Banks: To Stay Relevant – Build Partnerships With Fintech

[vc_row][vc_column][vc_column_text]Read time: 5 minutes Fintech allows community banks and credit unions to compete with the larger financial conglomerates. Most banks are likely already utilizing some fintech, but the addition of artificial intelligence and machine learning produces better outcomes. For example, automated loan underwriting software can help a bank to increase the number of applications that […]

How Can a Bank Increase Revenue By Accessing Fintech Automated Underwriting?

[vc_row][vc_column][vc_column_text]Read time: 6 minutes [/vc_column_text][vc_single_image image=”10314″ img_size=”large” alignment=”center”][vc_column_text] Introduction Any lending business faces a challenge with modern banking processes. How can your institution balance the loan amount with the time spent underwriting to ensure that loan processing is profitable and functions as a revenue stream generator? Luckily, your institution can use Fintech automated underwriting software […]

5 Key Challenges that Banks & Credit Unions will face the most in 2020

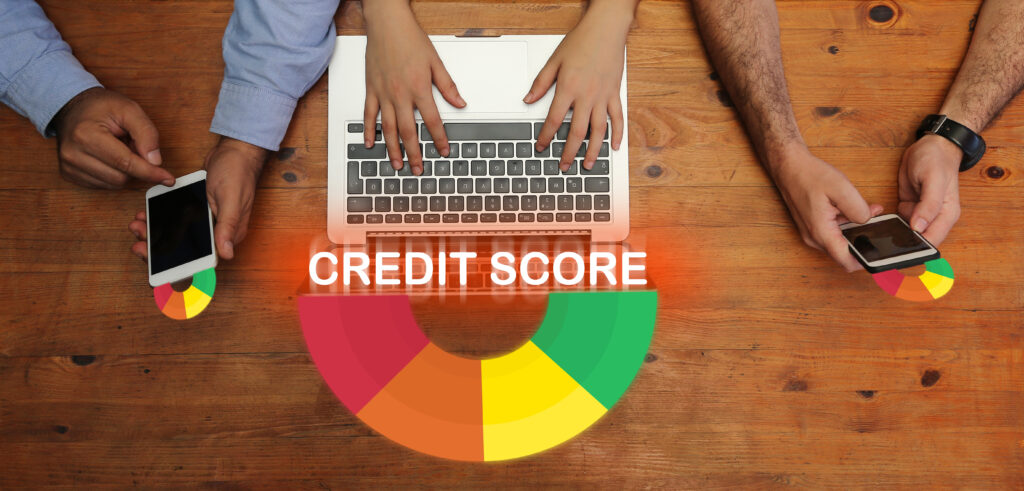

[vc_row][vc_column][vc_column_text]Read time: 8 minutes [/vc_column_text][vc_single_image image=”10222″ img_size=”medium” alignment=”center”][vc_column_text] Introduction The banking and financial services industry has evolved in the past decade. With the emergence of digital banks and marketplace lenders, banks and credit unions are no longer the first port of call for credit and banking needs. The biggest challenge being faced by the industry […]

Automation Of Credit Underwriting For Banks And Credit Unions: 9 Reasons Why It Is Beneficial

Introduction The advent of technology has undoubtedly changed the way things function in the world. In times where people depended on traditional banking and other offline sources for loans, credit underwriting was a tedious and very long process for borrowers. Now, with lending accessible through digital platforms, credit underwriting has also had to evolve to […]