Alternative Lending is now mainstream with SoFi, Lending Club and Prosper capturing the imagination of the millennial generation disillusioned by the banking sector after the financial crisis of 2008-09.

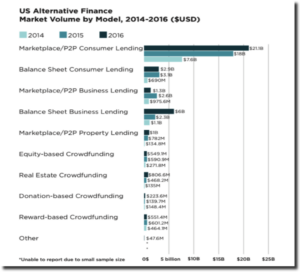

A report by the Judge Cambridge Business School highlights the fact that fintech consumer lending is now a big part of the consumer lending landscape. The Consumer lending segment ended 2016 with $23 billion in total funding as compared to just $7.3 billion for small business lending.

With 28 million small businesses in the United States, it is still a trillion dollar opportunity.

Consumer lending and consumer payments is something which is being cannibalized at a very aggressive rate by startups like Venmo and Alt-Lenders and large borrowers were always the domain of Wall Street Banks. Thus, it is imperative for traditional regional and community banks to hold the fort at the last bastion they still dominate- small and medium businesses.

Small Banks or Fintech Lending – What to Choose?

Lending to SMB clientele requires a different type of skill as compared to consumer lending.

FICO data is not enough with a SMB for credit underwriting. Small Banks have an edge here as they have had years of on the ground contact with their SMB clients.

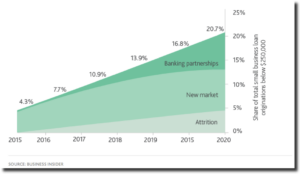

But this advantage has not been enough for banks to protect their turf. According to a report by Moody Analytics and data by Business Insider, Online Lenders are going to capture an increasing share of the SMB portfolio. The biggest losers will be regional and community banks.

It is first important to understand the reasons of this shift.

- New Business Domains – Banking personnel have great experience in dealing with other traditional industries but majority of new entrepreneurs are springing in technology, e-commerce and similar digital spaces. As they don’t have the fixed assets as brick and mortar players, they are not able to evaluate their business and their credit worthiness.

- Inefficient process – The funding process is very inefficient with dozens of documents to be submitted in physical format and multiple visits required to the branch. The credit underwriting process is long and drawn out and do not cater to a new age entrepreneur who is looking to move fast in a dynamic business environment.

- Use of obsolete technology – Banks have a legacy IT system which is not conducive to latest online technologies. Customers expect 24 hour banking and all tools of a bank on their smartphone. However, small banks are often, unableto deliver the same to them.

- Limited flexibility – Banks stick to their lending ‘policy’, which is sacrosanct at all costs. This not appreciated by small businesses who are looking to partner a bank which is flexible, nimble and understands their needs.

On the other hand:

Online lenders have gone completely digital.

They have no need for a borrower to come into any physical branch and they can disburse the loan amount in as short as 2 business days. Small businesses are left with little or no choice but to approach online loan providing solutions.

Importance of Small Business Portfolio for Banks

Small businesses are the lifeblood for small community banks and credit unions.

- Small business funding is a trillion dollar opportunity. Also, the banks are able to earn better spreads as compared to serving corporate clients.

- Banks are able to cross sell multiple other services i.e. sell a variety of different products to the existing customer base. Apart from loans, banks also provide an array of investment services, credit card services, etc. to the small business.

- Building long-term relationships is not only a vital requirement for small businesses but also for the banks because it reduces to their overall cost of acquisition per client.

- Small businesses stimulate job creation and economic development. This has a huge trickle down effect in the immediate vicinity of the bank branch.

Silver Lining

In a survey Respondents placed the most emphasis on price, with an average of 26.7 of the 100 available points allocated to more favorable interest rates and minimal fees. 91% of the firms made some sort of point allocation to price.

Banks have an inherent advantage over fintech lenders because of their low cost deposit base.

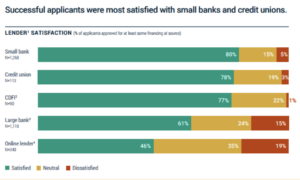

Also, borrowers are not too happy with fintech lenders. In a 2016 Small Business Credit Survey released by Federal Reserve Bank of New York, borrowers are most happy with small banks and credit unions.

This means Banks only need to figure out the tech side of the business to ensure they are able to compete successfully against new age lenders.

Small Banks cant invest in multi billion dollar IT platforms as being done by the likes of JP Morgan and Goldman Sachs. Neither can they look to buy out unicorn fintech lenders. The only feasible way is to partner with technology players who are able to save the banks upfront costs and charge on the basis of a pay-as-you go model.

This is a win-win model for all involved and helps bank keep its customer base in-house along with ensuring no major technology buildup costs.

MonJa – Small Business Loan Underwriting Platform

MonJa offers a “3-in-1” SMB Loan Underwriting Platform. It is an end-to-end solution for banks and credit unions that are lending to small businesses.

It includes Automated Underwriting, Loan Scoring and Proprietary AI-Powered Algorithm.

This software package enables banks and credit unions to underwrite small business loans efficiently and effectively, allowing institutions to attract and retain the best business clients. With the MonJa underwriting platform, a bank can serve a range of loan sizes, including smaller loans that would otherwise be unprofitable to underwrite. MonJa’s suite of underwriting modules is perfect for banks and credit unions that want to expand small business lending volume without high upfront costs and while improving experience and efficiency of lending to business customers.

Few Benefits:

- Easy deployment leveraging our Software-as-a-Service for rapid integration and low startup costs

- Objective and independent underwriting using MonJa Loan Score Model

- Increased profit: open new business loan underwriting opportunities particularly for loan sizes under $100,000 that woud otherwise be uneconomical

- Time savings: MonJa’s advance AI reviews loan applications in seconds rather than days

- Security – 2048-bit TLS end-to-end transport encryption ensures data security

- Modern customer experience: easy, intuitive loan application process for mobile devices

- Client rentention – faster approval and funding process increases client satisfaction and retention

- Dedicated account representative – MonJa stands behind your implementation

- Flexible fee model- pay-as-you-go model that scales with your origination volume

Conclusion:

Small business banking can take the economy to a different level altogether.

Small banks can support small businesses by creating new-age tech-enabled lending products and services.

Powering SMB underwriting with MonJa allows financial institutions to fasten the process while simultaneously reducing the expenditure on each individual case. Additionally, MonJa provides Banks and Credit Unions with extra layer of analytics which will provide deep insight into their lending practices.

Sounds interesting? Learn more about MonJa’s Small Business Loan Underwriting Platform.[vc_row][vc_column width=”1/2″][vc_custom_heading text=”Request MonJa’s Free Demo” font_container=”tag:h4|font_size:25|text_align:left” google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_custom_heading text=”Our platform supports C&I, CRE, auto and other small business loans.” font_container=”tag:p|font_size:20|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal” css_animation=”bounceInUp”][/vc_column][vc_column width=”1/2″][vc_column_text][yikes-mailchimp form=”10″ submit=”Request Demo”][/vc_column_text][/vc_column][/vc_row]