and Apple employees launch new fintech. (AltFiNews) 12/6/2019 The 5 Debates That Will […]