Mistake #4: Investing in Only High Interest Loans (Part 4 of 5)

In the beginning of fall, MonJa launched our “5 Common Mistakes P2P Loan Investors Make” blog series. This week, we will talk about the fourth mistake investors make in peer-to-peer lending. These observations aim to help investors understand essential investment strategies.

There is a common rationale that riskier investments can generate higher returns. This rationale originates from the classic risk and reward tradeoff, where the level of risk correlates with the level of return the investment might yield. However, I’m here to challenge this belief with one simple Lending Club data-set to validate that not all risky investments are rewarded for the risk.

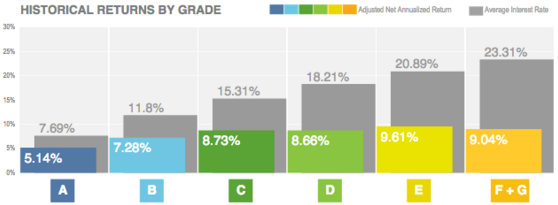

From the graph above, notice that the loans have progressively higher interest rates across the spectrum of loan grades. However, you see that expected returns increase only to a certain point. Notice that the adjusted net annualized return for F+G are not as high as E. The high interest rates for F+G loans yield higher expected returns, but these loans are often subject to defaults.

Another risk factor to consider is that there are generally very few F+G notes available to investors. You’ll have a higher chance of selecting risky loans in a narrow pool. However, keep in mind that there is also a wide range of risk when loans are in the same interest rate bucket. That said, all investments have some risk, but understanding basic strategies, such as diversification and allocation, can help improve the performance of your loan portfolio.