A few weeks ago, MonJa launched our “5 Common Mistakes P2P Loan Investors Make” blog series. This week, we will talk about the second mistake investors make in peer-to-peer lending. These analytical findings will shed insight to those who are against using credit models.

5 Mistakes P2P Loan Investors Make – Using Simple Filters (Part 2 of 5)

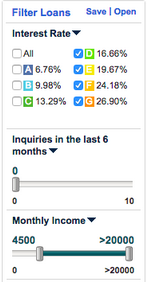

As peer to peer lending matures, lending platforms continue to support the growth by pumping up the volume of loans on their platforms. On Lending Club alone, there were over 150,000 loans issued in Q2 2015.¹ With the abundance of loans available, investors need to consider that each loan contains different characteristics before investing. Of course, a good investor would also want to select the loans in pertinent to their risk tolerance. To limit the exposure of risk, investors use filtering as a basic investment strategy. For years, these were the recommended variables in designing simple filters on Lending Club and Prosper:²

- Loans with low credit grades

- Inquiries in the last 6 months = 0

- Income >$50,000

There is no doubt that using simple filtering strategies is helpful in exposing basic weak spots in the assignments of loan grades. However, as Simon Cunningham warned, “we will most likely experience the death of simple filtering as lending platforms improve their loan pricing.”³ Given that using simple filters may no longer yield above average returns, investors are now turning to algorithm investing or outside credit models to help select optimal loans.

When customizing an investment strategy, investors try to strike a balance between creating a filter that is oversimplified and creating one that is too restrictive. Creating an oversimplified filter can increase exposure to risky loans and limit returns, while creating an overly restrictive filter may prevent the investor from purchasing sufficient loans to put enough capital to work. A careful investor would consider the variations in each credit grade and select loans based on the history of the borrower and the purpose of the loan. While filtering can help select loans, the strategy can be outdated when lending platforms periodically make underwriting changes. When that happens, investors need to manually update their filters and find different variables to select their loans.

One difference between secondary credit models and simple filtering strategies is that credit models consider the changing characteristics of loans. When the quality of the loans change, credit models are updated to take into account of these changing characteristics and avoid investing in poorer quality loans. To help investors search for the most optimal loans, an outside credit model approach would be a more secure method than using simplistic filters.

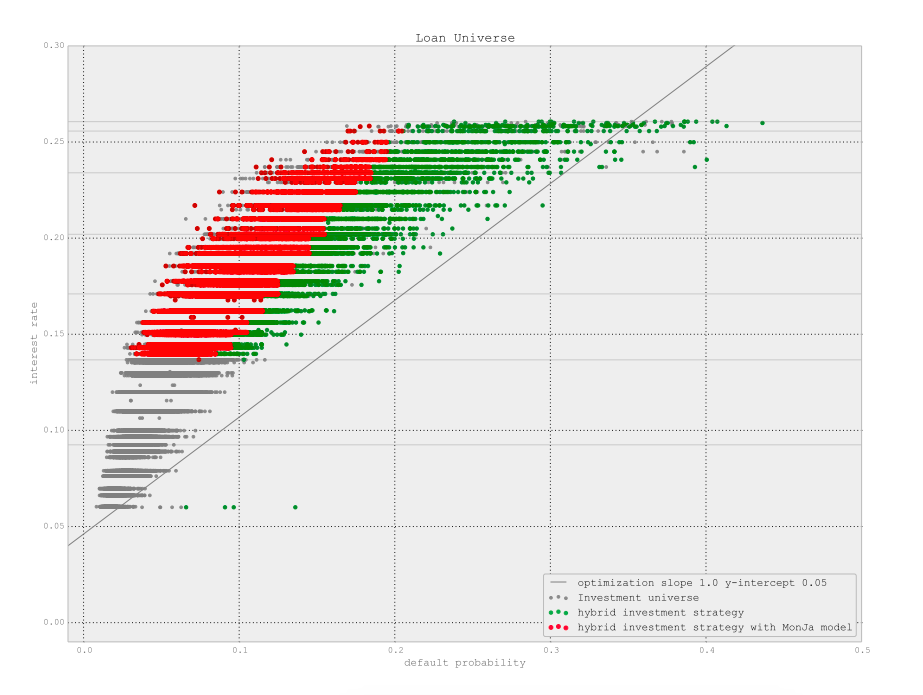

With that said, MonJa’s analytics team has been working on loan modeling to provide credit models to investors. Below, you can see that an investment strategy with the MonJa credit model reduces portfolio delinquencies for loans.

While default probability is highly correlated with interest rates, a loan selection model can allow investors to select the loans with the lowest loss rates, within each interest rate level. A hypothetical hybrid investment strategy with MonJa’s loan selection is shown in the graph above (highlighted in red), achieving a higher level of return by taking similar or lower risk of loss than average.

Investors can also reduce their risk exposure (and thus increase return) by recognizing the changing characteristics of loans. The graph below shows a drill down on individual loan grades and keeps track of the loan quality through the average DTI and FICO scores.

Given the interplay between a platform’s origination patterns vs ongoing credit quality, many quantitatively-driven investors incorporate this information into their loan purchase strategy, and this presents additional return opportunities that is missed for an investor using a simplistic filter.

_____

¹ https://www.lendingclub.com/info/statistics.action

² http://www.lendacademy.com/simple-investment-strategy-for-lending-club-and-prosper/

³ http://www.lendingmemo.com/credit-model-lending-club-prosper/