As I previously wrote, some of the recent coverage on Lending Club’s credit performance is somewhat one-sided, and we believe Lending Club’s loan performance is broadly in line with expectation. That said, the actual performance depends on the specific segment in question, which we will explore in greater detail in this post. Similar to what some of the commentators have indicated, we found a difference generally driven by the credit quality of the borrowers.

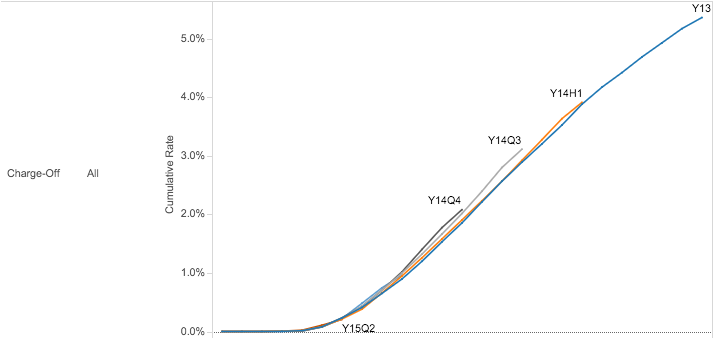

We’ll start with the general performance across the platform, for all 36 months loans:

The performance is quite consistent from one vintage to the next.

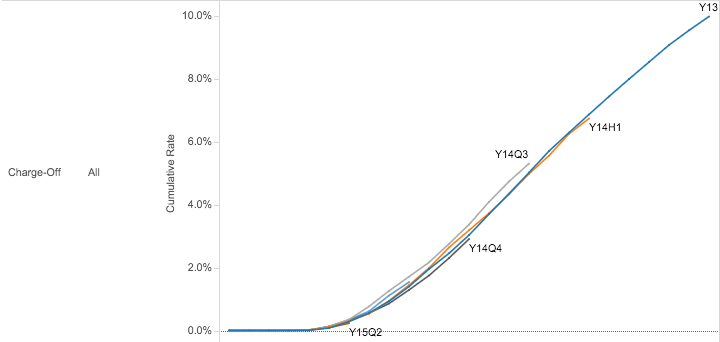

Next, all 60 months loans:

While the 60 month program is more recent, it appears that Lending Club has amassed sufficient experience in underwriting these longer loans, to achieve the consistent performance.

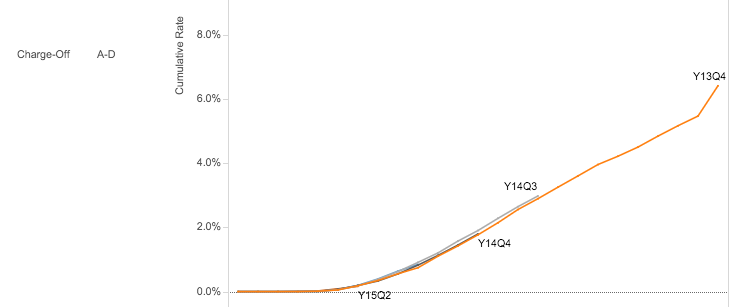

Here is a third very similar looking chart, detailing all loans with grades A to D, consisting of higher quality borrowers on the Lending Club platform:

The lines overlap with each other to an even greater extent compared to the prior charts, indicating almost identical performance vintage after vintage. Not to beat a dead horse, but this is what consistent performance looks like.

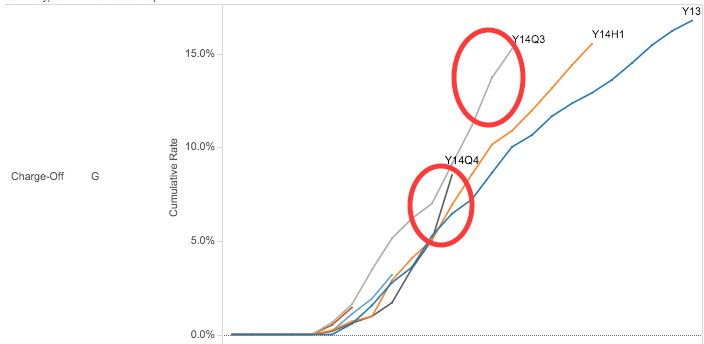

On the lower end of the credit spectrum, things look very different – specifically for Lending Club Grade G:

A couple observations:

- Two of the recent seasoned vintages (Y14Q3 and Y14Q4) have charge-off levels above prior vintages, in contrast to Lending Club’s general ability to keep charge-offs level across vintages for other segments

- The last few points of these two vintages appear to have higher slope than prior months, indicating a potential acceleration of losses in Q3 and Q4 of 2015.

- Based on the corresponding rolling of delinquencies, some of the effect is likely seasonal and coincidental with the timing of prior DQ. Nonetheless, it’s worth monitoring this vintage closely.

In conclusion, we believe that the higher grade Lending Club loans will continue to perform as expected, as we have seen no increase in charge offs with more recent vintage loans. However, investors should closely monitor more recent vintages of lower grade Lending Club loans (particularly grade G). The performance seen in recent lower grade Lending Club loans may indicate a timing issue, or deteriorating economic fundamentals underpinning lower grade borrowers.

To see the performance of each Lending Club vintage in detail, sign up to receive our Lending Club delinquency and loss vintage curve report in your inbox.