Introduction

There was a time when doing banking transactions used to be a very difficult and time-consuming task. You had to stand in a long queue to conduct basic financial transactions such as withdrawing cash or depositing money. Thanks to secured atm services and later to the digitalization, the users can perform all these transactions at their home at a click of a button. Digitalization refers to the conversion of data (and money!) into a digital format with the adoption of technology. Digitization of the bank has enabled all traditional banking products and services to be delivered over the internet. It has transformed the banking industry and has made banking transactions faster and effective.

But the effect is not limited to transactions alone. Digitalization has ushered in a new era of personalized offers (both loans and investments). Apart from acquiring new customers, retaining the existing customer base is of the essence. According to the 2019 Marketing Metrics report, it is revealed that the success rate of selling a product or service to an existing customer is 60-70%, whereas the success rate of selling a product or service to a new customer is only 5-20%. It is important for any financial institution to stay up to date with new technology in order to meet and exceed customer’s expectations. Digitization becomes even more important in current unprecedented times of COVID-19 pandemic, which is accelerating the conversion of more and more processes to online, including banking processes.

7 Benefits of Digitalization to a Bank’s Existing Client Base

Embracing digitalization proves to be very beneficial for banks to cater to the demand of existing as well as new customers. Mentioned below are the benefits of digitalization to bank’s existing customer base:

1. Digitalization helps in enhancing the quality of services provided by banks to its customers

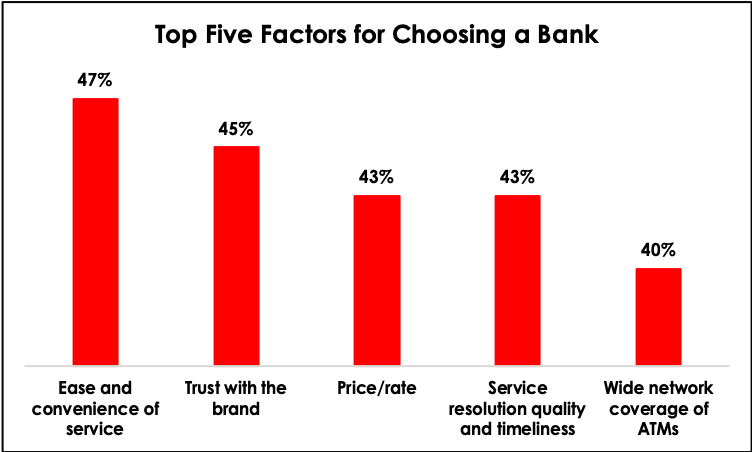

Customer service is a very important aspect of banking. No bank can survive without their customers. Digitalization has forced the banks to reorganize their structure and change the way of their operations to deliver quality services to its customers. The services which are being provided by the banks have now become more standardized and efficient. The above figure depicts the top five factors for choosing a bank. From this graph, it can be inferred that 47% of the customers decide on the basis of ease and convenience provided by the bank while using its services and 43% of the customers make their decision on the basis of service resolution quality and timeliness.

2. Digitalization has made banking transactions easier and less time consuming for the customers

Digitalization has changed the way banking transactions are performed. Before the emergence of digitalization, a prospective borrower would have to submit hundreds of pages of documents for a credit application and wait for months for an answer. But in the digital age, customers are not required to visit the bank for conducting financial transactions. They can transfer funds from their account, pay their bills, check their account balance with the help of mobile and internet banking services offered by the banks. They can borrow without ever stepping into a branch. This has made banking transactions easier and less time consuming for customers. As per the 2019 American Bankers Association report, it has been found that 77% of the customers find it “much easier” or “somewhat easier” to access their financial services because of the tech improvements.

3. Digitalization has helped the customers in getting personalized services as per their needs from the bank

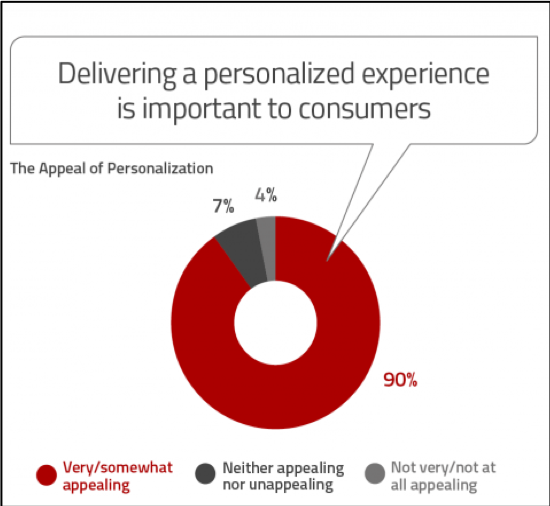

The needs and expectations of every customer from a bank are different. Therefore, a banking service or offer that can be beneficial for one person might not be useful for others. With the emergence of digitalization, banks can now provide customized services to their customers. The quality, content, and the method of delivering the services can be tailored according to the needs of the customers.The figure represents the importance of personalized banking services for the customers. It can be observed that 90% of the customers consider personalized services important for them.

4. Digitalization helps to build a better relationship between a bank and its existing clients

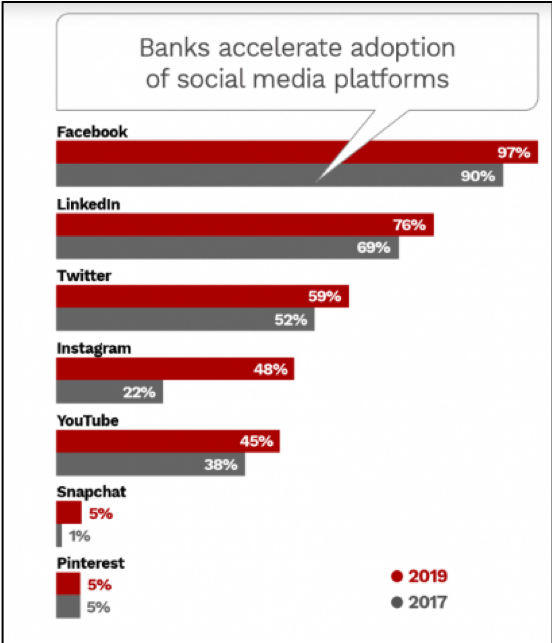

In today’s competitive world, establishing a good relationship with your existing customers is very essential for the success of your organization. Businesses use social media platforms to communicate with their customers and the banking sector is not an exception. Social media is a widely used platform by the banks to give information to customers about the new schemes offered by them. I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. The figure shown above highlights the usage of various social media platforms such as Facebook, LinkedIn, YouTube, WhatsApp, etc. by the banks. The usage of social media platforms by banks has increased in 2019 as compared to 2017. Facebook and LinkedIn are the most preferred social media platforms used by the banks to reach its customers. So customers can now engage with the bank and/or complain on social media channels used by the customers as compared to having to use the existing complaint forums provided by the banks.

5. After the emergence of digitalization, clients can easily give their feedback regarding the services provided to them by their bank

Earlier the customers were not able to give their feedback on the services provided due to lack of a centralized system to address their problems. But after the adoption of digitalization, there is establishment of customer support service teams in every bank. Their work is to take feedback from the customers about the services provided by the bank on a regular basis and address their issues. This enables the banks to provide a better customer experience. If the bank would respond to the complaints and issues of its customers in a proper way it will help in enhancing the image of the bank in mind of the customers.

6. Digitalization has helped the clients by providing them with good and secure customer experience

To remain competitive, banks need to consider “customer experience” as its most important parameter. Digitalization has led to an increase in expectations of the customers from their banks. To fulfill these expectations, banks need to provide the best services to their customers through online as well as offline channels.

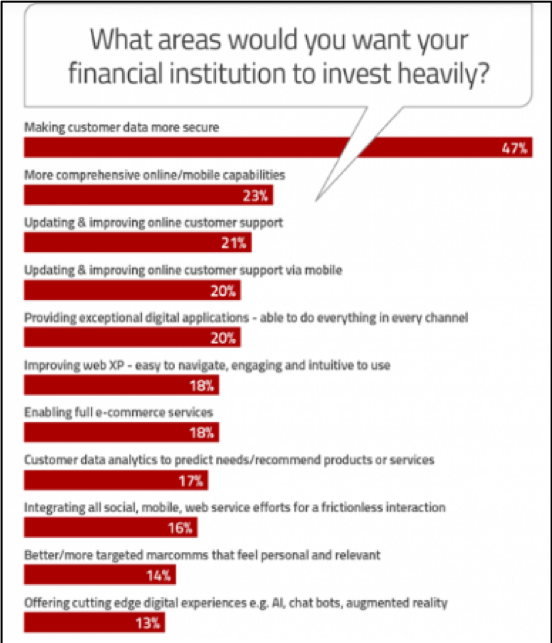

The graph given below depicts the areas where banks need improvement to enhance the banking customer experience. Out of all the areas, addressing the security concerns of the customers is the most important area which needs to be considered by the bank.

7. Digitalization helps in increasing the existing client base of the bank

With the help of digitalization, the bank can expand its existing client base to a large extent. Various tools such as SEO, social media platforms, mobile banking, etc. can be used by the banks to increase their client base. When customers discover that the bank has a good brand presence on social media platforms, it is interactive and open to customer’s complaints, queries, then automatically, they develop a sense of trust for that bank. This will help the bank in increasing its customer base. It’s a win-win as customers gets all the information in a detailed yet informative manner.

Conclusion

The adoption of digitalization was a huge turning point in the history of the banking sector. Digitalization has completely transformed the way of working of the banks. It has made banking transactions easier and faster. The banks have now become technology-driven and provide various new features such as online banking, mobile banking, online loan approvals and many more services to their clients. Digitalization powers stronger return on investment for banks. It is also very beneficial to the existing client as it helps them in getting more personalized services from the bank along with overall enhanced customer experience.