James Wu, MonJa’s CEO and Co-Founder, recently attended the 3-day Marketplace Lending and Alternative Financing Summit. The summit was an endeavor to create a platform for dialogue and education for all the stakeholders involved in the Marketplace Lending (MPL) ecosystem.

The who’s who of the alternative lending industry were gathered to share their insights on the newest techniques to maximize returns and reduce risk exposure.

A lot of light was shed on the current landscape of the alternative lending industry and possible trends that could be shaping the industry in the near future. The event took place in Dana Point, California from 3rd December 2017 to 5th December 2017. It was organized by the Opal Group.

Featured Presentations

The summit was kicked off by the highly engaging and insightful presentation “Has Marketplace Lending Grown Up?” by David Klein, CEO, and Co-Founder of the CommonBond (a marketplace that helps in lowering the student loan cost and has funded over a billion dollar in loans). In his presentation, he discussed the possible trends and strategies that need to be followed by the industry in order for growth to continue. He also discussed the 2017 developments in MPL industry and what’s in store in 2018. It was followed by another highly knowledgeable featured presentation “Marketplace Lending – The Next Steps” by Tim Ranney, a consultant at Clarity Services, Inc., a credit bureau providing real-time credit-related data on subprime consumers.

Speakers

Speakers from various verticals of alternative lending as well finance industry shared their thoughts on the pain points of MPL industry like bank DUE DILIGENCE, CREDIT RISK and how revolutionary technologies like BLOCKCHAIN will fit into the scheme of things. Apart from this, speakers also discussed the present landscape of alternative lending and what pivotal role TECHNOLOGY and data are playing in the various areas of the lending process.

The best part?

Tyler Kim, Global Head of Fund Services at Maple FS (a leading provider of fiduciary, administration and accounting services to financial institutions, investment management firms and institutional investors) was the moderator at Credit Risks Panel. Other speakers on the panel included Chris Franzek, Managing Director at Duff & Phelps LLC, where he is involved in Portfolio Valuation Practice; Conor Neu, co-founder and CIO of Pier Asset Management, his firm provides institutional investors with access to the alternative lending asset class via private funds and managed accounts and our very own James Wu. Prior to starting MonJa, James worked as an Executive Director of Risk Management Analytics at MSCI and has over 15 years of experience in designing and selling investment tools to institutional investors.

What’s the real story?

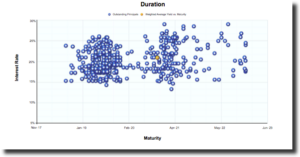

The discussion focuses on how important it is for the investors to understand the risk attached with portfolios comprising MARKETPLACE LOANS and why it is important for the investors to identify the risks they are willing to take. They also shed light on the returns offered by marketplace loans and how those returns can significantly enhance fixed income performance and help institutional investors achieve their investment objectives. To give the audience a better perspective, they also shared facts and figures relating to default rates, yields, maturities and other data across of thousands of loans on a diverse array of platforms.

The graph above provides further insight on the analysis shared by the panel. If investors are able to manage and understand the credit risk, their money can yield handsome returns.

Key Issues

- What should be the key screening criteria for evaluating a potential partner?

- Has that criteria changed in recent years and how?

- What role can IT play in the due diligence process? Where does the value of IT in due diligence end and the need for “feet” take over?

- Whether the industry is expecting deeper PARTNERSHIPS and investments by FIs into Fintechs? In what areas? Why?

- Why is debt servicing and collections important to Marketplace Lenders?

- Why it is important for institutional investor to understand credit risk?

- Whether the returns offered by marketplace loans is an attractive option for institutional investors?

Background

The ill-fated market crash that happened in 2008 was a blessing in disguise for the MPL industry. It is safe to say that the industry made most of the opportunity. The MPL industry saw a gap vacated by the traditional banks and is now pushing towards a trillion dollar market size. But the numbers do not always reflect the perfect story. The young industry is marred with dodgy regulatory compliance, not so thorough loan paperwork coupled with minimalistic credit profiling of the borrowers. This has resulted in ever so growing default rate that has threatened the stability of the nascent industry.

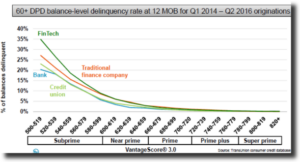

High Delinquency Rate

To bring home the point, the graph above clearly shows FinTech loans experience higher delinquencies and the situation is even worse when it comes to low tier credit scores.

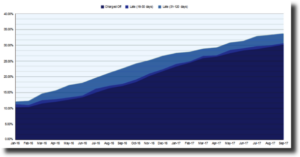

High charge off

Another image that paints the same story: fintech companies are struggling with high charge off rates.

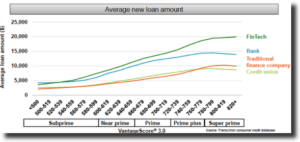

Loan Amounts

Above chart shows that fintech companies issue the largest loans across the risk spectrum, leaving them vulnerable and susceptible to high default rates.

That’s not all…

Based on above charts among other things, panelist emphasized on the importance of evaluating credit risk and how due diligence is of paramount importance in mitigating the risk of default rates and it is even more important since the regulators are tightening the noose around FinTech companies.

Insight

Though the default rates can seem a bit SCARY, all is not lost for the FinTech lending industry. Here at MonJa, with our proprietary credit solutions, we provide institutional investors and originators a framework to monitor portfolios and platforms for the underlying credit risks.

It is important for traditional players to understand that MPL is a DIFFERENT ANIMAL and advanced analytics is a MUST-HAVE to succeed in a world where data is the new oil.

Conclusion

In a nutshell, the summit provided a common ground where all the stakeholders involved in MPL industry were able to share their thoughts on various issues and gained valuable knowledge that will help them in steering their companies in the right direction. It also allowed the participants to network with their peers as well as professionals from other verticals of the industry.