[vc_row][vc_column][vc_column_text]7 Minutes Read.

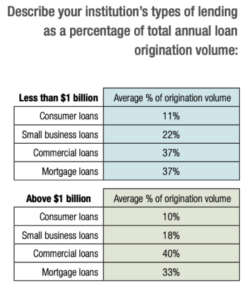

For the traditional lender, the increase in digital-only lenders has made the demand for traditional loans quite sparse. Digitalization has permeated the consumer and small business loan market. With new regulatory provisions such as the OCC banking charter to digital-only banks, applying for loans digitally is rapidly becoming the norm. As such, investing in lending automation is not an option anymore. Incorporating true-digital banking is an existential necessity for community banks and credit unions. Low cost deposits and local relationships are not a deep enough moat in the present era. A survey by American Bankers Association reveals just how far behind traditional banks are.

This being said, merely throwing money at traditional lenders will not solve the problem. Investment in automation technology must be ROI-driven. The focus should be on business value as opposed to merely adding technological features to the loan application. If lenders fail to conduct careful cost-benefit analysis before vendor selection, the final product may bring suboptimal results for the lender.

ROI: The What and the How?

- Quantification of the value accrued from technology adoption is a must. If vendors cannot provide specific, measurable parameters for assessing ROI, then it is better to choose a different technology provider.

Read more about what questions to ask your lending automation vendor here.

- The ROI does not need to be measured in terms of dollars and cents necessarily. Benefits in terms of customer experience/retention/upsell/etc. are all viable returns for investing in technology.

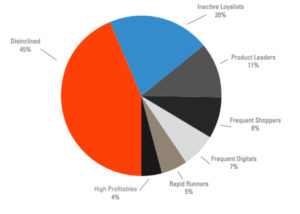

- A case study by Fiserv gives a strong overview on how to measure digital engagement. A strong preliminary analysis introduces the bank to the specific customer segments and their characteristics:

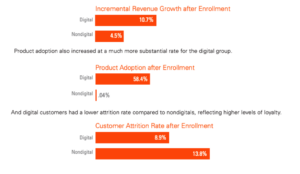

This is followed by actual impact assessment.

This gives a true picture of value-added to the banking management in general and the CIO in particular. For the success of your technology investment, it is essential that you consider all investments dispassionately. Keeping a firm eye on the value generated is essential.

Case Studies:

1. The ABA’s survey report also delved deep into the experience of Darien Rowayton Bank of Connecticut. The bank has transformed itself from a local community bank to an online lender operating in all 50 states. It has also launched an exclusive online student lending model under the “Laurel Road” brand name. In fact, the program was so successful that the bank has rebranded itself under the Laurel Road trade name. The bank has used a combination of third-party vendors, in-house developers and outside contractors to create a proprietary technology system. This system has helped the bank originate over $3 billion in federal and private school loans. Lending automation has led to a 60% growth in student loan origination in the past 18 months. The Net Promoter Score is in 60s as compared to the typical 40s for traditional banks.

It is easy to observe that digital lending has been extremely successful for small banks. But this was possible only because of the bank’s focus on KPIs. Only considering the technological features in digital banking would not have led to these spectacular results. Replicating a digital suite for millennial banking without assessing the underlying premise and the payoff from investing in that particular feature/technology would be more akin to a spray and pray approach.

2. Banks are embracing digitalization to a great extent. An advantage of AI in the banking sector is that it cuts down the time-intensive and error-prone work. This includes replicating customer data from contracts, forms and other sources. Moreover, natural language processing when combined with intelligent process automation tools will allow banks to manage their back-office operations while removing complexity from banking workflows. The replacement of human processes with AI-based automation has been a boon. It has allowed banks to regulate audit and regulatory control that was extremely cumbersome previously. According to Accenture, banks are able to up their ROI by 20-25% by implementing AI-based systems.

What Obstructs the Success of Automation?

A Capgemini research report highlights the two areas that prevent the successful automation of the banking sector.

- Focus on wrong/complicated set of use cases

- Surpassing business and resource challenges

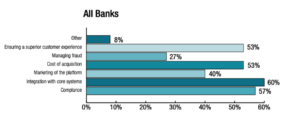

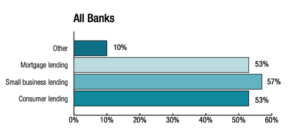

After the evaluation of 540 use cases, it was found that about half of the organizations tried to start execution with complex projects which led to slower paybacks. The approach instead should be tackling the ‘low-hanging-fruit’ category, where implementation is far easier and organizations achieve a faster ROI. Moreover, challenges like a proper team to handle transition, improper data and security management, lack of coordination etc can all derail the automation process. The concerns on whether the vendor will be able to deliver what was promised will always remain. In the ABA survey, the biggest hurdles considered for a consumer lending product digitally was:

Insights

Though challenges remain, banks have pivoted from their stance against fintech and understand that digital banking is the future. Partnering with a tech partner and giving it access to your customers was formerly considered anathema. But recent surveys shows that banks understand that it is not possible to invest billions of dollars in lending tech. Nobody can afford 10 billion dollars in tech investments like JP Morgan and thus partnering is a win-win solution. Over 50% of banks were happy to structure a referral model relationship with their digital peers.

This means that the industry is going to see a lot of collaboration between traditional banks, fintech companies and lenders. As a bank, it is important to select the right partner for digitalization. To help you navigate through multiple lending software providers – here is a buying guide to small business lending software.

Why MonJa?

MonJa is an AI-based end-to-end loan underwriting automation solution for banks and credit unions. Its technology is built on allowing clients to underwrite loans more efficiently. It improves funding decisions accuracy by leveraging it’s proprietary MonJa Loan Score and AI-powered risk algorithm. The company believes in a ROI based approach for selecting your technology partners. It has achieved the following impact for it’s existing clients:

– 70% reduction of time spent on manual document collection and setting.

– 42% decrease in loan processing duration.

– 20% increase in loan origination volume.

The company’s combination of software and human support is it’s USP. The goal is not to provide a software but a working automation solution that helps the bank and credit union achieve profitability in small loan underwriting in a scalable yet cost-effective manner. [/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_custom_heading text=”Request MonJa’s Loan Underwriting Demo” font_container=”tag:h4|font_size:25|text_align:left” google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_custom_heading text=”Our platform supports consumer term, C&I, CRE, auto and other small business loans.” font_container=”tag:p|font_size:20|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal” css_animation=”bounceInUp”][/vc_column][vc_column width=”1/2″][vc_column_text][yikes-mailchimp form=”10″ submit=”Request Demo”][/vc_column_text][/vc_column][/vc_row]