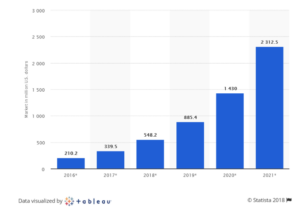

[vc_row][vc_column][vc_column_text]The blockchain technology is now mainstream and is expected to grow to a market size of $2312.5 million by the year 2021. Though media only seems to be reporting about Crypto currencies and their gyrating prices, experts agree that the real future is in adopting the fundamental i.e. the blockchain technology into existing business frameworks.

SIZE OF THE BLOCKCHAIN TECHNOLOGY MARKET WORLDWIDE

Source: Statista 2018

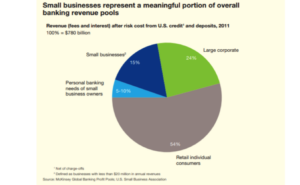

Blockchain startups have been hogging the limelight but on the other hand, one of the pillars of the US Economy- Small Business is being ignored. A McKinsey Report reveals that small businesses generate about half of the nation’s GDP and contribute over 15% to the overall banking revenue pools.

Source: McKinsey & Company Report on Digital Models for Digital Age:

Transition and Opportunity in Small Business Banking

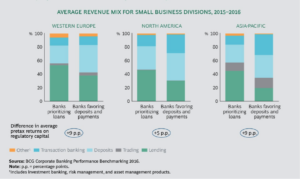

Source: Corporate Banking Growth- BCG Publications

But still, more than 29% of failed small businesses attribute lack of working capital as the primary reason for shutting shop. With an emphasis on activities other than lending while serving small businesses, it is clear that there is a genuine need for the banking industry to evolve. The issue commonly raised by bankers that small business banking is expensive and unit economics do not support increase in lending to the sector do not cut ice in an era of fintech innovation. Banks cannot afford to lose out on a trillion dollar market and Blockchain seems to be the best bet in ensuring that they provide a truly world class experience to their customers while generating sustainable profits in the long term.

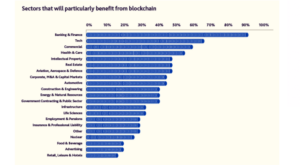

WILL BLOCKCHAIN DISRUPT THE BANKING SECTOR?

Gowling WLG, a multinational law firm, carried out a 2018 Future of Blockchain Survey to identify the sectors that could benefit from Blockchain. In the survey, Banking and Finance topped the list and over 90% of the total respondents held the view that the Banking & Finance Sector shall be disrupted by the Blockchain technology.

Source: Gowling WLG & BizWord

THE REAL IMPACT:

Blockchain technology can be used to decentralize the small business banking sector. Not only does it have myriad applications in forex transfer, payments, invoice finance etc, it can help banks in maintaining a permanent record of any kind of transactions between parties at a fraction of a cost.

The blockchain technology maximizes value for both the small business as well as the bankers in the following ways:

- Automation: Blockchain technology will be successful in bringing automation throughout the banking processes and especially in small business banking which has a dire need for

- Fraud: The integration of the blockchain technology in the small business banking processes would help in reducing fraudulent activities. Block chain provides high-end security, low fees and no dependency on intermediaries. Banks drowning in paperwork and regulatory fines can leverage blockchain to create an auditable and immutable trail for overall compliance and audit.

- Transactional Security: Blockchain will help in securing transactions in an end-to-end decentralized ledger. The encryption techniques will help in validation of transactions and storing them on a common database. At the same time, the blockchain technology will also ensure that the stored data is not tampered or misused.

- Speed & Efficiency: A direct transfer of funds without the role of intermediaries would not only save time but also ease processes. Blockchain technology shall reduce the need of reconciliations and make the waiting process for international bank transfers redundant. Thailand’s Siam Commercial Bank and Japan’s SBI Remit are partnering to using blockchain applications for transacting FX worth over $250 million yearly. The transaction is now completed in 5 seconds as compared to the earlier timeframe of 1-2 business days.

- Verification of Identity: Identity verification is yet another powerful feature of Blockchain technology. The extensive KYC requirements needed for a transaction or account opening can now be moderated by using blockchain.

Harvard Business Review is of the view that Blockchain will have the same impact on the banking sector as the internet had on the media. It is believed that the deepest impact will be on the lending segment.

Lending and Blockchain:

Online marketplace lenders are currently reimagining lending by eschewing the traditional branch led model and focus on giving borrowers a hassle free digital-first experience. Banks focusing on small businesses can now compete with online lenders in terms of cost and speed by introducing blockchain into their processes. Lets take the example of trade finance. The current system of invoice finance is convoluted with banks needing to maintain a mountain of paperwork for each client and requiring permission for every single transaction. The end result is the small business faces the brunt of delayed payments from the banks, defeating the purpose of invoice financing in the first place. Secondly the increased costs of managing all the information and permission requests from the banks make the actual cost of invoice finance prohibitive.

Blockchain and smart contracts can actually automate the entire trade finance with suo moto release on acceptance of predefined conditions. The processing cost of such invoice financing will be negligible thus creating true value for the small business customers. IBM is partnering a Thai lender to create a new blockchain-powered Enterprise Letter of guarantee network. If a Thai lender can look to integrate blockhain for its trade finance business, the potential for American lenders is enormous.

WHY IS BLOCKCHAIN A GAME-CHANGER?

- Establishing a banking system for the under-banked:

The Blockchain technology operates irrespective of the size of the business. It shall be successful in setting up a scalable system of banking even for the smallest of businesses and rather act as a catalyst to connect the entire economy through the decentralized financial network.

- Profitability for Banks, Service for Small Businesses

Small businesses’ dollar amounts for transactions and borrowing is usually so small that banks feel that they need to charge exorbitant fees to cover their expenses of serving the segment. Blockchain eradicates the need for multiple toll keepers and simultaneously increases the process speed of the entire organization. The most critical thing is that blockchain can be utilized at any scale. A bank can actually run a pilot project impacting a very small part of overall business and then take the solutions to the bigger segments.

CONCLUSION:

Blockchain is a win-win situation for both banks as well as small businesses with faster settlements, easier processes, secure transactions and savings in both cost and time. Banks need to consider the blockchain world not as a competitor or a fad but as an enabling technology that will allow the banks to truly serve the backbone of American economy. Blockchain represents an opportunity to take back the turf lost to fintech challengers and build a small business banking division that is receptive to the needs of its customer base and simultaneously generates positive ROI for the banks shareholders.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_custom_heading text=”Request MonJa’s Loan Underwriting Demo” font_container=”tag:h4|font_size:25|text_align:left” google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_custom_heading text=”Our platform supports C&I, CRE, auto and other small business loans.” font_container=”tag:p|font_size:20|text_align:left|color:%23000000″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal” css_animation=”bounceInUp”][/vc_column][vc_column width=”1/2″][vc_column_text][yikes-mailchimp form=”10″ submit=”Request Demo”][/vc_column_text][/vc_column][/vc_row]