Planning Your Journey To Digitization – A Guide for Banks

[vc_row][vc_column][vc_column_text]4 Minutes Read. Digital solutions are opening opportunities for financial institutions in small business lending and other services. Specifically, automation boosts process efficiency, reducing costs while raising productivity. For most banks, a third-party provider is the most practical source for small business lending software solutions. In order to successfully integrate a digital lending solution, your […]

How To Create The Ideal Millennial Bank

[vc_row][vc_column][vc_column_text]4 Minutes Read. How to Create the Ideal Millennial Bank Millennials, or the generation born between 1980 and 2000, are an economic force of almost unimaginable strength. They are the largest generation in American history, and by 2022 will make up more than 40 percent of the country’s workforce. They already account for $1.3 trillion […]

Data Security in Digital Lending Space

[vc_row][vc_column][vc_column_text]4 Minutes Read. The Equifax data breach in 2017 caused a significant data loss for more than 145 million people in the U.S., U.K. and Canada. Cybersecurity has become a top priority for financial institutions around the globe, particularly in the digital lending. The Equifax incident was considered a wake-up call for the industry. But even […]

MonJa's Digital Banking and Lending Monthly Roundup | October

[vc_row][vc_column][vc_column_text] MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a […]

Digital Lending and Artificial Intelligence

[vc_row][vc_column][vc_column_text]3 Minutes Read. Artificial intelligence (AI) is expanding rapidly in the fintech industry. In particular, AI has largely affected digital lending. By 2020, as much as 5 percent of all of economic transactions will be handled by autonomous software, including loan transactions. By applying machine learning to collected borrower data, software solutions can approve or […]

The Future of Digital Lending Innovation

[vc_row][vc_column][vc_column_text]6 Minutes Read. Digital Lending Innovation is revolutionizing business in the financial sector. Going digital has helped many banks and other lenders streamline processes and improve the quality of their services. This, in turn, has led to reduced costs and improved efficiency. Innovations in digital lending are constantly being developed, and the future for the […]

Lenders of the New Age: Incorporating Artificial Intelligence, Machine Learning and Blockchain Technology

[vc_row][vc_column][vc_column_text]12 Minutes Read. Although alternative digital lending is still in its infancy, it has made a major mark in the consumer and SMB lending industry. A survey conducted by American Banks Association claims that: the volume of loans originated by digital lending platforms will rise to USD 90 billion in 2020 in the US, constituting […]

MonJa's Digital Banking and Lending Monthly Roundup | September

[vc_row][vc_column][vc_column_text] MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe? Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a […]

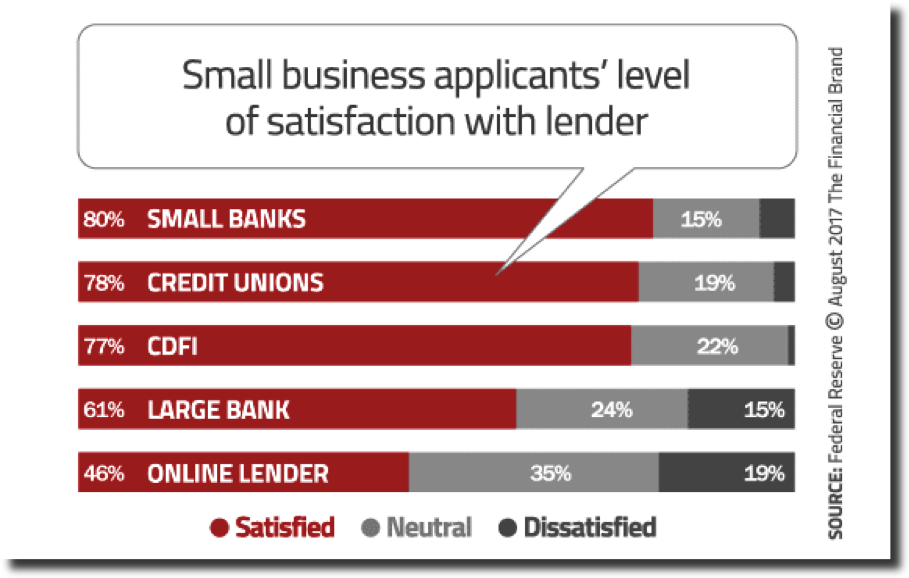

Small Banks and Why They Need To Adapt To The Latest In Artificial Intelligence and Machine Learning

[vc_row][vc_column][vc_row_inner][vc_column_inner][vc_column_text]Small banks and credit unions play an important role in the US financial system particularly in serving rural and small metropolitan areas. Why should they care about artificial intelligence and machine learning when their business with borrowers is based on personal relationships? Their essence is in relationships built with the community at the local level, […]