Building your financial institution’s commercial loan portfolio without adding more staff can be a challenge. Customer demand for convenience and faster commercial loan underwriting makes it necessary for banks to do more with the resources they have in order to stay ahead of the competition.

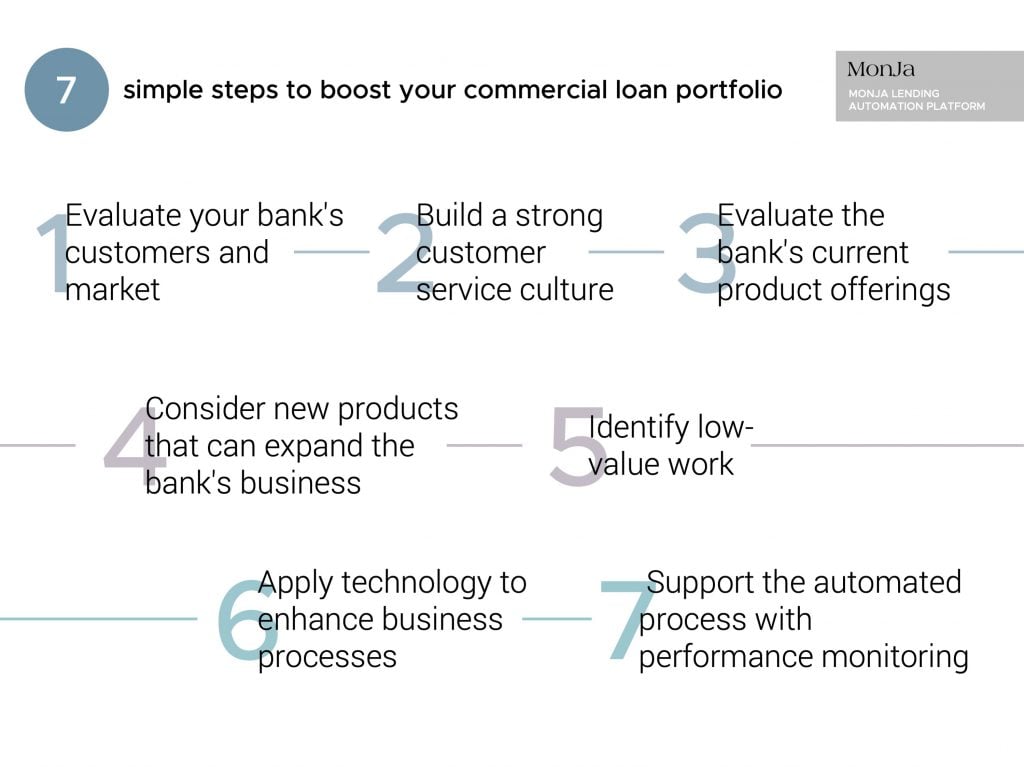

This guide, provided by my friend who wrote several Upstart loan reviews, provides 7 simple steps you can use to improve your processes, better connect with your customers, and increase your commercial loan portfolio without increasing your costs.

1. Evaluate your bank’s customers and market

The best strategies to increase loan portfolios always begin with an assessment of what business opportunities are available, among both existing and new customers. One suggestion to do this easily is to take advantage of third-party data sources and insights.

2. Build a strong customer service culture

Community bank growth strategies and credit union growth strategies rely heavily on customer engagement, but this can be applied to commercial banking as well. One basic, effective approach to this is to evaluate customer engagement methods, and eliminate questions that might lead to a “No, thank you” answer.

3. Evaluate the bank’s current product offerings

The objective here is to examine the relationship between bank products, for example, loans and deposit accounts. Take a look at ways to connect credit and non-credit products and create opportunities for cross-selling. This will be helpful later in integrating data and automating processes.

4. Consider new products that can expand the bank’s business

Along with expanding commercial loans, your bank should consider other new products that would complement them. Auto loans, for example, are proven to attract additional loan business from existing customers. They can also help to expand offerings to commercial loan clients and build the commercial loan portfolio.

5. Identify low-value work

One common complaint among loan originators and underwriters is that too much of their time is spent on work that does not directly provide value. A good example of this is the amount of time people have to spend manually entering data. Making these steps in the commercial loan underwriting process more efficient will save time, reduce costs, and allow your credit officers to focus on areas where their expertise is needed most.

6. Apply technology to enhance business processes

Using automation to re-engineer and streamline your business processes is the key to building your commercial loan portfolio without increasing your existing resources to do it. Automation provides a number of advantages:

- Automation can eliminate almost all manual handling of customer data by allowing the customer to upload their own documents with an application. This reduces processing time, allowing for a higher volume of applications. It also eliminates the risk of errors in data caused by manual entry.

- Autoamtion offers more convenient, customer-friendly interfaces, such as through mobile apps. Making it easy for customers to apply for loans and monitor the progress of their applications at their convenience online helps to attract more customers.

- Artificial intelligence (AI) based data management systems allow for flexibility in setting credit standards and can apply prudent risk management to customers that do not fit well into conventional credit profiles.

- Centralized data management and secure integration with external sources mean automated underwriting can be accurately completed in a fraction of the time. The integration with other parts of the bank also enhances customer engagement by creating smooth opportunities for cross-selling.

7. Support the automated process with performance monitoring

Automated loan application, generation, and underwriting solutions make performance management easier by providing customized reports. In commercial lending, however, there are several factors that must be carefully considered:

- The sources of loan guarantees: Taking these directly from customer documentation rather than interviews is more accurate. Make sure your automated platform is capable of capturing this data.

- Closing costs: Automation naturally reduces costs, but these still should accurately reflect the actual costs the bank needs to recover upfront when a loan is disbursed.

- Actual performance/use of loan proceeds: You can enhance your customer service as well as the profitability of your commercial loan portfolio by providing follow-up monitoring of loan use. Are your customers borrowing the right amounts to meet their requirements? Gathering this information after loans are made will help your bank to offer more effective loans to returning and new customers later.