Based on our observations, Hurricanes Harvey and Irma had a sizable impact on consumer loan performance and delinquency rate during September 2017 among affected borrowers. Please see below for our analysis

Hurricanes Harvey and Irma had inflicted intense damage on communities in Texas, Louisiana, Georgia, and Florida. While the hurricanes had caused undisputed humanitarian impact, the economic impact appears less clear, in part because Hurricane Irma’s path narrowly avoided inflicting maximum damage to Miami. In September, the Fed issued a statement indicating that there will unlikely be lasting economic damage:

Storm-related disruptions and rebuilding will affect economic activity in the near term, but past experience suggests that the storms are unlikely to materially alter the course of the national economy over the medium term.

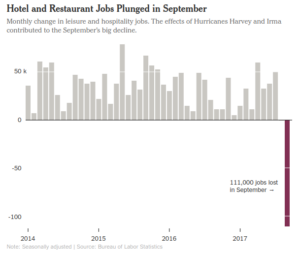

New York Fed President William Dudley also suggested that the economy may in fact benefit from the effects of the hurricane. At the same time, BLS’s September report showed a dip in employment numbers, which would generally have a knock on effect on consumer loan repayments.

Image credit: New York Times

Impacts on Delinquency Rates

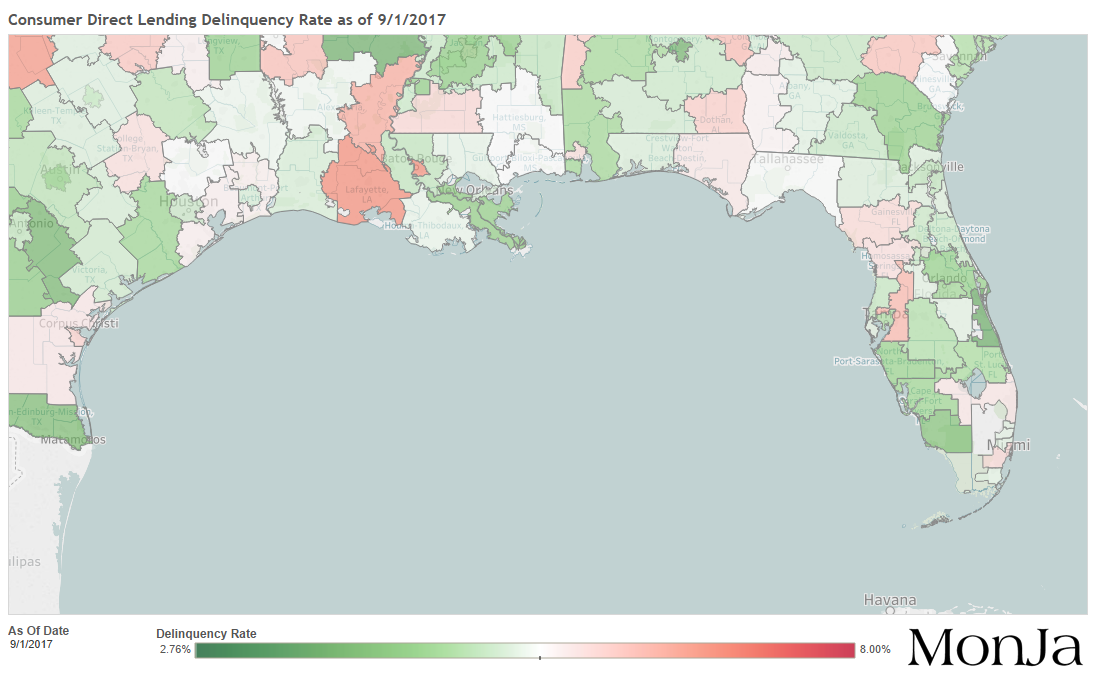

Over the last month, we had noticed sizable impacts on borrowing repayments in the areas affected by Hurricanes Harvey and Irma. During the month of September, the percentage of borrowers who became delinquent increased sharply within the impacted region:

Consumer Direct Lending Delinquency Rate – Sep 1 2017

Consumer Direct Lending Delinquency Rate – Sep 1 2017

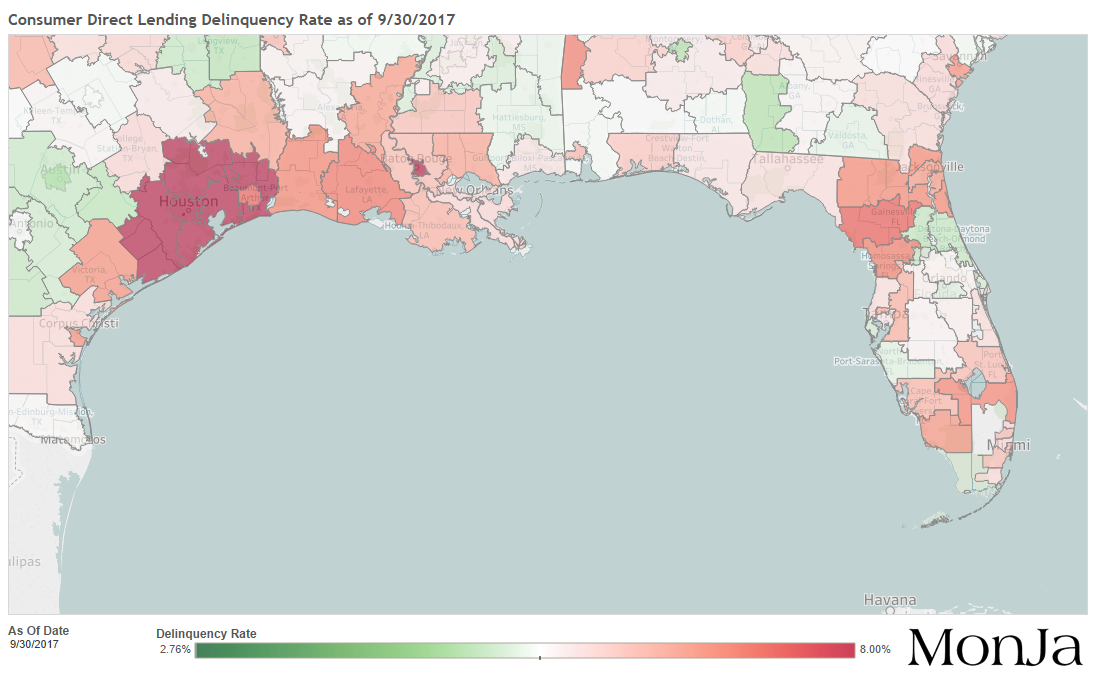

Consumer Direct Lending Delinquency Rate – Sep 30 2017

Consumer Direct Lending Delinquency Rate – Sep 30 2017

The pattern is striking as we look at the day-to-day progression of delinquency rate estimates. While there is a delay in which payment status actually reflects borrowers’ ability to repay (given payments are usually monthly), the trend is clear. As individual payments become due, the delinquency rate increases noticeably from one week to the next.

A number of observations:

- Most of Florida, Georgia, and coastal Louisiana saw a moderate increase of delinquency rate, while the Houston metro area had a severe increase of delinquent borrowers, going from 4.5% to 10%+ in a single month.

- The areas with a high delinquency impact closely mirrors FEMA disaster zones. However, we also noticed an increase of late payments in some borrowers residing outside of the immediate disaster zone, potentially due to impacts of employers and family affected by the storms.

- While some have suggested a quick recovery for loan performance, preliminary data from TX indicates that delinquency rate continues to rise (albeit at a slower clip) even beyond 8 weeks after the disaster. Therefore, we believe additional portfolio losses will continue to accumulate in the coming weeks at a minimum.

Ultimately, loan payment behavior for consumers is tied intimately to consumer income; while we are hopeful for a quick rebound, it appears likely that the path to recovery for many affected by the disasters will be a long way.