[vc_row][vc_column][vc_column_text]MonJa’s Digital Banking and Lending Monthly Roundup – Why Subscribe?

Digital banking and lending is evolving rapidly. Recent fintech-banking partnerships and innovation in technology with the introduction of AI, ML and blockchain herald a new era in lending. Fintech’s are changing the competitive ecosystem, empowering lenders to process loans faster and smarter. In a world full of noise, understanding how the technologies and developments may impact your financial institution’s credit decisions and credit portfolio is of critical importance. With MonJa’s Digital Banking and Lending Monthly Roundup, it’s easy to stay up to date on what’s happening in the space. Get the latest updates, analysis and commentary on digital banking and lending segment!

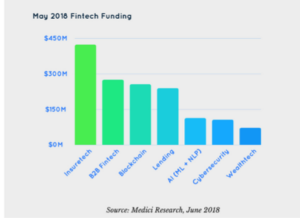

- 06/13/18 Insuretech Investment On the Rise (Bank Innovation)

Earlier considered as a Fintech backwater, Insuretech is stepping on the gas. Not only is Insuretech now mainstream, May 2018 saw it attract higher funding than B2B Fintech, Blockchain and Lending. The sector saw $423 million in funding spread across 22 deals.

- 06/17/18 BIS wants tighter rules for funds offering credit, fintech (Reuters)

The Bank for International Settlements (BIS) emphasized that Central Banks need to take notice of asset management funds and fintech startups. The Swiss based bank is considered the nodal banker for central banks. In its latest report, it suggests that the growth of shadow lending through asset management companies and shifting of risk through fintech startups requires strong oversight to ensure prudent economic management.

- 06/12/18 Why Digital Lenders Are Tightening Their Lending Criteria (PYMNTS)

Borrowing money will no longer remain as easy as it was just recently. Lenders on platforms like LendingClub, Prosper, SoFi etc. have been insisting that online-lending platforms tighten their credit policies and underwriting standards due to the increasing number of defaults. With the ease in processing loans online, Fintechs also witnessed increased write-offs and loss of capital. The recent diktat should lead to maturing of the ecosystem. The focus is expected to shift from capturing market share to profitability.

With loan approvals for small businesses hitting a new high, there is intense competition between the various credit providers. The Small Business Lending Index by Biz2Credit revealed that the loan approval rates for credit unions were falling while big “brick and mortar” banks were increasing their lending to the segment. The approval rates stagnated even for alternative lenders. Even more impressive was the fact that over 30% of applications were approved at the big banks but the small banks saw an approval rate of a whopping 49%. This is a big win for small businesses indeed. But clouds are not yet clear for those looking to hang on to the old way of lending, a report by Kabbage, an alternative lender, estimates that over 20% of the lending activities on its platforms is expected to be facilitated by mobile devices in 2019.

- 06/17/18 Brexit And UK Fintech Investment: Two Years On From The EU Referendum (Forbes)

The Fintech sector in the UK attracted $2.4 billion in investments in 2017. This was a massive 150% jump from the previous year. Analysts had predicted that post-Brexit UK would see reduced investor interest and will see its position as global fintech hub challenged. But the investors have voted with their wallets and London seems to still hold its position as the nerve center of the global fintech industry. With the industry generating GBP 7 billion a year for the economy, the British Government must be heaving a sigh of relief.

- 06/06/18 Chinese Giant Ping An Looks Beyond Insurance To A Fintech Future (Forbes)

Ping An Insurance is the 800-Pound Gorilla of the Chinese Insurance industry. With $94 billion in premium revenue and $180 billion in market capitalization, it dwarfs its Asian competitors by a mile. The company is ranked 10th on Forbes Global 2000 list and is now looking towards evolving from an insurance behemoth to a fintech conglomerate. Its fintech incubator, Ping An Technology is behind startups like Lufax, OneConnect, Ping An Good Doctor and Ping An Healthcare and Technology. All of these startups are unicorns in their own rights. It will be interesting to see how it evolves with Alibaba’s Ant Financial making big strides of its own.

- 06/07/18 Index Ventures Expects A $2 Billion Windfall From Early Bets On Fintech (Forbes)

Index Ventures is arguably the best VC fund in Europe with 4 of its partners on Forbes Midas Europe List. The VC’s founder Neil Rimer was ranked as the number one on the coveted list. The reason for such heady success has been the major payday from its fintech investments. Adyen, the Dutch payments startup and iZettle, Sweden based portable POS startup, alone account for an estimated $1.39 billion in payouts. The number can inch past 2 billion when FundingCircle, the UK based P2P lending marketplace, IPOs in second half of 2018.

- 06/15/18 This German Fintech may soon be more valuable than Deutsche Bank (Bloomberg)

Wirecard AG, the German payments company recently debuted on stock markets with its blockbuster IPO. It was the biggest fintech public offering in Europe and has already given returns of over 60%. The more surprising issue is that the young upstart is nearing the valuation of German banking giant- Deutsche Bank. Now hobbled with legal costs and trading losses, the bank trades at a fraction of its book value and Wirecard is just shy of crossing the market capitalization of the bank, which once used to dominate the European banking scene.

- 06/11/18 Tech Startups Are Trying to Make Bank Accounts Cool (Bloomberg)

Banks accounts are suddenly cool again with Silicon Valley Fintech giants looking to launch multiple products and services with the ubiquitous saving and checking account as the core offering. SoFi is introducing SoFi Money, an amalgamation of checking and savings account. Wealthfront and PayPal have sent out email surveys to evaluate user interest in products similar in features to a traditional bank account. Startups seemed to have figured out that the basic account is still their best bet in being able to retain the millennial user.

- 06/14/18 Fintech’s Adyen Shows the Long Path to Unseat Giants of Finance (Bloomberg)

Adyen, the Netherland based Paypal rival, just debuted on the stock markets with a bang. It surged by almost 90% and is among the most successful fintech offerings of 2018. But even with a market cap of over 12 billion, it pales before the “traditional” financial services leaders. Alibaba backed Ant Financial, with a valuation of $150 billion is the only firm to crack the top 10 of biggest financial services company by market cap. Paypal, recently cracked the top 20. The fintech startups have some way to go before they can look to dominate financial services rankings.

- 06/12/18 California may force online business lenders to disclose rates (American Banker)

A Bay Area Democrat, Senator Steve Glazer proposed a bill that mandates standard price disclosure for small business lending outfits. In an aim to curb the rampant miss selling, a bipartisian initiative was able to pass the bill though the senate. Its fate in the state assembly seems to be unclear as yet with no major opposition or support by industry or consumer advocate bodies.

- 06/15/18 Peer to Peer Micro-Credit Site Puddle Shuts DownSource (Crowd Fund Insider)

Puddle, a San Francisco based peer-to-peer micro-credit lender, has decided to shut shop. The founders could not scale the business and found the model unsustainable. It had raised $250,000 from VCs and angels but 5 years since launch could not really grow the company to the next level. This shows that the industry is coming to terms with the reality of fintech lending and scaling without burning money seems to be the new mantra.

- 06/13/18 New Technologies and New Customer Experiences Drive Banking Today (Lend Academy)

The article is a report on American Banker’s Digital Banking Conference in Austin recently. The limelight was on Blockchain and AI. Startbucks mobile payments App and Venmo’s unrelenting growth were the talk of the conference. Customer experience in the digital future was an important discussion point with everyone from small banks to giants like Bank of America investing in digital technologies to remain relevant. But a report by Samsung and Celent highlighted that customers still prefer branch banking in complicated cases. Branch banking has a future but it needs to be empowered with digital technology to brave the onslaught of fintech startups.

- 06/19/18 28 days later…Assetz Capital’s rate rise attracts £10m (AltFi)

Assetz Capital, a UK-based P2P Business Lender, has revised interest rates for investors on its platform. The increase in rates from 4.25% to 5.1% was intimated on 16th May but was retrospectively effective form 1st May. The startup’s ISA (Individual Savings Account) has now raised a cumulative GBP 50 million since its launch 6 months ago. This proves that lenders are willing to bet on strong p2p players who can provide above market yields for their investments.

A report by Royal London Asset Management, a 114 Billion Pound Asset Manager, believes that pension investors should stay away from investing in P2P investments. Attracted by the high yields on offer, p2p loans put retirement money at great risk. Researchers point out that such investments tend to usually perform poorly during period of economic stress and there is a chance of permanent erosion of capital.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_custom_heading text=”Interested to find out if MonJa’s lending automation platform is a fit for your organization? ” font_container=”tag:h4|font_size:23|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_custom_heading text=”Request Free Demo Today!” font_container=”tag:p|font_size:24|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][/vc_column][vc_column width=”1/2″][vc_column_text][yikes-mailchimp form=”10″ submit=”Schedule a Demo Today”][/vc_column_text][/vc_column][/vc_row]